Catena Media shares collapse following Q3 Revenue decline, 25% Europe staff layoffs

Shares of gaming and FX broker affiliate company Catena Media plc (STO:CTM) were trading down by 17% on Thursday morning, following Catena’s release of its Q3 financial and operating summary.

Catena stated that its Q3 revenues came in at €32.3 million, down 2% YoY, with organic growth actually down 4%. The company’s EBITDA margin also narrowed to 36% from 50% last year. The decrease reflected continued strong growth-oriented investment into the fast-expanding North American market.

New depositing customers at Catena hit its lowest level in Q3-2022 since Q3-2020, at 117,000.

As part of an expanded strategic review announced by Catena in August, restructuring measures unlocked combined annualised cash savings in Europe of €5.5 million, higher than the initial target of €5 million. The savings, which included a 25% reduction in European headcount, will be fully effective from Q1 2023.

Regarding certain assets and websites which Catena had said earlier this year it would look at divesting including its Financial Trading related sites, the company noted that it is in “advanced discussions” over specific asset divestments as it evaluates multiple options for certain parts of the business subject to the strategic review. External advisors have been engaged to support this process, which remains ongoing.

In 2017-2018 Catena made a concerted effort to grow from its base of gaming affiliate websites into the “financials” area, spending tens of millions of dollars in acquiring a number of (mainly) FX broker affiliate and news websites such as DeutscheFXBroker.de, BrokerDeal.de, ForexTraders.com, TheBull.com.au, TheBull.asia, FatCat.com.au, LearnTrading.com.au, LearnCFDs.com, hammerstonemarkets.com, and Leaprate.com.

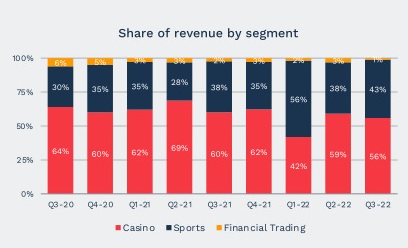

The company hired FXcompared.com Global General Manager Nigel Frith in early 2018 to head the Financial Trading group out of London. Initially, the Financial Trading segment comprised about 5-6% of overall Catena revenues, in 2020 bringing in €5.8 million in revenues and EBITDA of €1.3 million. However Catena announced toward the end of 2020 that it “won’t be making further investments into the Financial Services segment.” Revenue from the Financial Trading segment has tumbled to just 1% of company revenue by Q3-2022, at just €367,000 for the quarter, generating negative EBITDA of €308,000. We believe that Nigel Frith has been reassigned within the organization.

Today’s 17% share price decline takes Catena Media shares to near their 52 week low of kr22.01.

Catena Media share price, past 12 months. Source: Google Finance.

Catena Media’s full Q3 results press release can be seen here.