CMC Markets reports record H1 trading performance

UK online broker CMC Markets Plc (LON:CMCX) has just posted the financial report for the six months to end-September 2020 (H1 2021), with the results, as indicated in recent trading updates, being very solid. In fact, the broker enjoyed a record six-month period, with revenues registering a steep rise.

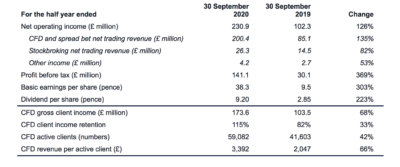

Net operating income increased by £128.6 million (126%) to £230.9 million. There was strong growth in both the CFD and Stockbroking areas of the business as a result of ongoing volatility related to the COVID-19 pandemic driving new clients to on-board and dormant clients to reactivate their accounts.

CFD and spread bet net trading revenue increased by £115.3 million (135%) driven by increases in both gross client income and client income retention. The increase in gross client income was in turn driven by CFD active client numbers increasing by 42% to 59,082 and clients trading more during the volatile market environment. This resulted in revenue per active client (“RPC”) increasing by £1,345 (66%) to £3,392.

Stockbroking net revenue was 82% higher at £26.3 million (H1 2020: £14.5 million), also driven by increased client trading activity from a significantly enlarged client base during the volatile market environment.

Statutory profit before tax increased by £111.0 million (369%) to £141.1 million and the profit before tax margin1 increased by 31.7% from 29.4% to 61.1%.

In the UK, the number of active clients increased by 61% to 14,871 (H1 2020: 9,259), predominantly due to COVID-19 volatility, in addition to increased marketing spend, causing new clients to set up an account and dormant clients to reactivate their accounts. Gross client income grew 69% to £63.3 million (H1 2020: £37.4 million) driven by both higher active clients in addition to trading activity also being elevated due to market volatility.

In Europe (comprising CMC’s offices in Austria, Germany, Norway, Poland and Spain), active client numbers were 24% higher than prior year, with gross client income increasing by 65% to £28.3 million as a result.

In APAC and Canada, active client numbers increased by 46% to 27,020 (H1 2020: 18,479), with strong growth across the majority of offices in the region. Gross client income increased by 67% to £82.0 million (H1 2020: £49.0 million), driven by both higher active clients in addition to trading activity also being elevated due to market volatility.

CMC Markets also commented on the latest regulatory climate developments. On 23 October 2020, the Australian Securities and Investments Commission (ASIC), issued the outcome of the August 2019 consultation paper regarding the application of product intervention powers on the issuance and distribution of binary options and CFDs to retail clients, which will be implemented from 29 March 2021.

In summary, the product intervention order will restrict CFD leverage offered to retail clients to the same maximum ratio as those implemented by the European Securities and Markets Authority. Other measures such as margin close out protection and negative balance protection for retail clients will also be implemented.

CMC Markets believes a large proportion of Australian CFD net revenue is generated by clients eligible to qualify as wholesale clients, meaning they will not be impacted by the potential regulatory changes when they are implemented.

In addition, in the UK, the FCA has imposed a ban on the sale of instruments, such as CFDs, with prices linked to cryptocurrencies to retail clients from 6 January 2021. During the previous financial year this contributed less than 1% of the Group’s CFD net trading revenue, CMC Markets notes.