Broadridge registers 5% Y/Y increase in revenues in Q3 FY25

Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the third quarter ended March 31, 2025 of its fiscal year 2025.

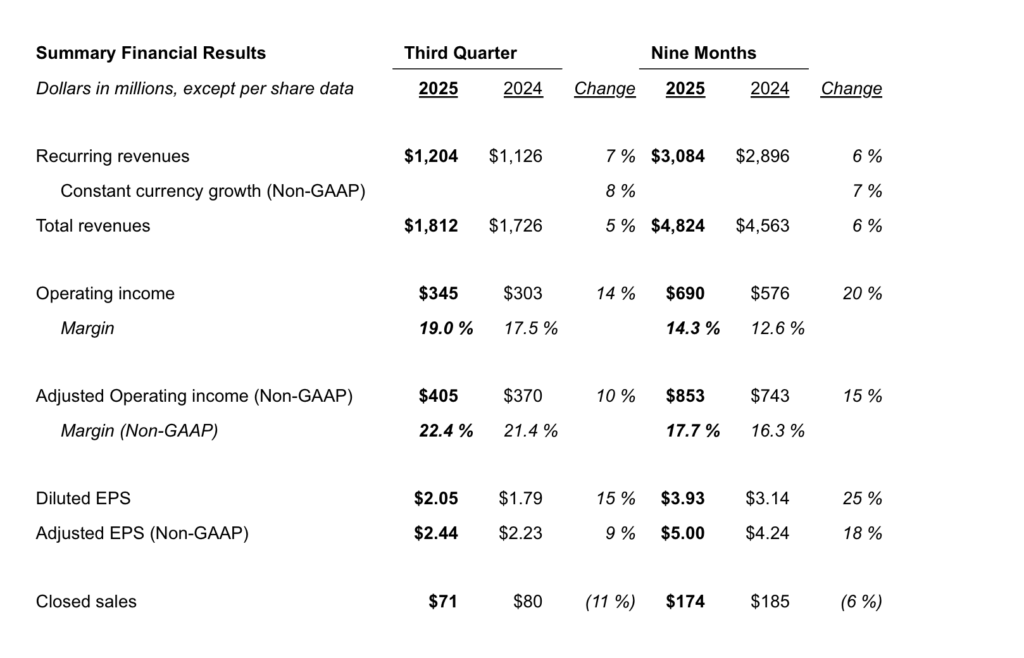

Total revenues increased 5% to $1,812 million from $1,726 million in the year-ago period.

Recurring revenues increased $78 million, or 7%, to $1,204 million. Recurring revenue growth constant currency (Non-GAAP) was 8%, driven by organic growth in ICS and GTO and an acquisition in GTO.

Event-driven revenues decreased $14 million, or 21%, to $53 million, driven by a lower level of equity proxy contest activity.

Distribution revenues increased $22 million, or 4%, to $555 million, driven by the postage rate increase of approximately $32 million which more than offset lower mail volumes.

Operating income was $345 million, an increase of $42 million, or 14%. Operating income margin increased to 19.0%, compared to 17.5% for the prior year period, primarily due to higher Recurring revenues.

Adjusted Operating income was $405 million, an increase of $36 million, or 10%. Adjusted Operating income margin was 22.4% compared to 21.4% for the prior year period. The combination of higher distribution revenue and higher float income negatively impacted margins by 10 basis points.

Interest expense, net was $31 million, a decrease of $4 million, primarily due to lower average borrowing rates.

Net earnings increased 14% to $243 million and Adjusted Net earnings increased 8% to $289 million.

Diluted earnings per share increased 15% to $2.05, compared to $1.79 in the prior year period, and

Adjusted earnings per share increased 9% to $2.44, compared to $2.23 in the prior year period.

“Broadridge delivered strong third quarter results, including 8% Recurring revenue growth constant currency and 9% Adjusted EPS growth,” said Tim Gokey, Broadridge CEO. “Our continued execution is being driven by the resilience of our business and powerful long-term trends.