Interactive Brokers’ TWS platform offers Advisors to make use of new features

Electronic trading major Interactive Brokers continues to expand the functionalities of its TWS platform.

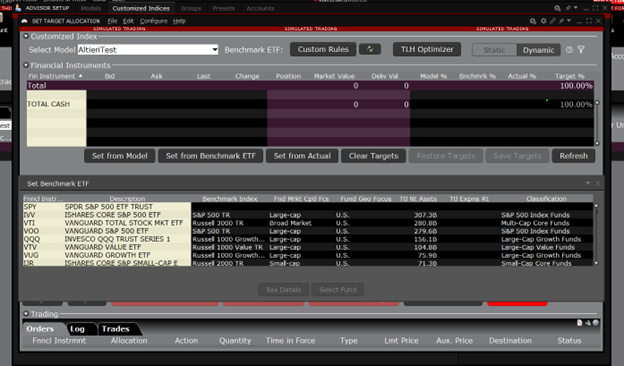

With TWS’s customizable Direct Indexing feature Customized Indices, Advisors can easily create a portfolio model benchmarked from popular Index ETFs like SPY, QQQ, and more. Once imported, advisors can customize the composition as needed using the Custom Rules button.

To create a Customized Index model:

- Open the Advisor Setup tool from within Mosaic (button on top menu) or the Classic Layout.

- Select the Customized Indices tab, and then Create Customized Index model. Enter a name for your new model.

- From the displayed list of index ETFs, highlight the desired benchmark. You can View Details and then Select Fund to populate the model.

Once the index composition has been imported to your new Model Portfolio, use “Custom Rules” to automatically modify by setting a new cash target, excluding symbols, creating an ESG-based “exclude” list, and setting other custom criteria including new weights.

Once you’ve saved and applied your custom rules, simply invest clients in the new model as you do for other Model Portfolios.

Advisors can then use the Tax Loss Harvesting feature to take advantage of capital losses on losing positions and reap the benefits come tax time. Simply sort model positions by Unrealized Model P&L, select a losing position, right-click and open the Allocation Order Tool. Next, choose to liquidate all or a portion of the position, and if desired use the sale proceeds to invest in another asset you can find using the scanner tool.

Interactive Brokers has recently added Morningstar proprietary Ratings and Analyst Commentary for Funds/ETFs & Equities to Fundamentals Explorer. Traders can see an overview in the Morningstar summary tile when they open Fundamentals Explorer.

Data points provided by Morningstar include both qualitative coverage which is contributed by an actual analyst, and quantitative coverage which is calculated programmatically and without the input of an actual analyst.

Let’s note that the latest (beta) build of the TWS platform comes equipped with new Advanced Charts.

Advanced Charts offer a robust charting system with sophisticated but easy-to-use drawing and annotation tools, customizable trendlines, and unique studies and indicators. Use Advanced Charts as a standalone window, or make TradingView the default chart type in your Mosaic layout.