BUX adds bond market exposure via iBonds ETFs

Amsterdam based neobroker BUX has announced that it is offering iShares iBonds ETFs, an innovative investment solution developed by BlackRock, one of the world’s leading providers of investment, advisory and risk management solutions. iBonds ETFs combine the best aspects of Exchange Traded Funds (ETFs) and traditional bonds, offering retail customers across Europe a cost effective access to the corporate bond market in today’s yield environment, with the diversification, transparency and liquidity benefits of indexing. BUX is proud to introduce this cutting-edge product to its clients.

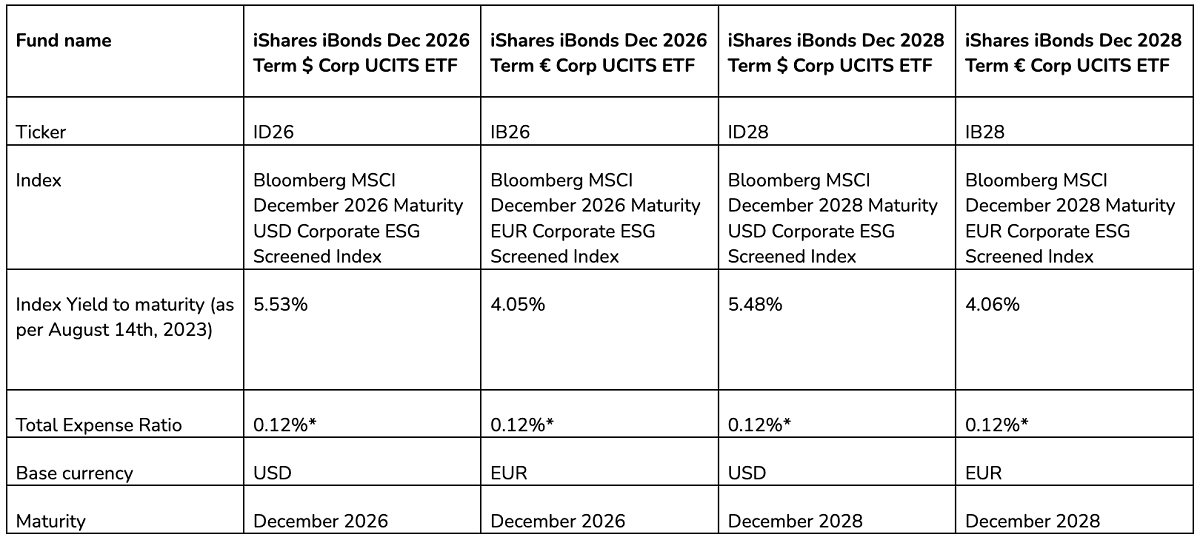

– iShares iBonds Dec 2026 Term $ Corp UCITS ETF

– iShares iBonds Dec 2026 Term € Corp UCITS ETF

– iShares iBonds Dec 2028 Term $ Corp UCITS ETF

– iShares iBonds Dec 2028 Term € Corp UCITS ETF

iBonds represent a game-changing addition to the investment landscape, providing retail investors with access to corporate bonds in an ETF that behaves similarly to bonds. Designed to trade on regulated exchanges in Europe, these groundbreaking products offer investors a unique blend of features and benefits. By marrying the cost efficiency, diversification, transparency and liquidity benefits of ETFs with the defined maturity of bonds, iBond ETFs provide a versatile investment opportunity. iBonds ETFs can be used by retail investors to complement investment and savings accounts, in an easily understood structure that provides access to income and a final pay out at maturity.

“We are delighted to bring iBond ETFs to our customers across Europe,” said Yorick Naeff, CEO of BUX. “This new product is a testament to our commitment to providing innovative investment solutions that empower and educate our retail investors. With iBond ETFs, investors can benefit from the diversification and liquidity associated with ETFs, while also enjoying the predictability of a set expiry, and benefits of income, much like a bond.”

“iShares iBond ETFs offer European investors cost efficient and diversified access to the yields available from investment grade corporate bonds through an ETF, now with a fixed maturity feature,” said Christian Bimueller, Head of Digital Distribution Continental Europe for iShares and Wealth for BlackRock, “Availability through digital platforms will broaden the opportunities available to investors and further financial inclusion.”

The introduction of iBond ETFs by BUX marks a significant step forward in democratising access to corporate bonds. Retail investors will now have a cost efficient opportunity to participate in markets traditionally reserved for institutional players, further levelling the playing field and enhancing financial inclusivity.

These four iBonds ETFs provide exposure to investment grade (IG) corporate credit across various countries and sectors in each ETF. These ETFs offer two defined maturity dates respectively, in December 2026 and 2028, both across $ and €, giving investors flexibility of currencies, maturities, and income targets across different exposures.

Key Features of iBonds:

- ETF-like liquidity: iBond ETFs are listed and traded on regulated exchanges in Europe, enabling investors to buy and sell units throughout the trading day.

- Defined maturity: Similar to traditional bonds, iBonds have a set expiry date, providing investors with a known timeline for their investments while providing income to investors through coupon payments over their lifecycle.

- Diversification: iBonds will offer exposure to a wide range of underlying bond assets, providing investors with diversified portfolios and risk mitigation.

- Accessibility: BUX is committed to making iBonds accessible to retail investors through its intuitive mobile app, ensuring a seamless and user-friendly investment experience.