Paysafe reports net loss of $50.1M for Q2 2025

Payments platform Paysafe Limited (NYSE:PSFE) today announced financial results for the second quarter of 2025.

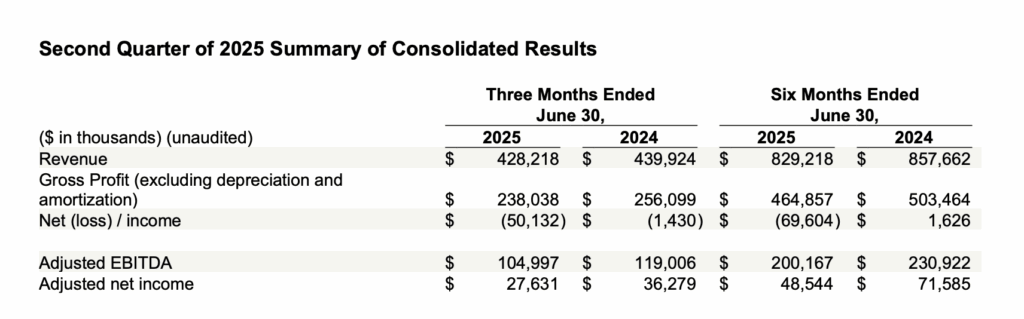

Reported revenue for the second quarter of 2025 was $428.2 million, a decrease of 3%, compared to $439.9 million for the second quarter of 2024, as the prior year period included $36.7 million of revenue related to the disposed direct marketing payments processing business line.

Organic revenue growth was 5%, reflecting 6% organic growth from Merchant Solutions, led by double-digit growth in e-commerce, and 3% organic growth from Digital Wallets.

Net loss for the second quarter was $50.1 million, compared to $1.4 million in the prior year period. Net loss included a charge to income tax expense of $30.6 million related to the recognition of a valuation allowance against the company’s UK deferred tax assets, which is a non-cash expense that does not impact the company’s current or future cash tax payments.

The increase in net loss also reflects a decrease in operating income of $16.0 million mainly associated with the disposed business and an increase in non-operating expenses, including higher losses on foreign exchange and legal costs.

Adjusted net income for the second quarter decreased to $27.6 million, compared to $36.3 million in the prior year period, reflecting the decline in Adjusted EBITDA, as the prior year period included $25.4 million of Adjusted EBITDA related to the disposed business.

Adjusted EBITDA for the second quarter decreased 12% to $105.0 million, compared to $119.0 million in the prior year period, reflecting a headwind of approximately 24 percentage-points related to the disposed business as described above. This was partially offset by a decrease in selling, general and administrative expenses, reflecting cost discipline and the non-recurring nature of certain investments in the prior year to expand the company’s sales capabilities and optimize the portfolio.

Movement in foreign exchange rates was favorable to second quarter revenue and Adjusted EBITDA by $9.6 million and $2.5 million, respectively. This was partly offset by a $4.0 million headwind to both revenue and Adjusted EBITDA due to a decrease in interest revenue on consumer deposits.

Second quarter operating cash flow was $39.6 million, compared to $54.1 million in the prior year period.

Unlevered free cash flow was $53.9 million, compared to $70.0 million in the prior year period.

Bruce Lowthers, CEO of Paysafe, commented:

“A very solid quarter with revenue, adjusted EBITDA, and adjusted EPS all in line with our expectations. We delivered 5% organic revenue growth and strong adjusted EBITDA growth of 12%, when excluding the divested direct marketing business, reflecting continued execution on our strategic share priorities and growth across all major product lines. In Europe, for the first time in years, we had double-digit headwind related to the disposal of the direct growth led by our consumer business, marketing business line coupled with overall strong performance from existing customers, a higher contribution from new customer wins, and the launch of innovative products.

Collectively, we remain on track to drive stronger growth and margin improvement in the second half of the year.”