Paysafe incurs net loss of $87.7M in Q3 2025

Payments platform Paysafe Limited (NYSE:PSFE) today announced financial results for the third quarter of 2025.

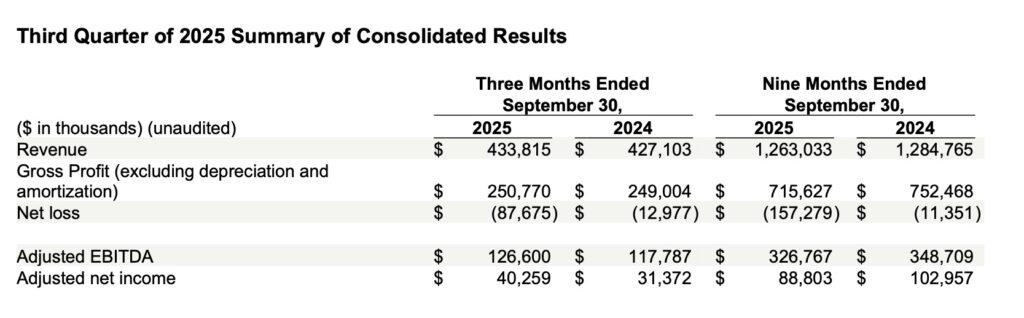

Reported revenue for the third quarter of 2025 was $433.8 million, an increase of 2%, compared to $427.1 million for the third quarter of 2024, despite a headwind of $24.1 million related to the disposed direct marketing payments processing business line.

Organic revenue growth for the third quarter was 6%, reflecting 7% organic growth from Merchant Solutions and 4% organic growth from Digital Wallets.

This growth was led by double-digit growth from e-commerce, including robust volumes with the start of the U.S. football season, strong demand for Paysafe’s suite of local payment solutions in Latin America, as well as increasing consumer engagement related to eCash product initiatives and the expansion of Paysafe’s digital banking partnerships across Europe.

Net loss for the third quarter was $87.7 million, compared to $13.0 million in the prior year period, mainly due to a charge to income tax expense of $81.2 million related to the recognition of an additional valuation allowance against the company’s U.S. deferred tax assets due to the enactment of the One Big Beautiful Bill Act in July 2025.

The wider net loss also reflects higher restructuring and other costs of $12.4 million, primarily related to legal fees.

Adjusted net income for the third quarter increased to $40.3 million, compared to $31.4 million in the prior year period, mainly driven by higher Adjusted EBITDA and lower interest expense.

Adjusted EBITDA for the third quarter increased 7% to $126.6 million, compared to $117.8 million in the prior year period, despite a $10.3 million headwind (approximately 10 percentage-points) related to the disposed business line.

Movement in foreign exchange rates was favorable to third quarter revenue and Adjusted EBITDA by $11.9 million and $3.5 million, respectively, partly offset by a $3.6 million headwind to both revenue and Adjusted EBITDA due to a decrease in interest revenue on consumer deposits.

Third quarter operating cash flow was $69.2 million, compared to $81.9 million in the prior year period, which was mainly driven by higher restructuring costs and income tax paid. Unlevered free cash flow was $83.6 million, compared to $89.9 million in the prior year period.

Paysafe is also announcing that its Board of Directors has authorized a $70 million increase to its existing share repurchase program. Including the $70 million increase announced today, approximately $97 million in aggregate remains available under the share repurchase program.

Under the share repurchase program, management is authorized to purchase shares of our common stock from time to time through open market purchases or privately negotiated transactions at prevailing prices as permitted by securities laws and other legal requirements, and subject to market conditions and other factors. This program does not obligate the company to acquire any particular amount of common stock and the program may be extended, modified, suspended or discontinued at any time at the company’s discretion.