Cypriot CFD brokers criticized by Germany’s BaFin for non-compliance with regulations

Cypriot CFD brokers have come under fire in a report by Germany’s Federal Financial Supervisory Authority (BaFin) as many of these brokerages do not comply with requirements regarding the risks associated with trading CFDs.

The most common scenario, according to Bafin, is when providers from Cyprus do not use the required risk warning or do not use it properly. BaFin passes such infringements on to its Cypriot colleagues – and takes action against German providers itself.

BaFin’s General Administrative Act of 23 July 2019 imposed restrictions on the marketing, distribution and sale of contracts for difference (CFDs) to retail clients in Germany. As of the entry into force of the product intervention measure on 1 August 2019, these activities are permitted only if the provider satisfies the following five conditions:

- Leverage is limited depending on the respective category of the underlying used for the CFD (initial margin protection)

- Open CFD positions are closed out at the latest when the initial margin is only 50 percent of the original initial margin (margin closeout protection)

- Negative balance protection is ensured; additional payments obligations are excluded for retail investors

- No monetary or non-monetary advantages are granted to retail investors (ban on bonuses)

- Communications include a binding risk warning

However, one still finds providers, especially from other EU countries, seeking to attract clients in Germany with CFD offerings that are actually illegal. All they need is the permission of their home country supervisor and a German-language website.

BaFin, which regularly monitors providers’ compliance with the specifications of the CFD restrictions, takes this into consideration. The supervisory authority also keeps an eye on providers from other EU countries.

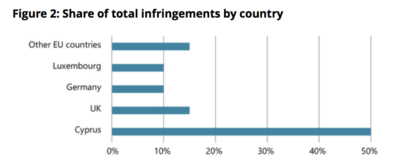

Of the 40 or so CFD providers last reviewed, a total of 48% were domiciled in Cyprus and 12% in the UK. Only 29% of the CFD providers are supervised directly by BaFin itself. In addition to established credit institutions and online banks, these also include institutions that specialise in CFD business.

About 70% of the identified infringements of the CFD General Administrative Act were due to the fact that the providers’ notifications regarding CFD trading lacked a risk warning or that the warning was inadequate.

In many cases, the prescribed risk warning was completely missing in advertising or training videos, smartphone apps, podcasts and social media contributions. It was often not positioned prominently enough: on some websites, for example, it appeared only at the bottom of the text and was thus not permanently visible. This is contrary to the requirements of the CFD General Administrative Act.

In second place, comprising 13% of the infringements found, were deviations from the requirements for leverage limitation. Providers were offering leverage at irregular levels, especially for CFDs involving bonds and exchange-traded funds (ETFs) as underlyings. The CFD General Administrative Act does not include ETFs or bonds among the underlying asset categories, which is why they fall under “other”. This means that an initial margin of at least 20% and a maximum leverage of five apply.

About 9% of providers tried to motivate investors to trade in CFDs by offering bonus payments. However, CFD providers are not permitted to grant investors monetary or non-monetary benefits.

Infringements of the CFD General Administrative Act constitute an administrative offence under section 120 (9) no. 30 of the WpHG and are subject to BaFin’s investigation and the imposition of a fine. BaFin makes German providers aware of the infringements identified and initiates administrative enforcement measures if they do not remedy the deficiencies found.

BaFin cannot directly take supervisory action when foreign companies utilise the European passport to offer CFDs to retail investors in Germany. It refers such cases to the relevant foreign supervisory authority, who then investigates the infringements as part of its own supervisory activities.

The regulator says it will continue to check whether CFD providers are complying with the product intervention measure and observing the interpretive guidance. Where necessary, BaFin will take action to counter infringements by taking administrative enforcement measures and imposing fines.