Beeks registers 22% Y/Y rise in revenues in H1 FY25

Beeks Financial Cloud Group Plc (LON:BKS), a cloud computing and connectivity provider for financial markets, today announced its unaudited results for the six months ended 31 December 2024.

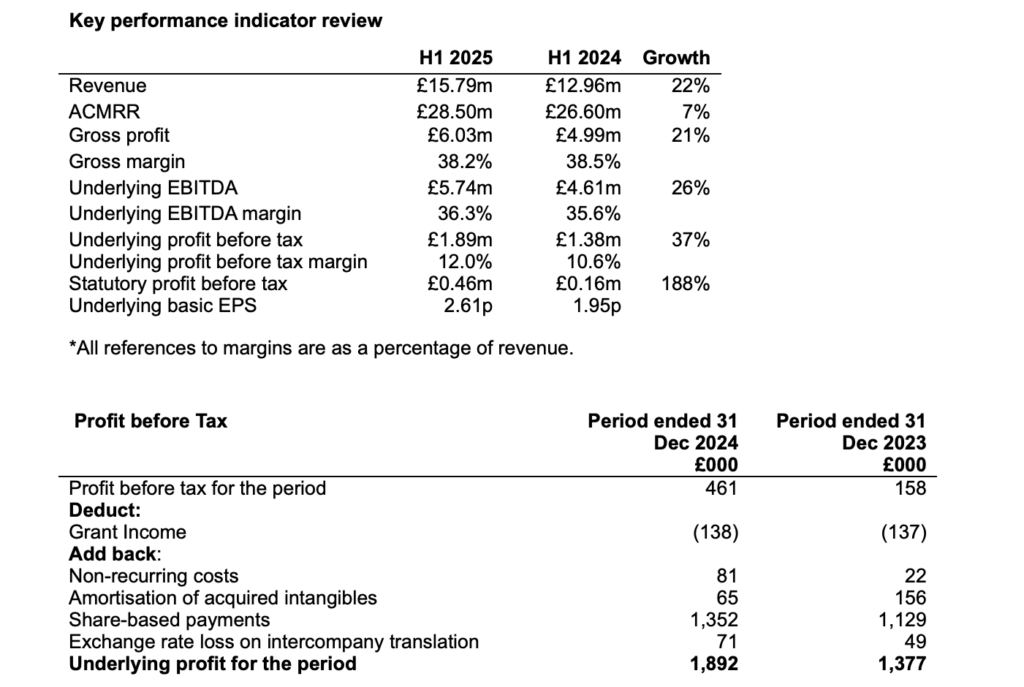

Group revenues grew by 22% to £15.79m (H1 2024: £12.96m) driven by organic growth in both Beeks’ core Public/Private Cloud offering as well as new wins in Exchange and Proximity Cloud.

Beeks’ core Public and Private Cloud revenues grew by 8% to £12.65m (H1 2024: £11.66m).

Beeks’ overall contractual revenue (ACMRR) grew 7% to £28.50m (H1 2024: £26.60m).

During the period Beeks delivered growth in both our Proximity and Exchange Cloud products via three new customers, recognising additional revenues of £3.3m relating to these three new contract wins.

Gross profit in the period increased by 21% to £6.03m (H1 2024: £4.99m) with gross margin largely unchanged. In line with previous periods, Beeks expects gross margins to improve in the second half of the year.

Underlying EBITDA increased by 25% to £5.74m (H1 2024: £4.61m) with underlying EBITDA margins slightly ahead of this time last year at 36.3% (H1 2024: 35.6%).

Beeks reported a Statutory profit before tax of £0.46m (H1 2024: £0.16m) with underlying profit before tax increasing to £1.89m (H1 2024: £1.38m).

There has been an increase in administrative expenses (excluding share-based payments and non-recurring costs) when compared to the prior year of 16% to £4.11m (H1 2024: £3.55m) but administrative costs have remained lower as a percentage of revenue.

In addition to Edge Intelligence hires, Beeks has further strengthened its sales team with a London based senior sales hire to capitalise on its pipeline, and further increased its security team. In line with its automation strategy, engineering and support staff have remained flat. Beeks’ headcount as at 31 December 2024 has reduced marginally to 103 from 105 as at 30 June 2024 and from 105 as at 31 December 2023.

Beeks has continued to invest in product, in product enhancements to Exchange Cloud and a new Edge Intelligence product that provides cutting-edge latency and client experience insights to enhance trading performance. As such, capitalised development costs in the period were £1.39m (H1 2024: £1.40m). Most of this cost is internally generated as Beeks uses its in-house teams to develop the bespoke technology.