Active trading environment propels Interactive Brokers revenues in Q1 2021

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has reported its financial performance metrics for the first quarter of 2021, with increased market volatility pushing revenues higher.

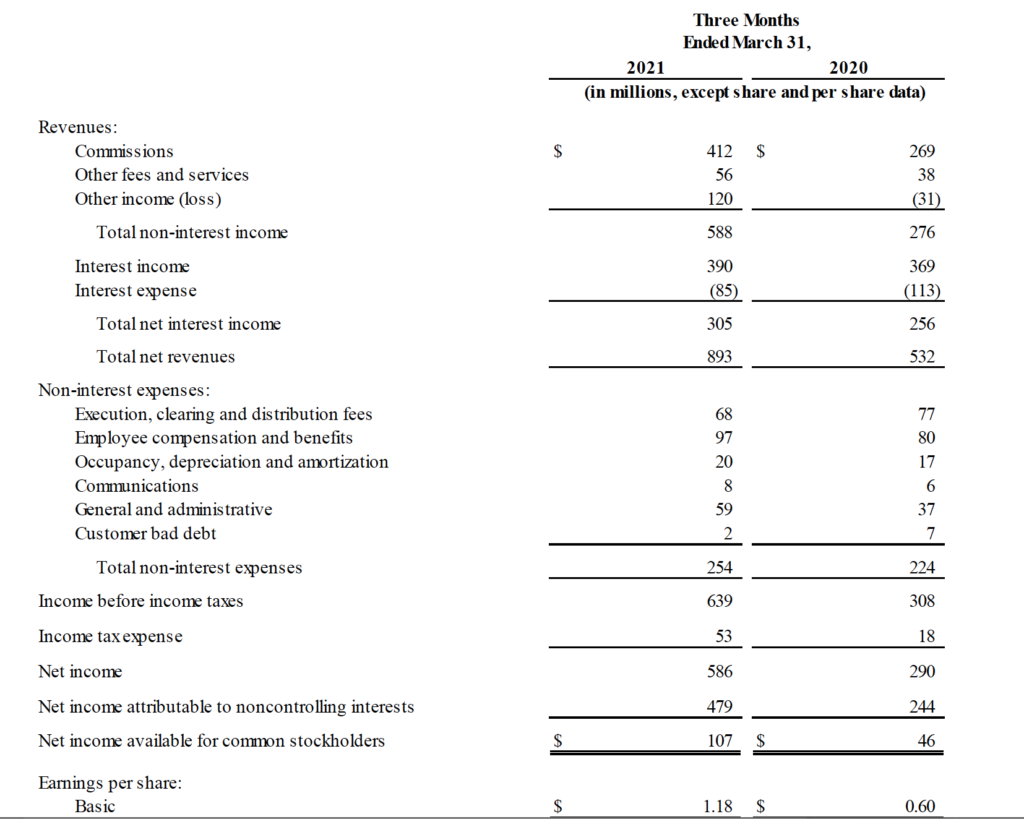

For the first three months of 2021, the company reported diluted earnings per share of $1.16 compared to $0.60 for the same period in 2020, and adjusted diluted earnings per share of $0.98 for this quarter compared to $0.69 for the year-ago quarter.

Net revenues were $893 million and income before income taxes was $639 million for this quarter, compared to net revenues of $532 million and income before income taxes of $308 million for the same period in 2020. Let’s note that net revenues were much stronger than in the final quarter of 2020.

Adjusted net revenues were $796 million and adjusted income before income taxes was $542 million for this quarter, compared to adjusted net revenues of $581 million and adjusted income before income taxes of $357 million for the same period in 2020. Commission revenue showed strong growth, increasing $143 million, or 53%, from the year-ago quarter thanks to higher customer trading volumes within an active trading environment worldwide.

Net interest income increased $49 million, or 19%, from the year-ago quarter on strong securities lending activity, tempered by a decrease in the average Federal Funds effective rate to 0.08% from 1.25% in the year-ago quarter, which reduced earnings on segregated customer cash and margin lending.

Other income increased $151 million from the year-ago quarter. This increase was mainly comprised of $107 million related to Interactive Brokers’ strategic investment in Up Fintech Holding Limited (“Tiger Brokers”), which swung to a $99 million mark-to-market gain this quarter from a $8 million mark-to-market loss in the same period in 2020. The result also reflected $47 million related to IBKR’s currency diversification strategy, which lost $2 million this quarter compared to a loss of $49 million in the same period in 2020.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.10 per share. This dividend is payable on June 14, 2021 to shareholders of record as of June 1, 2021.