Saxo Bank unveils changes to CMS API

Multi-asset investment specialist Saxo Bank has unveiled potentially breaking changes to its Client Management Systems API (CMS API).

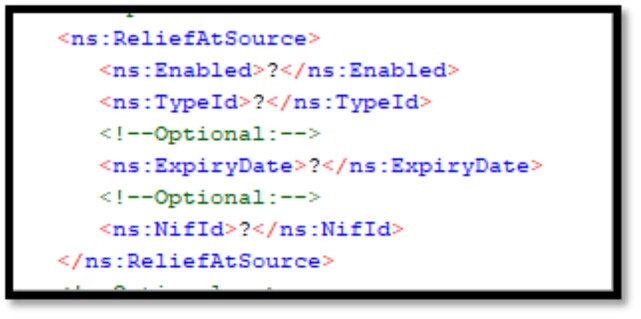

If you are a Qualified Intermediary and you are submitting your end-client’s “Relief at Source” data via the CMS API, then you need to ensure that the following conditions are met before 10 May 2024.

- When submitting “Relief at Source” information over the CMS API, if the flag ReliefAtSource.Enabled is set to “true”, and a ReliefAtSource.TypeID submitted, then it will be mandatory to also submit a valid future date (relative to the date of submission) in the field ReliefAtSource.ExpiryDate.

If, after this deployment, you have not taken action to guarantee the above, meaning the expiry date field is either = Null or has a past date (relative to the date of submission), your request will be rejected, and it may break your integration.

This validation affects the CMS API’s CreateCounterpart and UpdateCounterpart requests.

Saxo will deploy the new validation in the Live/TST CMS API endpoint on 27 April 2024. This will allow you to test any developments that you may need to execute to cater for this change, taking place 10 May 2024. Please note that you can access the Live/Test environment with your Test CMS API User.

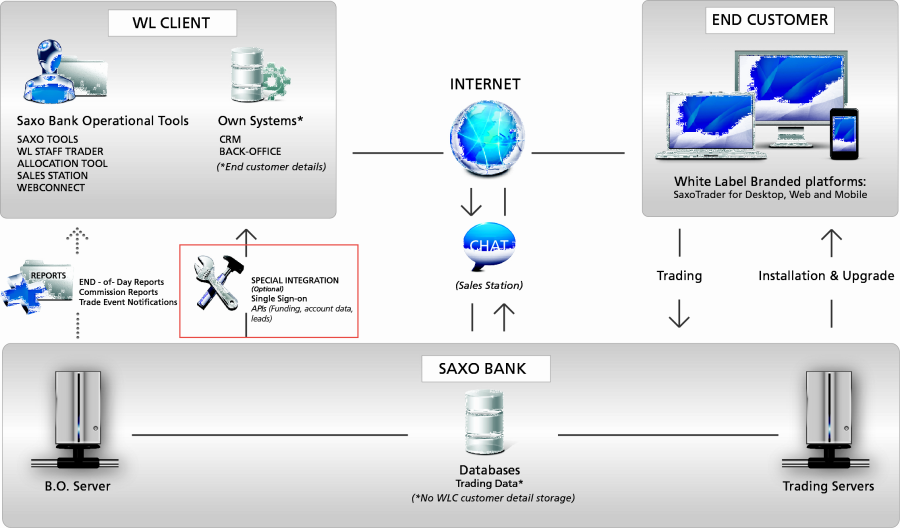

With the CMS API, White Labels now have the opportunity to integrate functionality of Saxo Tools within the White Label’s own systems and retrieve customer data for bespoke reports.

The CMS API allows the White Label to create and modify customers, perform cash transfers between the White Label’s funding account and its customers’ accounts and third, the API allows the White Label to retrieve a range of customer data which can for example be used to build reports or develop an account summary outside Online WebConnect.