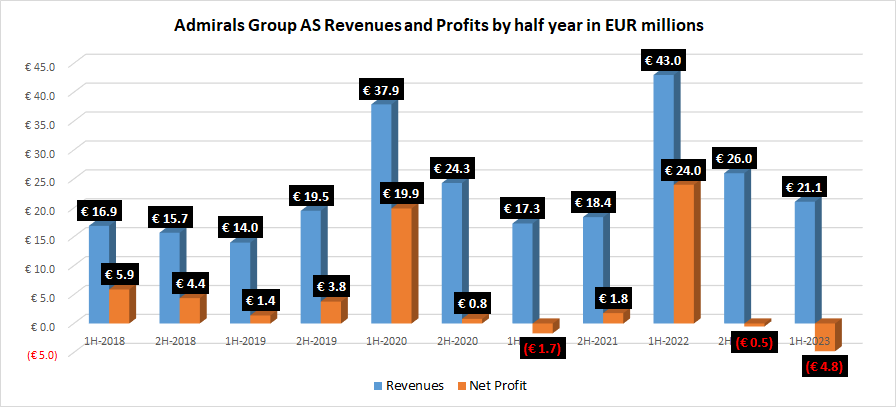

Admirals Group revenues collapse 51% in 1H 2023, posts €4.8M loss

Estonia based Retail FX and CFDs broker Admirals Group A/S has reported its financial results for the first half of 2023, indicating a significant decline in Revenues from last year, leading to a net loss of almost €5 million for the six month period of January to June 2023.

Revenues at Admirals came in at €21.1 million for 1H 2023, down 51% as compared to the first half of 2022 (€43.0 million) and down 19% from the second half of 2022 (€26.0 million). The company posted a net loss of €4.8 million in 1H 2023, a far cry from the €24.0 million profit Admirals made in the first half of last year.

The decline in results come amidst a restructuring at Admirals, announced this past May.

Admirals’ trading volume decreased 4% to EUR 448 billion (or about USD $81 billion in monthly trading volume) comparing to period 2022 (6M 2022: EUR 467 billion and 6M 2021: EUR 429 billion). interestingly, the number of trades actually went up by 6% to 30.3 million comparing to period 2021 (6M 2022: 28.7 million and 6M 2021: 29.2 million). Also, the number of active clients in Group went up by 96% to 65,636 clients, compared to same period of 2022 (6M 2022: 33,493 and 6M 2021: 40,235 active clients). Similarly the number of new applications in Group went up by 222% to 143,414 applications compared to same period of 2022 (6M 2022: 44,508 and 6M 2021: 75,759 new applications).

While Revenues fell, the Group’s operating expenses increased by 24% in the first half of 2023. The largest share of total operating expenses (which includes payroll and depreciation expenses) for the Group in the first half of 2023 comes from personnel expenses. Personnel expenses increased 13% compared to year-on-year and reached EUR 7.48 million by the end of June 2023. Personnel expenses account for 30% of total operating expenses.

In the first half of 2023 marketing expenses were EUR 6.65 million which is an 37% increase year on-year and account for 26% of total operating expenses. IT expenses make up around 12% of total operating expenses and reached EUR 3.08 million by the end of June 2023. Other larger expense types for the Group are legal and audit services, other outsourced services, VAT and intra-group expenses. The cost-to-income ratio increased to 119% by the end of June 2023 as a result of a decrease in company revenue.

Regarding the company’s first half, Admirals CEO and Chairman of the Management Board Sergei Bogatenkov wrote:

Regarding the company’s first half, Admirals CEO and Chairman of the Management Board Sergei Bogatenkov wrote:

“The transformation from a CFD and Forex brokerage targeting sophisticated experts in the industry to an international financial services hub providing effortless solutions to beginners and retail clients through the Admirals platform, has paved the way for our long-term success and progress. The community of people in our ecosystem is rapidly increasing.

“Admirals has always emphasized the importance of a long-term strategy. The expansion in new regions, leveraging the existing licenses and global brand presence, is as remarkable as our commitment is clear. We are driven by the desire to pursue progress and innovation. Admirals’ vision is to empower financial inclusion by providing easy-to-use, affordable, and secure access to financial products through the Admirals’ ecosystem.

“I am proud that we have unlocked significant possibilities for growth and the expansion through diversification. Admirals has positioned itself in the rapidly developing FinTech community as a flexible and operative technology provider, as well as an education-driven strategic partner.”

The full Admirals Group A/S first half 2023 report can be downloaded here.