eToro $10 billion SPAC IPO deal in trouble: Calcalist

Israeli business news source Calcalist is reporting that the going-public plan for Retail FX, CFDs, and crypto broker eToro via a merger with special purpose acquisition company (SPAC) Fintech Acquisition Corp V (NASDAQ:FTCVU) is in trouble – at least in its current format.

According to Calcalist, the eToro-SPAC deal is unlikely to be completed in the few remaining business days of 2021, and that – combined with the trouble eToro’s main comparable / competitor Robinhood is having – is putting the deal itself in jeopardy. The current agreement is to see eToro merge with the SPAC at an implied valuation of $10 billion for eToro. The deal includes an injection of an additional $650 million in capital from a group of private equity investors (ION, Softbank, Third Point, Fidelity, Wellington), and a $300 million secondary share sale by company insiders and existing shareholders.

First, the timing issue.

The eToro-SPAC deal was first announced in March 2021, nearly nine months ago, at a time when SPACs were hot and on-the-rise on Wall Street, with the deal aiming to be complete by Q3-2021. (We had exclusively reported in late September that the target date for completion of the eToro IPO was delayed to Q4). However if the agreement spills into 2022 uncompleted, the private investment group can pull their $650 million equity commitment without penalty.

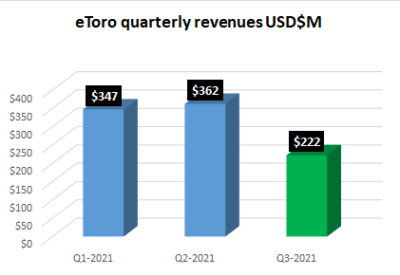

With valuations down significantly in the sector (more on that below), and eToro’s own reported results falling dramatically in the second half of 2021, Calcalist believes that those sophisticated investors are likely to do just that – or at least demand a renegotiated deal, at a much lower valuation.

Similarly, the Fintech Acquisition SPAC investors. Those shareholders are not yet really committed to the deal, which they still need to vote to approve. A smaller / renegotiated deal, unless they get a better “cut” in such a new transaction, is also at risk of being rejected by the SPAC shareholders, in favor of them just getting their money back. As the SPAC market has cooled, an increasing number of SPACs are being redeemed, with the SPAC shareholders just getting their cash back, instead of a merger deal with a private company getting done.

But the real issue is valuation – it almost always comes down to valuation in both the IPO and SPAC markets.

eToro rival Robinhood (NASDAQ:HOOD) went public at a valuation of $32 billion in late July, and saw its valuation peak at about $60 billion in early August. Since then, Robinhood stock has been on a four-month-plus slide, with its shares down by about 71% from the peak, thanks to a combination of problems with its payment-for-order-flow business model, and underwhelming results.

Robinhood now is trading at a valuation of about $17 billion. With more that 20 million active users, versus 2.1 million for eToro, it may be hard to sell investors on a $10 billion capitalization for eToro.

The delay in the deal getting done seems out of eToro’s hands, and in those of US regulators. eToro’s SPAC partner, Fintech Acquisition Corp V, recently had to restate its financial results after reporting “material weakness” in internal controls. The regulators are also taking their time wrapping their arms around eToro’s business, which has a large crypto trading component.

We would expect an announcement or filing in the coming days by either eToro or Fintech Acquisition relating to deal timing, and also regarding deal structure, as we note above. We will continue to follow this story as it unfolds.

December 13, 2021 @ 2:16 pm

eToro has some of the worst operating margins in the FX/CFD space from what I can tell. How on earth can they be worth $10bn when Plus500, a far more efficient company, which makes almost the same in revenue terms, is only worth £1.3bn or when IG Group, which makes more than them in revenue, is only worth £3.4bn. Arguably CMC, which has more AUM than them in its Aussie stockbroking business ALONE, should be worth more than them, even if they’re not making as much in revenue terms. Not to mention that all of those companies are actually profitable, unlike eToro. Rubbish company, annoying leadership that pretend to be woke for better PR, and dishonest in how they go about their business (eg. claim to be ‘commission free’ but then list all their revenue as from ‘commissions’ in their financial reports.)

December 14, 2021 @ 3:29 am

Everything you say is theoretically correct however the Etoro valuation is based on user numbers not profitability. It’s arguably one of the hottest debates in the markets which has to at some point punish companies that cannot meet their profit expectations basis their lofty valuations. The valuation of Etoro shouldn’t be a mystery to anyone as its in line with other fintechs with similar user numbers. Fintech gets a much higher valuations on a per user basis than companies that make revenues from advertising for example. As the article points out the valuation comparison is Robinhood not IG, CMC or Plus. What’s perverse is that any of the ‘profitable’ CFD providers could have spent all their profits on advertising and done exactly what Etoro have done. However Etoro have very successfully tapped into a US tech story which arguably any other exchange would not have bought in the same way. Time will tell but it is no surprise they are having some difficulties, to be honest better this all plays out before they list than after, a la Robinhood!