eToro data: retail investors continue to back semiconductor and AI stocks in Q3 2023

Retail investors continue to back semiconductor and AI stocks, according to the latest quarterly stocks data from online broker eToro.

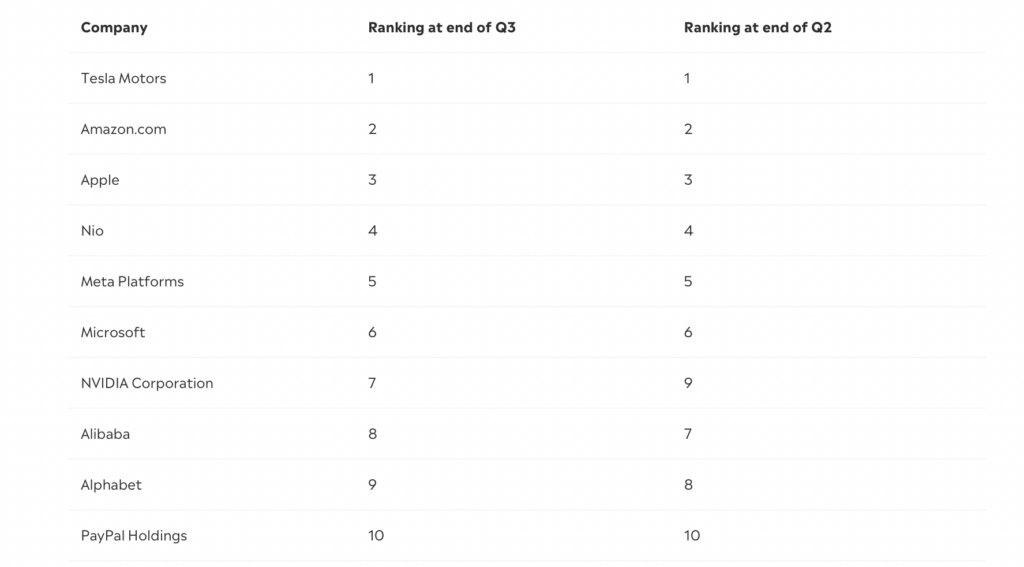

eToro looked at which companies saw the biggest proportionate change in holders at the end of Q3 versus the end of Q2, while also looking at the 10 most widely held stocks on the platform.

The list of most widely held stocks was led by Tesla and Amazon, both of which have seen massive share price gains this year, albeit with a far less impressive Q3. Others in this list include Meta and NVIDIA, with the latter now the eighth most held stock on the eToro platform, overtaking tech stalwart Alphabet.

Amongst the 10 ‘biggest risers’ list, AI stock C3.ai features once again, with a 22% jump in holders, whilst semiconductor firm Broadcom also rose in popularity (+21%).

The more prominent trend on this list however is the surge in popularity of pharmaceutical companies producing weight loss drugs. Danish drugmaker Novo Nordisk, manufacturer of the weight loss drug Wegovy, saw a 78% jump in holders, while US firm Eli Lilly, manufacturer of tirzepatide, recorded a 31% increase in holders.

Another focus of investors’ attention in Q3 was solar energy stocks, with eToro users apparently looking to buy the dip with companies such as Enphase Energy and SolarEdge Technologies after a prolonged period of poor performance.

Commenting on the data, eToro’s Global Market Strategist Ben Laidler, said:

“Big pharma is increasingly turning its gaze to the global obesity crisis and in recent months some frontrunners have emerged. Retail investors clearly recognise the huge growth potential in this area and it’s no surprise that two weight loss drug manufacturers have made it onto our top risers list. eToro users are also remaining bullish on AI with Nvidia and others growing in prominence on the eToro platform.”

At the other end of the spectrum, it was a mixed bag in terms of the stocks that saw the biggest proportional fall in users on the platform. Activision Blizzard, which has been at the centre of a Microsoft takeover saga, saw the biggest drop off in holders, with a 16% quarterly decrease. Meanwhile, cyclical stocks Royal Caribbean Cruises (-9%) and FedEx (-11%) also saw a significant fall in holders.

Laidler adds:

“The last quarter has seen us reach what is likely to be the peak of the global interest rate cycle, so it’s no surprise to see financial services firms rising in popularity amongst investors. With incomes still squeezed cyclical stocks such as Royal Caribbean Cruises are also under pressure, as people look to pare back spending and hunker down ahead of winter.

“It will be interesting to see how the next quarter is influenced by macro trends, and if we have indeed seen the last of interest rate rises, or whether there is still more to come, which of course will have ramifications across the markets.”