CMC Markets shares tumble 13% after 1H-2025 results and outlook disappoint

Shares of London based online trading provider CMC Markets (LON:CMCX) are taking a tumble on Thursday, after the company released earlier today its results for the first half of fiscal year 2025, i.e. the six month period from April-to-September 2024.

At the time of writing, CMC shares were down by 13%, trading at about 295p versus Wednesday’s close of 338.50p. The shares were trading as low as 281p late morning, down 17%, before recovering some of the losses. CMC shares are still up by almost 3x in 2024, starting the year at just 105p.

So why is the market disappointed with CMC Markets?

CMC Markets had already, in an earlier Trading Update made in early October, said what its 1H-2025 Revenues and Pre-Tax profits would be. However six-month Revenues of £177.4 million were a little lighter than the Trading Update figure of £180 million, and actual Pre-Tax Profits of £49.6 million were lower than the £51 million amount indicated in the Trading Update.

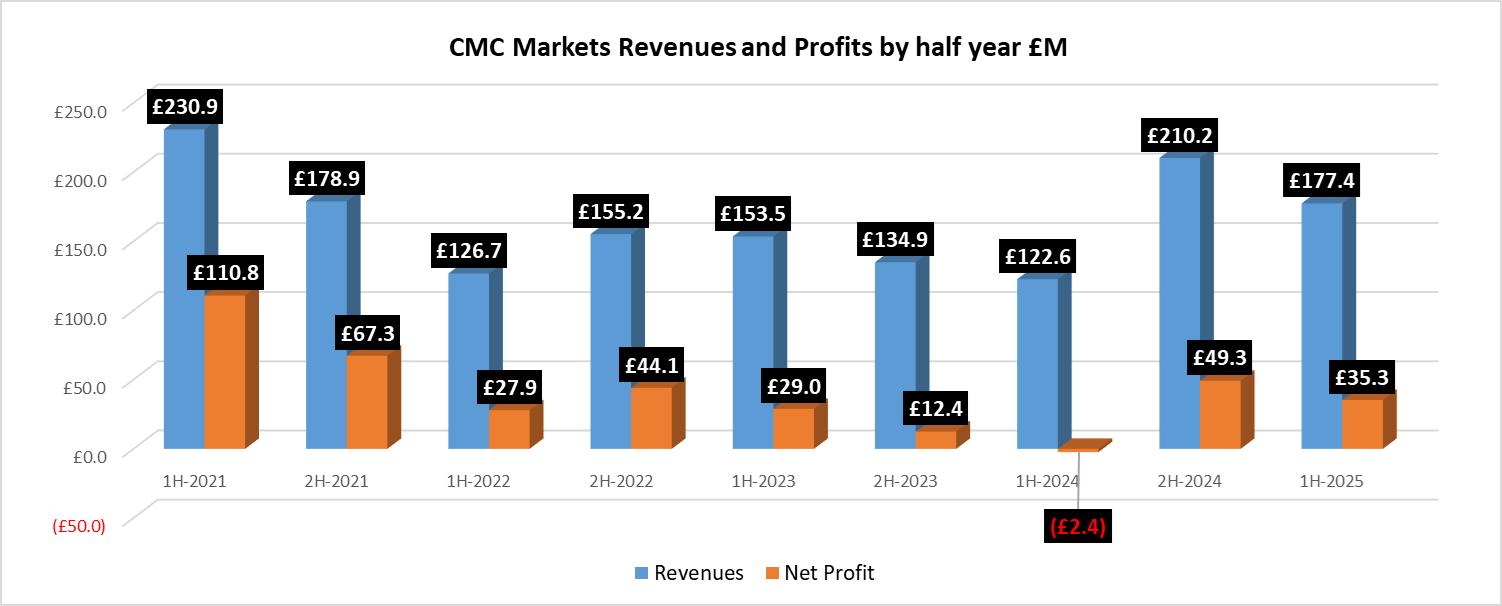

The slightly-lower Revenue and Profit figures at CMC were more disappointing in light of the fact that both were already expected to be well below corresponding figures for the previous six month period (technically 2H-2024), as per the following graph.

Then came the company’s Outlook.

After making a statement that CMC management was maintaining a pragmatic approach to investment with a focus on profit margin expansion, whilst continuing to explore and invest in opportunities for incremental growth, CMC stated that it “remains confident” in delivering on guidance set out at the beginning of the year, with net operating income (i.e. Revenue) for the full year forecast to be in line with external market expectations, that is at just under £333 million.

It seems as though City traders expected CMC to raise its guidance for the rest of FY2025 (i.e. through to March 31, 2025), but it didn’t do so. And by not doing so CMC seems to be indicating that it expects Revenues in the coming six-month period to be closer to the £155 million range, well below the current period’s £177.4 million – which was already well below the previous period’s (2H-2024) £210.2 million.

CMC does has some interesting initiatives in the works, including expanding its presence in New Zealand, and integrating with popular neobank Revolut. But it remains unclear how much these will contribute to both the top and bottom line of the company, in the near term.