Leverate to integrate Sumsub for FX broker client identity verification

FX broker platform and technology provider Leverate and KYC/AML specialist Sumsub have announced a partnership whereby Leverate will offer Sumsub’s solution to its FX broker clients for quick and reliable KYC and chargeback protection checks for Leverate’s SaaS based trading platforms worldwide.

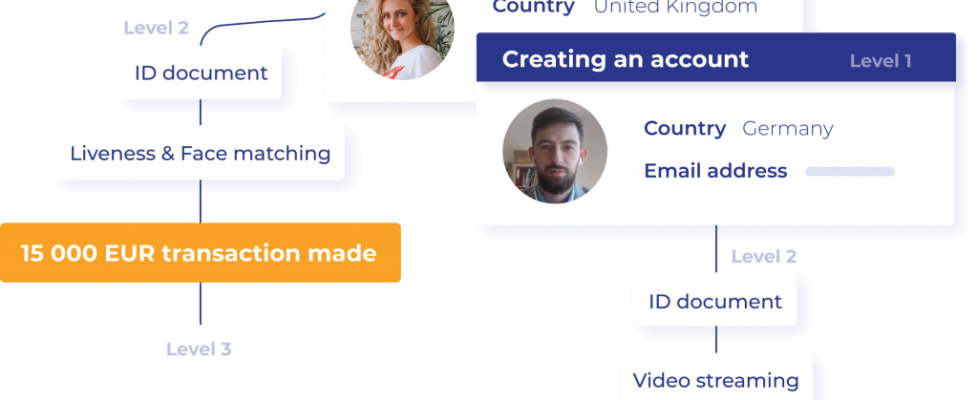

Partnering with Leverate, Sumsub will provide Leverate’s clients with quick KYC checks and AML screening for their users, securing access in line with regulatory demands. Sumsub has also supplied Leverate’s clients with fraudulent chargeback protection mechanisms, defending their platforms from fraudulent attacks, which have significantly increased since the start of the global COVID-19 pandemic.

Tal Laitner, VP of Innovation at Leverate. stated:

‘We were looking for a solution to go hand in hand with our platform, in addition to one that would remove the need for our clients to worry about identity verification and anti-fraud checks. Sumsub covered this need in full, providing our clients with fully automated, people-friendly onboarding mechanisms, a quick processing speed, and international document coverage. Our clients now don’t have to waste time on regulatory headaches and can focus on persistent growth, while Sumsub covers all of the necessary KYC/AML compliance demands for any region. Not to mention that traders will have a great time onboarding.’

Jacob Sever, Co-founder of Sumsub added:

‘Compliance is a vital aspect of the trading businesses—nobody wants to pay substantial fines for incomplete checks and risk their platform’s safety. For that, we are happy to supply Leverate’s clients with robust and friendly checks, built in line with regulatory requirements, and those that fulfill their need for a trustworthy ally. Leverate’s clients will be able to quickly onboard more happy traders, while we will be making sure to double check their intentions’.

Sumsub is an identity verification platform that provides an all-in-one technical and legal toolkit to cover KYC/KYB/AML needs. The company focuses on accelerated ID verification, digital fraud detection and compliance for over 200 markets. Sumsub employs top market technologies combined with legal expertise, and assistance with financial requirements (FCA, CySEC, MAS, FINMA, BAFIN, etc). Clients include BlaBlaCar, Gett, ESL Gaming, JobToday, Wheely, Vk.com, Decta, Exness, Bank Dobrobyt, HRS Group.