Deutsche Börse upgrades T7 trading architecture

Deutsche Börse Group has announced a new release of the T7 trading architecture, which aims to revolutionize the way traders and investors access market opportunities worldwide. Equipped with cutting-edge technology, the trading platform delivers ultra-low latency, robustness and safe handling even for very high throughput.

“Our latest release once again offers our customers an extended range of services to fulfill their needs and trade both simple and complex products or strategies at Eurex,” says Jonas Ullmann, Chief Operating Officer and Member of the Executive Board of Eurex.

The highlight is the product extension of the equity basket trading, including options as well as additional futures products. After the introduction of T7 Release 9.1, Eurex will expand the scope of the product types available for Equity Bespoke Basket (EBB) trading. From that point onwards, options as well as additional futures products will be available for basket trading.

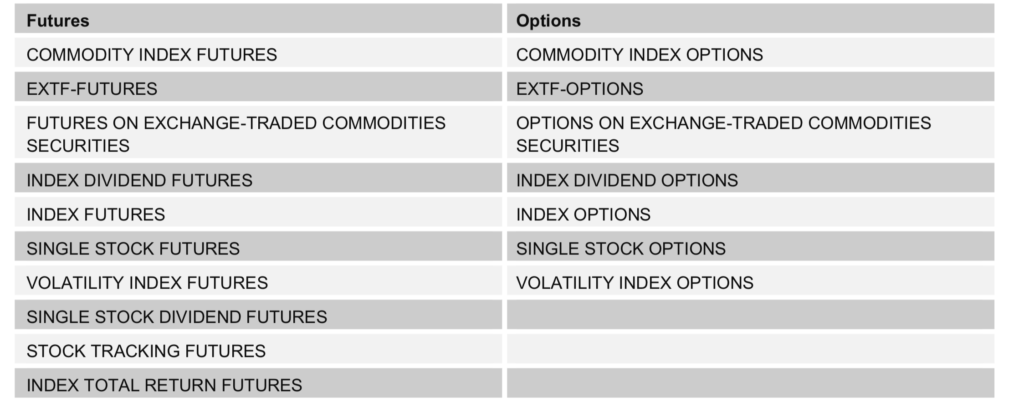

The following table shows the new product types which will be supported:

In addition to the product type extension, it will be possible to combine certain types of products available for EBB Trading within a Basket according to the respective exchange-provided bucket definition.

The following functional enhancements will be introduced to support the additional product types for EBBs:

- Preliminary trade products (e.g. Index TRFs) will be allowed as component products for EBB- type buckets and thus for EBB-type baskets associated with these buckets.

- The TES Type Trade at Market (TAM) will be supported for a component trade of an EBB-type basket, provided it will be allowed for the component product concerned.

- The maximum number of component trades in a basket trade will be enhanced from 99 to 199.

- The description of basket components will be enhanced by additional fields such as call/put indicator, strike price, expiration month, option version number (if required for identification), and currency.

Everything which applied to the previously known product types available for EBB trading will now apply accordingly to all new product types available for EBB trading:

- Pre-Trade Risk Quantity Limits will be applied individually, as before per component trade.

- The GUI will support TES Basket positions and upload of baskets.

- If a product of a component trade will be outside its trading hours, it will not be possible to submit a basket trade (entry or amendment).

- Brokerage functionality of baskets will be supported, i.e. it will be possible to enter a basket trade by a third party, which is not a counterparty.

The increased product scope and enhanced functionality will be supported via ETI and the T7 Trader GUI.

Release 9.1 will also see several improvements for Eurex EnLight, for example to the T7 Trader GUI, while workflows are further simplified. Further enhancements include the stepwise introduction of FIX LF Interface as well as for TES trading and Compression runs.