eToro data: AI, quantum computing among top investment themes for retail investors in 2025

The biggest investment themes among retail investors in 2025 were AI data centres, European defence, and quantum computing, according to the latest data from trading and investing platform eToro.

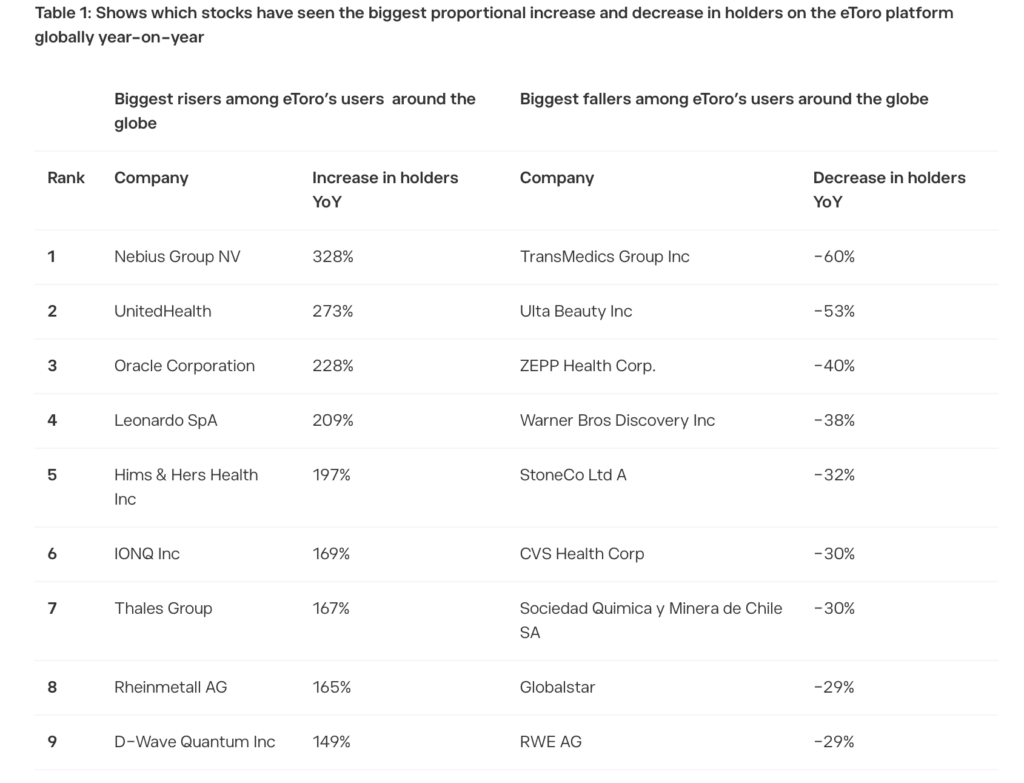

eToro looked at which companies saw the biggest proportionate change in holders year-on-year, while also looking at the 10 most held stocks on the platform to identify the key themes that caught retail investors’ attention in 2025.

AI infrastructure provider Nebius Group led the ‘top risers’ list with a 328% increase in holders in 2025. Oracle, also a key player in this industry, came third with a 228% year-on-year jump in holders.

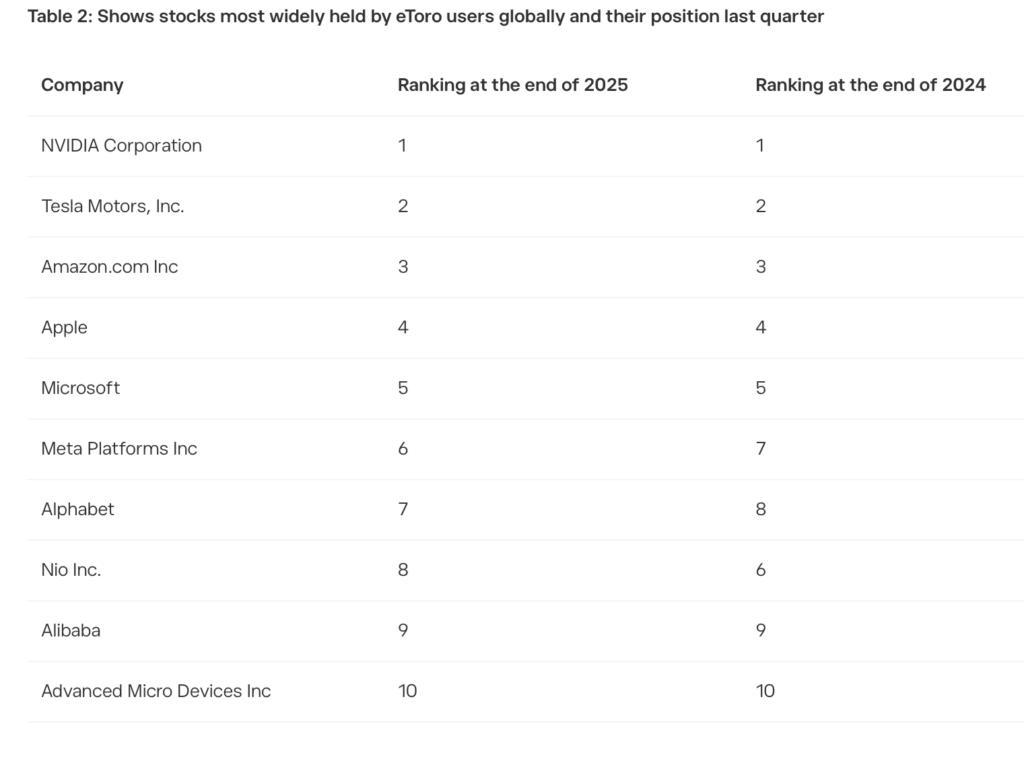

Despite talks of a bubble, eToro’s data suggests that retail investors’ interest in AI has not abated. Major AI stocks like Nvidia, which was the most held stock on the platform, rounded off the year with 21% more holders, while Meta, a frontrunner in AI technology, added 19% more holders.

Lale Akoner, Global Market Strategist at eToro, said:

“Retail investors remain constructive on AI, but 2025 shows a clear rotation within the theme. After a chip-led rally in previous years, investor attention has shifted toward infrastructure and enablers of AI deployment like Nebius Group and Oracle, fuelled by the massive surge in data centre investment around the world, which reached $61 billion in 2025 according to S&P Global. The data suggests that, despite valuation concerns, investors are increasingly differentiating between speculative AI exposure and businesses with clearer revenue visibility and capital intensity advantages.”

Retail investors also showed a growing appetite for the budding sector of quantum computing. Quantum computer makers IonQ (+169%) and D-Wave Quantum (+149%) came in 6th place and 9th place respectively. Although not in the top 10, Rigetti Computing also saw a 138% increase in holders, ranking in 11th place.

Lale Akoner said:

“The outlook improved for the quantum computing sector in 2025. While the sector is still high-risk and long dated, contract wins such as Rigetti’s which announced landmark purchase orders, including a $5.8 million contract with the US Air Force, helped anchor valuations in the sector. Retail investors appear increasingly willing to allocate selectively to frontier technologies where fundamentals, rather than hype, are starting to drive performance.”

In addition to these themes, UnitedHealth and Hims & Hers Health were two of the most popular stocks on eToro in 2025. As well as looking at stocks with the biggest change in holders year-on-year, eToro also looks at them quarter-on-quarter. After being named a quarterly top riser in Q2 and Q3, UnitedHealth finished the year as the stock that saw the second-highest increase in holders throughout 2025 (+273%). In a volatile year for Hims & Hers, the stock was a top riser in Q2, then a top faller in Q3, but overall in 2025 it was the 4th top riser, with 197% more holders than at the end of last year.

2025’s ‘top fallers’ list was led by TransMedics Group (-60% decrease in holders), Ulta Beauty (-53%), and ZEPP Health (-40%). All three saw significant gains in their stock price over the course of the year: 95% for TransMedics, 39% for Ulta, but most of all, 936% for ZEPP Health.

Lale Akoner added:

“Healthcare showed two distinct investor behaviors in 2025. In UnitedHealth, investors leaned into a quality, cash-generative business and a disciplined buy-the-dip approach. By contrast, stocks like TransMedics, Ulta Beauty and ZEPP Health saw exceptional price gains, and many retail investors chose to take profits and actively rebalance after a strong run.”

There was little change in the ranking of the top 10 most held stocks on eToro at the end of 2025. Nio dropped from 6th place to 8th place, while Meta and Alphabet climbed up to 6th and 7th place. While Nvidia and Meta had a decent increase in holders, Nio (-15%), Alibaba (-14%) and Tesla (-11%) saw the opposite.