Cboe unveils latest enhancements to Cboe Silexx

Cboe Silexx, a multi-asset order execution management system (OEMS) that caters to the professional marketplace, has announced a series of enhancements as part of version 24.10.

- Order Ticket | Pin Order Details to Ticket

The order details section can now be configured to display directly on the ticket. Choose which order details to pin to a ticket under the settings section.

- Disable Pre-Trade Risk Rejects

Risk admins can now choose to disable the pre-trade risk reject pop up. By disabling the pop up, orders will still be submitted to Cboe’s backend risk checks and will reject orders if any parameter is violated. This will allow risk managers to see rejected orders like in the Legacy platform. This setting is configurable at the user level.

- Multi Ticket and Order Ticket | Duplicate Ticket

Tickets can now be duplicated by clicking ‘Duplicate’ under the menu in the top right corner of the multi order ticket and order ticket.

- API | Easy to Borrow / Hard to Borrow Endpoint

Users of the new Cboe Silexx API can now access a list of ETB/HTB stocks using /securities/easytoborrowsecurities. The response will contain a list of stocks with their respective locateIds.

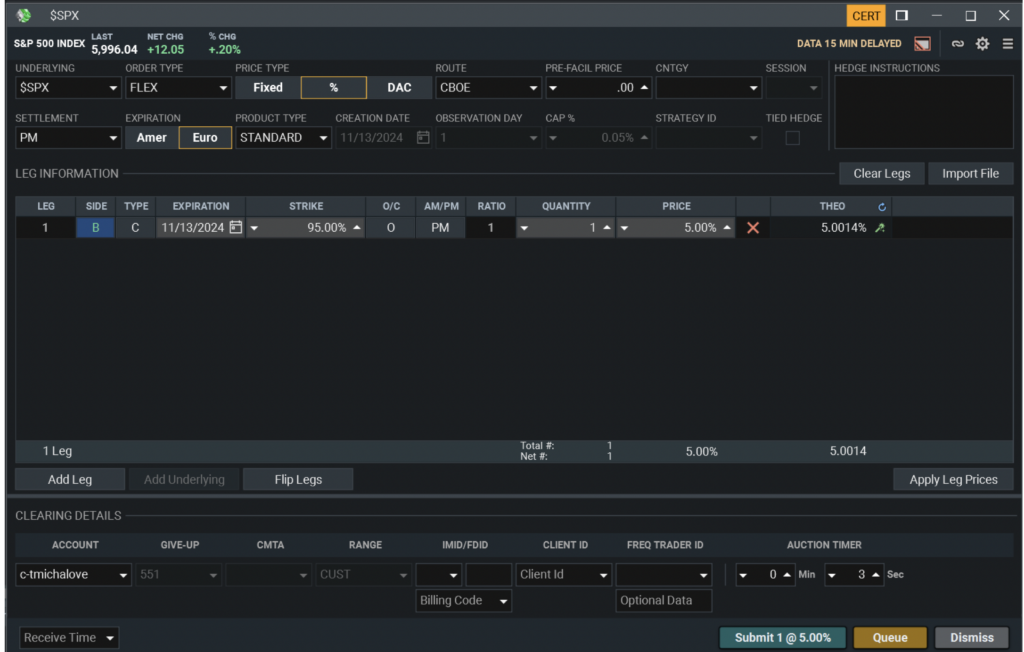

- FLEX Ticket | DAC and % Price Type Theoretical Prices

Building off Silexx’s previous FLEX Theo pricer release, the ticket now displays theoretical prices for % and DAC price types. Percent price types assume that the current underlying price will be the closing price. DAC will also assume the current price will be the close unless a reference price is provided. The pricer can be enabled in the ticket settings menu.