CLSA Premium sees losses widen in H1 2021

Hong Kong-focused Forex broker CLSA Premium Ltd (HKG:6877), formerly known as KVB Kunlun, today posted its financial results for the first six months of 2021, with net losses widening in line with the Group’s own forecasts.

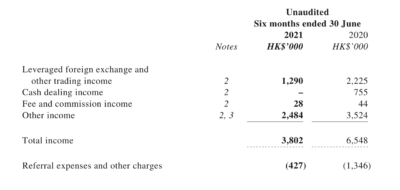

During the six months ended 30 June 2021, total income of the Group decreased by approximately 42% to HK$3.80 million from HK$6.55 million a year earlier.

The leveraged FX and other trading income of the Group decreased by approximately 42% to HK$1.29 million for the 2021 Interim Period from HK$2.23 million for the 2020 Interim Period, mainly caused by the reduced profit opportunities under the low market volatility.

The fee and commission income of the Group dropped by approximately 36% to HK$28,000 for the 2021 Interim Period from HK$44,000 for the 2020 Interim Period, due to decreased trading volume in New Zealand.

The Group incurred a net loss of HK$29.98 million in the first half of 2021, compared with a net loss of HK$21.20 million in the equivalent period a year earlier.

During the 2021 Interim Period, the operations of the Group were financed principally by equity capital, cash generated by the Group’s business operations and cash and bank deposits. As at 30 June 2021, cash and bank balances held by the Group amounted to HK$253.37 million (as at 31 December 2020: HK$287.09 million).

The Board did not declare the payment of any dividend for the 2021 Interim Period.