Exclusive: Admirals sees 53% growth in UK in 2020, launches copy trading

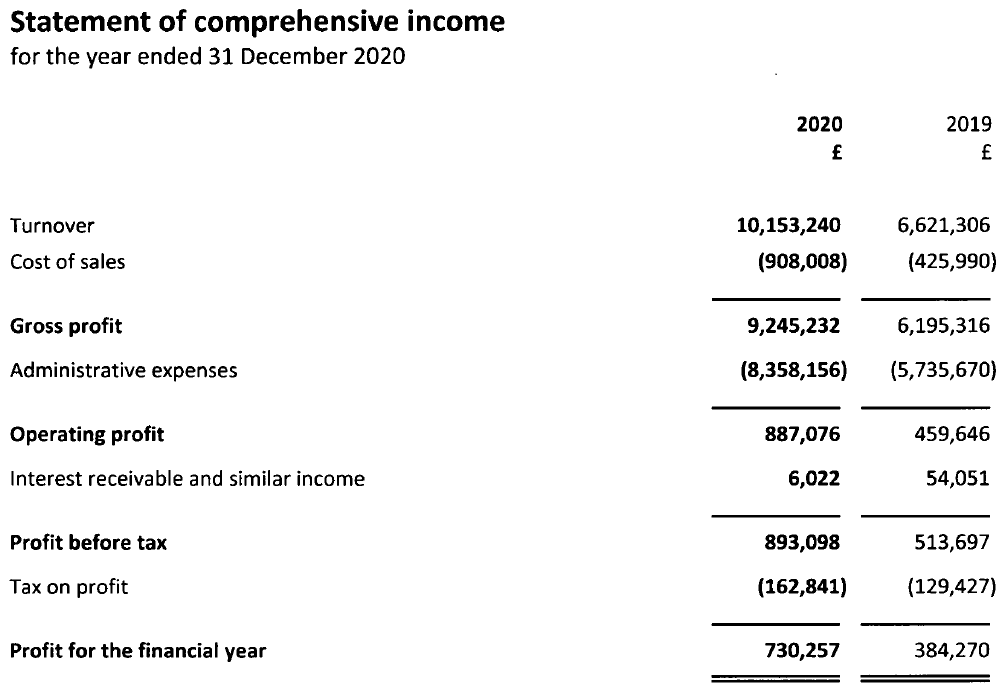

FNG Exclusive… FNG has learned via regulatory filings that Estonia based global Retail FX and CFDs broker Admirals enjoyed significant growth in its FCA regulated UK arm Admiral Markets UK Limited in 2020. Revenues at Admirals UK came in at £10.2 million in 2020, up 53% from £6.6 million the previous year. That increase basically mirrors the growth that Admiral Markets A/S saw in 2020, with Admiral Markets A/S revenues at €47.1 million for 2020 more than double the previous year’s €23.2 million, and trading volumes topping $100 billion monthly.

(Total Admiral Markets Group numbers were revenues of €62.2 million in 2020, up 86% from €33.5 million in 2019).

A quick calculation also reveals that the UK is responsible for about 25% of overall Admirals group activity.

On the bottom line, Admirals UK reported profit for the year of £730,000, up from £384,000 in 2019.

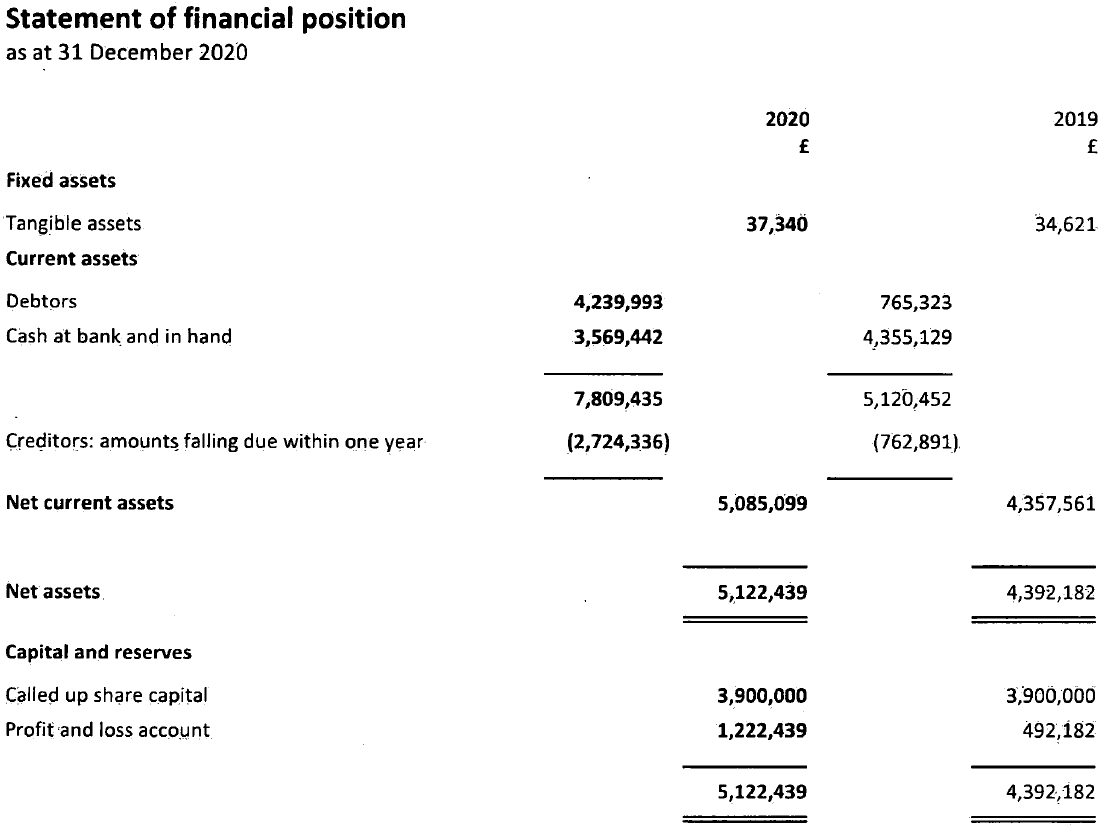

As at year-end 2020 Admirals UK held client assets of £58.5 million, up 118% from £26.8 million in 2019.

Separately, we have learned that Admirals, which recently rebranded from Admiral Markets, has sent a note to clients indicating that it is now offering copy trading. Social and copy trading have increased in popularity in recent months, both at brokers which formally offer the service and indirectly, via popular trader websites and chat forums, such as the now-famous WallStreetBets subreddit.

The company noted that the UK’s exit from the European Union has meant that the company has had to plan a programme of closure of European branches and offices outside the UK, as these no longer benefit from the European MiFID ‘passport’. No marketing to new EU clients is permitted now by Admirals UK, although it is expected that the company will continue to service its existing clients. In addition, clients are able to be on-boarded and serviced on a reverse solicitation basis as prescribed by the European Securities and Markets Authority. The company said that it is likely to fulfil a risk taking role for the Admirals group in the coming year and will place more emphasis on attracting UK clients in the post-Brexit environment.

Admirals UK’s income statement and balance sheet for 2020 follow: