OptionMetrics releases IvyDB Futures 3.0 database covering European and US futures options

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, today announced the release of its new IvyDB Futures database with historical futures option pricing data for US and European futures.

The database is designed to provide data of the highest quality for financial professionals to perform econometric studies on markets and test option trading strategies.

IvyDB Futures 3.0 offers clean historical data on 100+ of the most liquid optionable futures from CME, ICE, and Eurex global exchanges across eight sectors. This includes 30+ of the most liquid optionable US exchange-traded futures on the CME, in six sectors.

It also offers historical data on 70+ of the most liquid optionable European exchange-traded futures, from ICE and Eurex, in seven sectors. OptionMetrics leverages its proprietary pricing algorithm based on the Cox-Ross-Rubinstein (CRR) binomial tree model for American-style exercise options and the Black-Scholes model for European-style options, as well as a consistent database schema across all products.

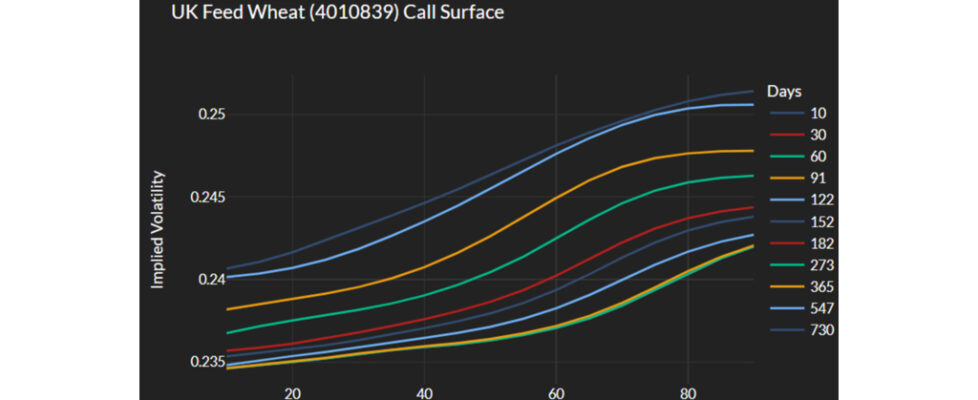

Financial professionals receive daily option pricing information (symbol, date, settlement price, volume, open interest), as well as Greeks, implied volatility, and other volatility surface calculations on corresponding futures options contracts as well as the associated zero curves.

Additional features of IvyDB Futures 3.0 include:

- US futures options data going back to January 2005, and European futures options data going back to October 1, 2020.

- US liquid futures sectors: agriculture, currencies, energy, equities, interest rates, metals.

- European liquid futures sectors: agriculture, crypto, currencies, energy, government bonds, interest rates.

- Data updated nightly to reflect current settlement prices, open interest, option contract expiration dates, and other changes.

- Pricing data on 1-Month and 3-Month SOFR for US futures added.

- Seamless ability to fetch and load files with in-house designed loader.

- Packaged by region and sector(s), based on user need.

- Linux and Windows operating systems supported.

“With research and financial strategies dependent on quality data, we are proud to announce IvyDB Futures 3.0 to give financial professionals access to complete, organized, clean futures options data on the European and US markets. We continually strive to provide the highest quality data, building on our 25+ years in the industry, to give financial professionals an edge in performing research, backtesting strategies, and assessing investment opportunities,” said OptionMetrics CEO David Hait, Ph.D.

IvyDB Futures 3.0 builds on OptionMetrics’ heritage of providing comprehensive historical financial data, with its flagship IvyDB US database offering complete end-of-day data on all U.S. exchange-traded equity, index, and ETF options since January 1996. The company also offers options data for Asia-Pacific, Europe, and Canada; options trading volume data; implied beta data on equities, and dividend forecasting data.