CMC Markets to hold GM on past dividends

CMC Markets Plc (LON:CMCX), a major provider of online trading and institutional technology solutions, will hold a general meeting the purpose of which is to vote on proposed ratification of past dividends.

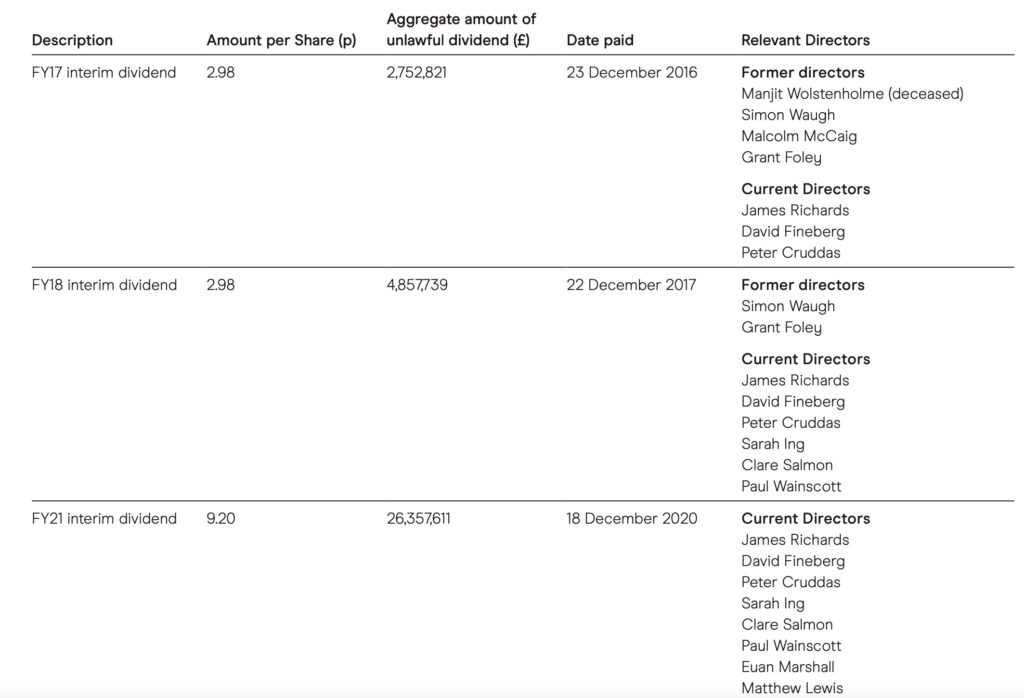

The Board of CMC Markets has discovered a procedural oversight in respect of the company’s processes for the payment of certain past dividends, namely that the FY17 interim dividend paid on 23 December 2016, the FY18 interim dividend paid on 22 December 2017 and the FY21 interim dividend paid on 18 December 2020 were made otherwise than in accordance with the strict formalities of the Companies Act 2006 (the “Act”).

The Board has taken steps to ensure that, in future, these issues do not arise in relation to the payment of future dividends.

In relation to the Relevant Dividends, the interim accounts were not filed at Companies House as required by the Act. In each case interim accounts were prepared which demonstrated sufficient distributable reserves, but such interim accounts were not filed. The omission of filing the interim accounts constitutes a procedural breach of the Act.

This means that the company could have claims against the shareholders who received the Relevant Dividends and the directors of the Company at the time the Relevant Dividends were approved, being all of the Directors other than Susanne Chishti and certain former directors of the Company.

CMC Markets has no intention of pursuing any such claims. Instead, the company is proposing a Resolution at the General Meeting to put the Company, its current and former shareholders and the Relevant Directors in the position they would have been in had the Relevant Dividends fully complied with the Act. This includes entering into deeds of release to release the shareholders who received the Relevant Dividends (the “Shareholders’ Deed of Release”), and the Relevant Directors (the “Directors’ Deeds of Release”), from any liability to repay any amounts to the Company.

Related party transactions took place between the Company’s subsidiary, CMC Markets UK plc and the Peter Cruddas Foundation in relation to royalties on books purchased, on 2 March 2022 in an amount of £818.40 and on 14 April 2022 in an amount of £400.00. There are no other related party transactions in the last 12 months.

Each of James Richards, David Fineberg, Peter Cruddas, Sarah Ing, Clare Salmon, Paul Wainscott, Euan Marshall and Matthew Lewis (being all of the Directors other than Susanne Chishti) are related parties of the Company. Therefore the entry by the Company into the Directors’ Deeds of Release constitutes a related party transaction for the purposes of the Listing Rules, as it benefits all of the Directors other than Susanne Chishti.

Lord Cruddas and certain of his family members are also related parties of the Company as substantial shareholders and therefore the entry by the Company into the Shareholders’ Deed of release also constitutes a related party transaction for the purposes of the Listing Rules.

Entry into the Shareholders’ Deed of Release and the Directors’ Deeds of Release is conditional upon shareholders’ approval being obtained at the General Meeting, as such transactions are related party transactions which require shareholder approval under the Listing Rules.

A General Meeting will be held at 133 Houndsditch, London, EC3A 7BX on 28 July 2022 at 10.30 a.m. (or as soon thereafter as the Annual General Meeting of the Company convened for 10.00 a.m. on that day has been concluded or adjourned) at which the Resolution will be proposed to approve the Transaction.

The Board considers the Transaction to be fair and reasonable so far as the Shareholders of the Company are concerned and the sole Director who is not party to the Transaction, Susanne Chishti, has been so advised by the Company’s Sponsor, RBC.

As each of the Directors other than Susanne Chishti has an interest in the Resolution, it is not possible to convene a quorate Board meeting under the Company’s Articles of Association to consider the Resolution. Accordingly, the Board has not considered whether the Resolution is in the best interests of the Company and cannot recommend that shareholders vote in favour of the Resolution although they do recommend that shareholders vote on it.