Dukascopy sees Revenues and Profit improve in 2H 2024

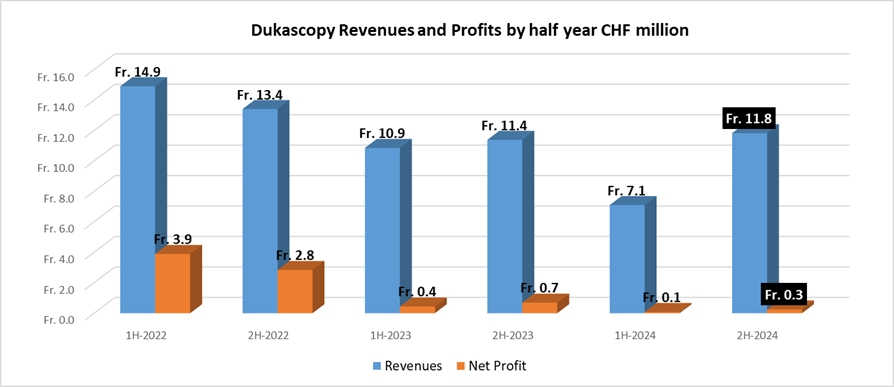

Geneva based Retail FX and CFDs broker Dukascopy has released its 2024 Annual Report and financial results, indicating that top line Revenues and bottom line Profit both improved significantly in the second half of the year.

After seeing its slowest period in years in 1H 2024 with Revenues falling to just CHF 7.1 million, second half 2024 Revenues at Dukascopy increased by 66% to CHF 11.8 million – its best result since 2022. 2H 2024 Net Profit came in at just above breakeven, at CHF 251K.

For the full year 2024 Dukascopy brought in Revenues of CHF 18.9 million – down by 15% from CHF 22.2 million in 2023. Net Profit of CHF 331K was down by 71% from CHF 1.1 million in 2023. We’d also note that 2024’s (small) profit was helped by Dukascopy releasing CHF 1.9 million in bank reserves. Without the reserve reversal, Dukascopy’s “operating result” in 2024 was a net loss of CHF 1.7 million.

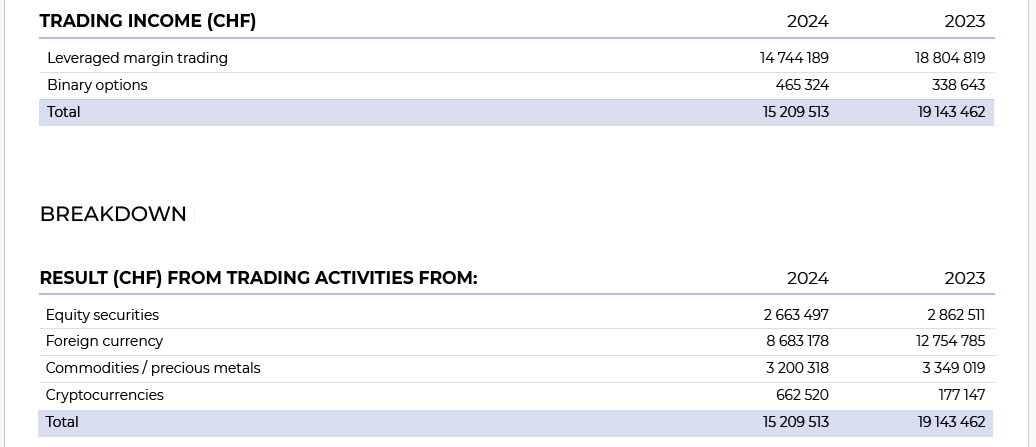

The overall decline in Dukascopy’s Revenues in 2024 was due to a drop in the company’s core Trading Income, from CHF 19.1 million in 2023 to CHF 15.2 million in 2024. More than half (57%) of Trading Income at Dukascopy in 2024 came from client FX trading. Crypto trading, although up from 2023, accounted for just 4% of Trading Income.

By comparison, Dukascopy’s (much larger) Switzerland based rival Swissquote posted record results on both the top and bottom line for 2024.

Dukascopy headcount was reduced for the second year in a row, 98 during 2023 to 94 in 2024.

Companies within Dukascopy Group are regulated in Switzerland, Latvia and Japan. The Latvian entity, Dukascopy Europe has a license to operate in the European Union. Founded in 2004, Dukascopy is controlled by its founders Andrey and Veronika Duka, who serve as co-CEOs of the company.

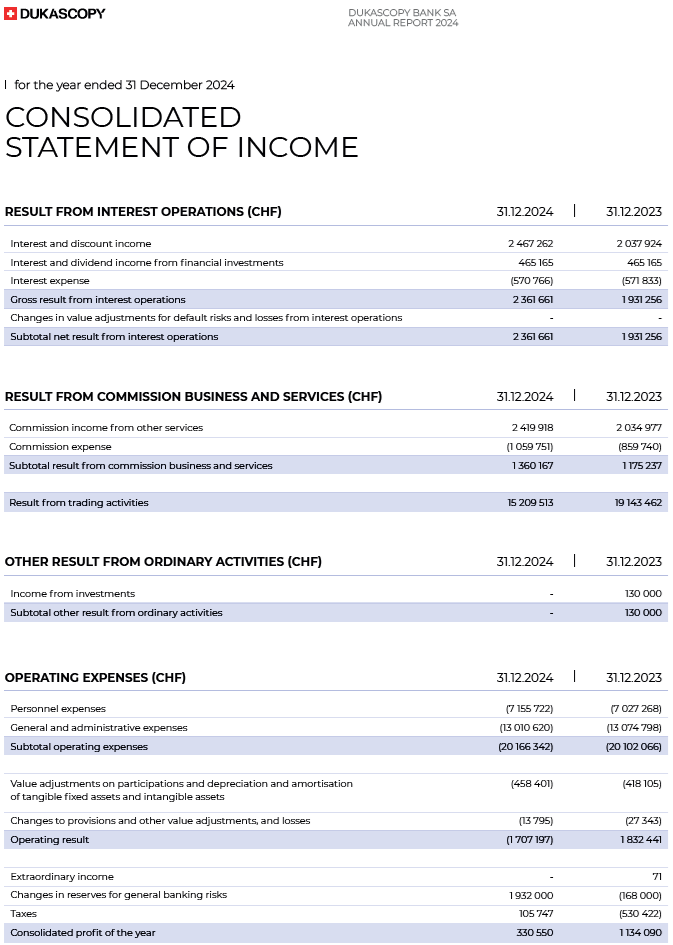

Dukascopy’s 2024 consolidated income statement and balance sheet follow.