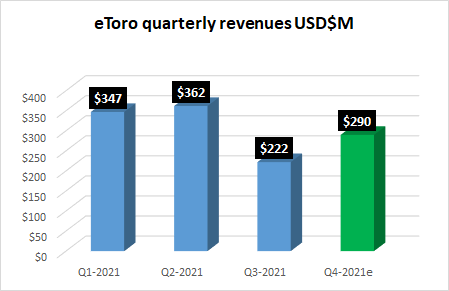

Exclusive: eToro Revenues up 30% QoQ in Q4 to $290M range

FNG Exclusive… FNG has learned via regulatory filings made by eToro’s SPAC merger partner FinTech Acquisition Corp. V (NASDAQ:FTCV), that eToro expects a significant improvement in financial results for the fourth quarter of 2021, which still has about a week to go.

The filing states that eToro expects Revenues (what it calls “Total commissions”) of between $285 million and $295 million for Q4-2021, about 30% higher as compared to $222 million in Q3 2021. The $285-$290 million figure, however, is still well below the $350-$360 million Revenue range that the Retail FX broker reported for each of the first two quarters of 2021.

The filing states that eToro expects Revenues (what it calls “Total commissions”) of between $285 million and $295 million for Q4-2021, about 30% higher as compared to $222 million in Q3 2021. The $285-$290 million figure, however, is still well below the $350-$360 million Revenue range that the Retail FX broker reported for each of the first two quarters of 2021.

The $285-$290 million Q4 figure would give eToro Revenues of just north of $1.22 billion for 2021, more than double 2020’s $602 million result.

The SPAC reported that total registered users at eToro will be approximately 27 million at December 31, 2021, with about 2.1 million new registered users in Q4 2021 as compared to 1.6 million new registered users in Q3 2021. eToro has approximately 2.4 million funded accounts at December 31, 2021, compared to 2.1 million funded accounts as of September 30, 2021.

Yoni Assia, CEO and Co-founder of eToro, commented:

Yoni Assia, CEO and Co-founder of eToro, commented:

“Our preliminary fourth quarter 2021 financial metrics show continued strong growth and demonstrate that we are executing very well on our business plan. Our fourth quarter 2021 preliminary results point to full-year 2021 total commissions of approximately $1.2 billion, representing more than 100% year-over-year growth. We continue to see a strong increase in the number of users engaging with our platform across our global footprint and are very excited for what lies ahead in 2022 and beyond.”

eToro announced plans to go public via a merger with FTCV back in March, but the closing of the deal – which values eToro at about $10 billion – has been delayed several times from an initial expected closing in Q3-2021 to now having the transaction leak into 2022, putting the entire eToro-SPAC IPO plan in jeopardy.