Paysafe sees net loss shrink in Q1 2023

Payments platform Paysafe Limited (NYSE:PSFE) today announced its financial results for the first quarter of 2023.

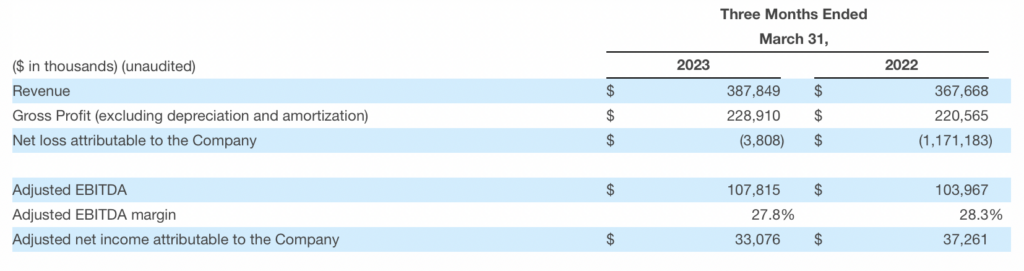

Total revenue for the first quarter of 2023 was $387.8 million, an increase of 5%, compared to $367.7 million in the prior year period. Excluding a $7.3 million unfavorable impact from changes in foreign exchange rates, total revenue increased 7%.

Revenue from the Merchant Solutions segment increased 8%, driven by strong growth from e-commerce as well as the SMB market in North America. Revenue from the Digital Wallets segment increased 2% on a reported basis and 6% on a constant currency basis, driven by underlying growth from iGaming and digital assets, as well as interest revenue on customer deposits.

Net loss attributable to the company for the first quarter was $3.8 million, compared to $1,171.2 million in the prior year period. The decrease in net loss reflects an impairment of goodwill recognized in the prior year period.

Adjusted net income for the first quarter was $33.1 million, compared to $37.3 million in the prior year period, primarily driven by an increase in interest expense.

Adjusted EBITDA for the first quarter was $107.8 million, an increase of 4%, compared to $104.0 million in the prior year period. Excluding a $1.5 million unfavorable impact from changes in foreign exchange rates, Adjusted EBITDA increased 5% compared to the prior year period. Adjusted EBITDA margin for the first quarter was 27.8%, compared to 28.3% in the prior year period, reflecting non-recurring executive severance payments of approximately $2.0 million.

First quarter net cash used in operating activities was $119.0 million, compared to an inflow of $503.8 million in the prior year period, mainly reflecting the timing of settlement of funds payable and amounts due to customers. Free cash flow was $70.3 million, compared to $59.2 million in the prior year period, which includes the movement in customer accounts and other restricted cash which was an increase of $167.0 million in the first quarter of 2023, compared to a decrease of $450.9 million in the prior year period.

As of March 31, 2023, total cash and cash equivalents were $221.7 million, total debt was $2.6 billion and net debt was $2.4 billion. Compared to December 31, 2022, total debt decreased by $32.1 million, reflecting net repayments of approximately $50 million, which was partly offset by movement in foreign exchange rates.

Bruce Lowthers, CEO of Paysafe, commented:

“We kicked off 2023 by delivering our strongest quarterly revenue since going public. Revenue increased 7% and adjusted EBITDA increased 5% year-over-year on a constant currency basis, fueled by double-digit growth from our classic digital wallets as well as e-commerce. We are confident in maintaining our full year outlook and remain very pleased with the progress of our sales transformation initiative, which is driving cross-selling and higher value client wins.”