Interactive Brokers adds Orbisa Securities Lending Analytics Dashboard to TWS platform

Electronic trading major Interactive Brokers continues to enhance the capabilities of its TWS platform.

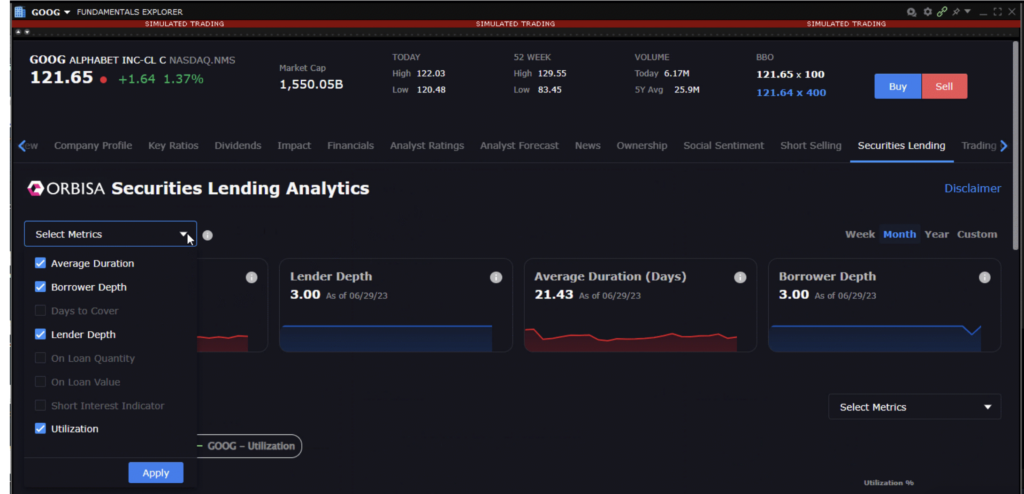

In beta build 10.24, users get access to the same valuable short/securities lending data for US equities historically available only to banks, broker-dealers and institutional investors. The Orbisa Securities Lending Analytics Dashboard in Fundamentals Explorer gives you professional-level access to key metrics and data to see when borrowing demand is increasing or decreasing so you’re better able to gauge in which direction market sentiment is trending.

Orbisa data includes 189,000 unique securities over more than 50 global markets.

With the Orbisa Securities Lending Analytics Dashboard you can view up to eight trend metrics including:

- Utilization: The total quantity of the security on loan divided by the total inventory of the security. Expressed as percentage.

- Lender Depth: A scale to indicate the number of lenders with an outstanding borrow in the name. 1: 0-5 lenders, 2: 6-10 lenders, 3: 11 or more lenders.

- Average Duration: The volume weighted average duration of all open loans in the security based on Trade Date, expressed in calendar days.

- Borrow Depth: A scale to indicate the number of lenders with an outstanding borrow in the name. 1: 0-5 lenders, 2: 6-10 lenders, 3: 11 or more lenders.

- Days to Cover: For equity securities, the number of shares on loan in a security for the business date divided by the 30 day trading average in the cash market.

- On Loan Quantity: Total quantity of the security on loan.

- On Loan Value: Total value (USD) of the security on loan.

- Short Interest Indicator: For equity securities, the number of shares on loan divided by the total number of shares in the public float, expressed as a percentage. For fixed income securities, the size on loan divided by the issuance size, expressed as a percentage.

Clients of the broker can also use the “Compare” chart to compare short-selling data of two companies. They can compare trends across multiple companies side by side using custom date ranges going back as far as one 12 months.

The Orbisa dashboard is available in Desktop TWS, Client Portal, IBKR Mobile, and in the soon-to-be-released IBKR Desktop. Find the dashboard in the Fundamentals Explorer.

Interactive Brokers regularly updates its TWS platform. Build 10.24 has also added swap support for European Mutual Funds.

The Exchange Fund feature allows clients to swap all or part of an eligible (long) mutual fund position into another fund from the same fund family. Eligible funds include European funds traded on FUNDSETL, and ALLFUNDS exchanges.