TradingView launches beta version of Deep Backtesting for Premium users

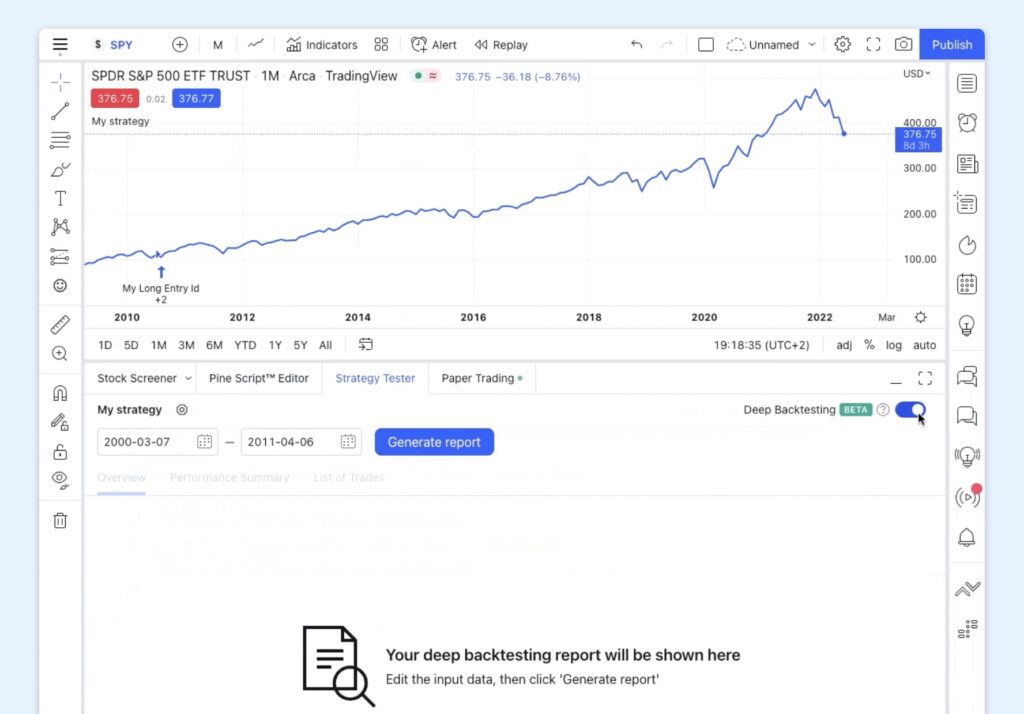

TradingView has made the beta version of Deep Backtesting available to its Premium users.

Those traders who did not have enough intraday data to test their Pine Script strategies before will most likely appreciate this functionality.

Deep Backtesting is an additional mode on the Strategy Tester. In it, testing on intraday time frames is possible on all data that is in TradingView’s storage. Now, you’re not limited by the number of bars on the chart.

How does it work?

- Just add your strategy to the chart and switch on the Deep Backtesting mode;

- Select the time interval for which you want to calculate the data and create a report.

TradingView has preserved the features of the Strategy Tester and improved them.

Earlier this year, TradingView introduced two new Pine Script functions, request.security_lower_tf() and request.economic(), and improvements to the existing request.security() function which allow traders’ scripts to access more data.

The new request.security_lower_tf() function makes it easier to request data from a lower timeframe than the charts. Before this new function, accessing all the 1min intrabars composing a 60min chart bar required complex user-defined functions and request.security() calls. The new request.security_lower_tf() now makes it a doddle by returning an array containing one value of the supplied expression for each intrabar. Note that the number of intrabars may vary for each chart bar.

The request.economic() function fetches economic data for a country or a region. Economic data includes information such as the state of a country’s economy (GDP, inflation rate, etc.) or of a particular industry (steel production, ICU beds, etc.)