Sumsub unveils full-cycle verification platform

London based identity verification and anti-fraud automation provider Sumsub has announced that it is introducing a full-cycle verification platform, stirring the borders of KYC, KYB, AML and anti-fraud.

With the new unified platform, Sumsub said that it is transforming from being one of the world’s leading KYC providers into the one future-proof platform that provides a full-cycle verification solution for the whole user journey.

“We knew that the industry needed a comprehensive solution to tackle the increasing fraud activity happening throughout the entire user journey. Our internal stats showed that an alarming 70% of fraud activity occurs past the KYC stage, which was a clear indication for our business to adapt, as KYC checks alone are no longer sufficient. With our new positioning, Sumsub anticipates industry changes by offering a future-proof full-cycle verification platform that is seamless and secure, addressing the challenges and expenses companies can face and assisting them to stay ahead of accelerating trends,” emphasized Andrew Sever, Co-founder and CEO of Sumsub.

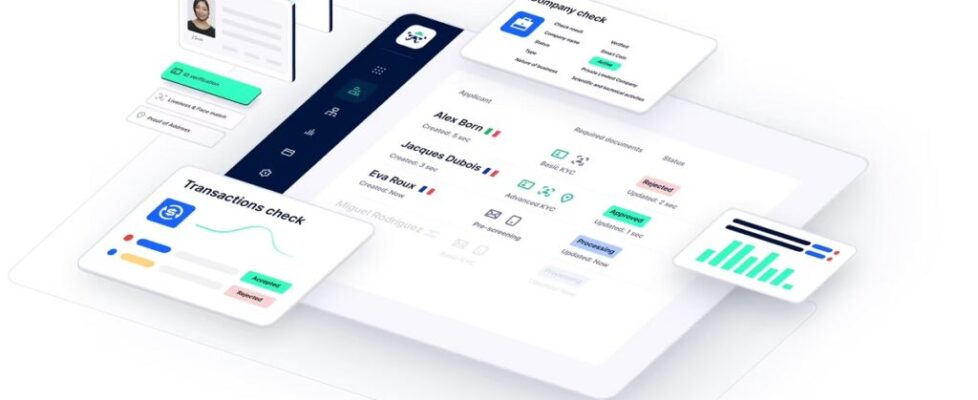

The new platform unites user and business verification, transaction monitoring, fraud prevention, and case management solutions into a single dashboard. It allows companies to orchestrate their verification flows with no limits for customization, code-free, and in no time. Empowered by AI technologies, the platform analyzes and monitors a vast amount of data for detecting suspicious patterns, thereby thwarting advanced fraud attempts.

The full-cycle platform guarantees ultimately efficient fraud protection by conducting cross-checks of user data at every stage and consolidated user risk profile. This user-centric approach enables Sumsub to verify data and combat fraud throughout the user journey, eliminating the need for multiple service providers and increasing the productivity of in-house teams.

Sumsub’s platform solution was designed to address four key trends, including the global increase in fraud, the trend for non-document verification and digital IDs, strictening regulations across various industries, and the rapid democratization of AI tech and innovation, leading to a rise of deepfakes and synthetic fraud. Sumsub in-house product, legal and compliance experts together with external advisers unite their insights for the further development of the full-cycle platform to anticipate new cyber threats, regulatory changes, and the shifting digital landscapes.

“The new Sumsub platform is the unique solution to an equation with three variables: 1) conversion, 2) anti-fraud, and 3) compliance that many leaders in the verification industry have struggled to solve until today,” explained Vyacheslav Zholudev, Co-founder and CTO of Sumsub. “It’s equally important that Sumsub breaks down borders for businesses by bringing top-notch customer experiences customized to different jurisdictions, with the highest pass rates across emerging and developed countries and being the only provider to openly share conversion rates. Additionally, we relentlessly introduce visionary solutions for market updates ahead of their implementation. For instance, the Travel Rule solution for the crypto industry or document-free verification, that allows fast and inclusive onboarding for users in emerging markets like India, Brazil, Nigeria, etc.”

Sumsub’s new positioning is the next step in the company’s journey towards creating a safe, accessible, and inclusive digital future for users and businesses alike. By eliminating fraud and verification hurdles, Sumsub aims to contribute to a world where anyone, regardless of age, location, or computing skills, can securely access and use any service. Sumsub is committed to innovating and improving the platform to eliminate fraud and verification hurdles and power a people-friendly digital future.

About Sumsub

Sumsub is a full-cycle verification platform that secures the whole user journey. With Sumsub’s customizable KYC, KYB, transaction monitoring and fraud prevention solutions, you can orchestrate your verification process, welcome more customers worldwide, meet compliance requirements, reduce costs and protect your business. Sumsub achieves the highest conversion rates in the industry—91.64% in the US, 95.86% in the UK, and 90.98% in Brazil—while verifying users in less than 50 seconds on average. The company’s methodology follows FATF recommendations, the international standard for AML/CTF rules and local regulatory requirements (FINMA, FCA, CySEC, MAS, BaFin). Sumsub has over 2,000 clients across the fintech, crypto, transportation, trading, e-commerce and gaming industries including Binance, Mercuryo, Bybit, Huobi, Unlimint, DiDi, Poppy and TransferGo.

“The new Sumsub platform is the unique solution to an equation with three variables: 1) conversion, 2) anti-fraud, and 3) compliance that many leaders in the verification industry have struggled to solve until today,” explained Vyacheslav Zholudev, Co-founder and CTO of Sumsub. “It’s equally important that Sumsub breaks down borders for businesses by bringing top-notch customer experiences customized to different jurisdictions, with the highest pass rates across emerging and developed countries and being the only provider to openly share conversion rates. Additionally, we relentlessly introduce visionary solutions for market updates ahead of their implementation. For instance, the Travel Rule solution for the crypto industry or document-free verification, that allows fast and inclusive onboarding for users in emerging markets like India, Brazil, Nigeria, etc.”

“The new Sumsub platform is the unique solution to an equation with three variables: 1) conversion, 2) anti-fraud, and 3) compliance that many leaders in the verification industry have struggled to solve until today,” explained Vyacheslav Zholudev, Co-founder and CTO of Sumsub. “It’s equally important that Sumsub breaks down borders for businesses by bringing top-notch customer experiences customized to different jurisdictions, with the highest pass rates across emerging and developed countries and being the only provider to openly share conversion rates. Additionally, we relentlessly introduce visionary solutions for market updates ahead of their implementation. For instance, the Travel Rule solution for the crypto industry or document-free verification, that allows fast and inclusive onboarding for users in emerging markets like India, Brazil, Nigeria, etc.”