CMC Markets Revenues top previous guidance at £333 million for FY2024, up 15% YoY

Following a fairly slow FY2023 and initial poor guidance for FY2024 which sent its shares tumbling late into last year, London based online trading firm CMC Markets plc (LON:CMCX) completed a fairly impressive turnaround in the second half of its fiscal 2024 (March 31 year end) to post healthy increases in both Revenues and Profit for the year.

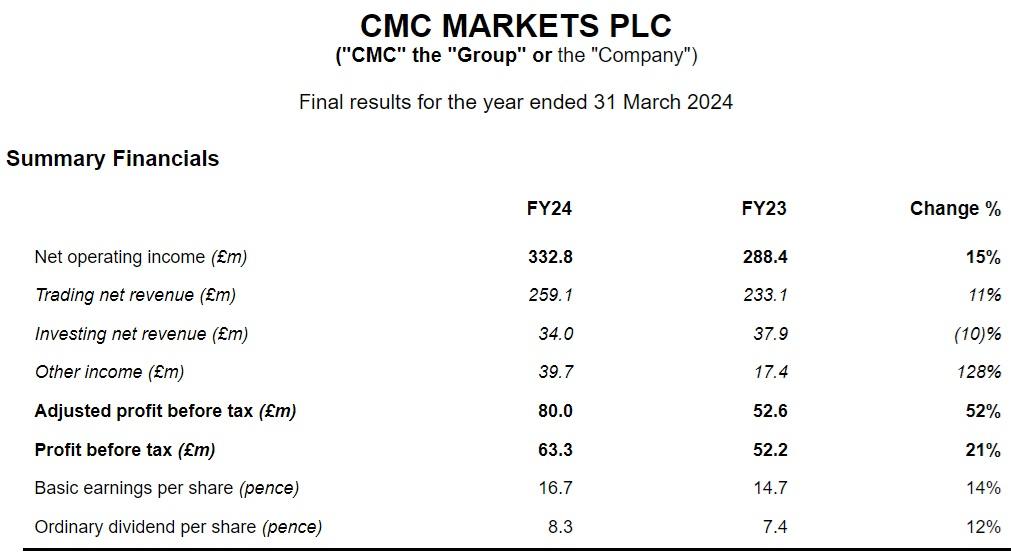

Overall, Revenues at CMC Markets came in at £332.8 million in FY2024, up 15% from 2023’s £288.4 million. CMC’s latest guidance, given in late March, was for a range between £290 and £310 million. The company’s Revenue base was significantly helped by increased Interest Income in the sustained higher interest rate environment, at £35.0 million versus just £13.9 million last year, an increase of 152%.

On the bottom line, CMC posted Net Income of £46.9 million, up 13% from £41.4 million the previous year, as the effects of a planned headcount reduction at CMC Markets began to take effect.

Despite the increase in Revenues and Profits, total segregated client money held by the CMC Markets group for trading clients was £517.6 million as at 31 March 2024, down from £549.4 million one year prior.

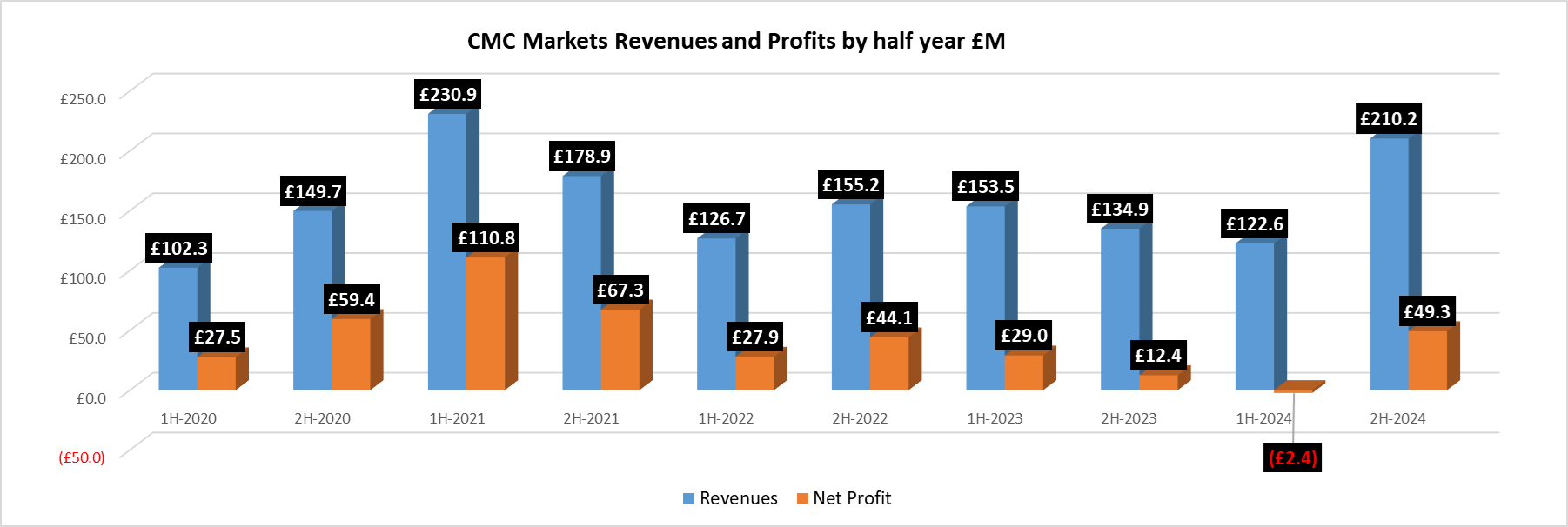

As shown in the following graph charting CMC’s semi-annual results, the second half of FY2024 (i.e. October 2023 through March 2024) was significantly improved over the first half of the year, in which CMC actually posted a small net loss.

Financial Highlights

- Net operating income of £332.8 million (FY23: £288.4 million), up 15%, marks a new record-high outside the COVID-19 pandemic period and was driven by consistently strong performance throughout H2.

- Trading net revenue grew by 11%, to £259.1 million (FY23: £233.1 million), with strong performance in both the retail and institutional segments of the business. Of our total trading net revenue, £74.8 million was made up of fixed transactional income, which constitutes financing and commissions. Institutional segment also continues to grow as a proportion of overall net revenue.

- Investing net revenue 10% lower than prior year at £34.0 million (FY23: £37.9 million) primarily driven by unfavourable movements in FX from a weaker Australian Dollar. On a constant currency basis investing net revenue was 3% lower year-on-year.

- Other income of £39.7 million (FY23: £17.4 million) up 128% due to higher global interest rates driving income from client and own cash balances.

- Operating expenses, excluding variable remuneration, were £249.5 million (FY23: £217.2 million), including a non-recurring £12.3 million impairment charge relating to internally-developed platforms for the UK Invest and cash equities offerings and £4.3 million of one-off costs relating to actions to reduce global headcount.

- Regulatory total Own Funds Requirements (OFR) ratio of 312% (FY23: 369%) and net available liquidity of £192.2 million (FY23: £184.2 million)

- Statutory profit before tax of £63.3 million (FY23: £52.2 million), up 21%, reflecting net operating income outperformance and steps taken on costs.

- Adjusted profit before tax, excluding non-recurring costs, of £80.0 million was up 52%.

- Final dividend of 7.3 pence per share (FY23: 3.9 pence), taking the total dividend for the year to 8.3 pence per share (FY23: 7.4 pence), up 12% year-on-year.

Operational Highlights

- Strong progress made to enhance operational efficiency with ongoing cost review programme driving synergies across product and business lines.

- Efficiency programme extending beyond costs to all areas of the business such as our new centralised Treasury Management Division with the launch of our global Treasury Management System focused on efficient cash management, currency and liquidity optimisation.

- CMC Markets Connect brand, API ecosystem and world-leading financial markets technology continues to underpin our growth and has proven critical in growing our B2B and institutional offering with several major client wins during the year and a strong pipeline of potential clients.

- Significantly bolstered product suite with the rollout of options and addition of cash equities to our institutional offering, to expand this valuable segment.

- Further development of investing platform with Invest UK rolling out mutual funds and SIPPs post-financial year-end and the rollout of cryptocurrencies for Invest Australia.

- Continued expansion across new geographies and markets with launch of CMC Invest Singapore, a growing footprint in Middle East with DIFC hub and renewed focus on strengthening the governance and capability of our European operations as a lever for growth.

- Regional expansion further supported by Opto, our content and thematic investing tool, which has over 100k subscribers, advanced API infrastructure and recently finalised cash equities trading functionality, which is set for imminent release.

CMC Markets Outlook

- Having reached the peak of the investment cycle, management continues to seek opportunities to drive further cost efficiencies and deliver margin expansion, whilst investing in significant opportunities for incremental growth.

- Combined with new product launches and further technological upgrades planned for FY25, we remain confident in the business’ ability to generate robust levels of income on a leaner cost base, resulting in improved profit margins.

- Current trading proving encouraging with positive trends seen early in the new fiscal year.

- Management is guiding to net operating income (i.e. Revenue) of between £320-360 million in FY25 on a cost base, excluding variable remuneration and non-recurring charges, of approximately £225 million.

Lord Cruddas, Chief Executive Officer, commented:

Lord Cruddas, Chief Executive Officer, commented:

“Over the past year, a recovery in client trading combined with our diversification strategy through B2B technology and an institutional first approach has delivered strong growth and opened up many opportunities for the company around the world.

“This strategy, based on continuous product launches and multiple application connectivity through the CMC Markets Connect brand, means we are making great strides in a huge market segment of B2B and institutional business, with limited competition from our peers.

“Building on this strategy this year we will launch a fully integrated multi-asset, multi-currency platform, underpinned by connectivity for B2B and institutional clients, as well as for retail clients. This is bolstered by new product launches including SIPPs, mutual funds (UK Invest), OTC options, cash cryptos, fixed income, and with futures, and exchange-traded options to come.

“CMC Markets Connect has added a new fintech dimension to our offering and there is no higher endorsement of our company than when a major bank or financial institution trusts our technology to deliver a service to their valued clients.

“Institutional, B2B and multi-asset, multi-currency platforms, across all brands is the future, and ours. We have built the infrastructure which will allow us to significantly increase our growth potential whilst improving profit margins through scale.

“It is going to be an exciting couple of years.”

CMC Markets’ full press release on its FY2024 results can be seen here.