New Swift scheme to require full predictability on price and speed for retail transactions

Swift and its participant banks today take the next step toward making cross-border payments as seamless as domestic ones.

Swift will introduce new network rules to ensure a consistently fast and predictable experience for consumers and small businesses sending money anywhere in the world.

Swift is developing the new scheme framework with a voluntary coalition of over 30 early adopter banks to provide retail customers with the peace of mind and predictability they expect when sending money internationally. The rules will ensure upfront transparency on payment costs, guaranteed full value delivery, end-to-end visibility and a commitment to instant settlement where available.

Financial institutions will leverage the advanced capabilities on the Swift platform — typically used for wholesale payments — to enhance cross-border retail payments. Recent upgrades have significantly improved the experience, enabling fully transparent transfers that exceed G20 targets, with 75 percent of payments reaching beneficiary banks within 10 minutes.

Initiatives like Swift Go and experience benchmarking have already benefited consumer channels, and the scheme will further extend the advantages to 4 billion accounts in over 200 countries.

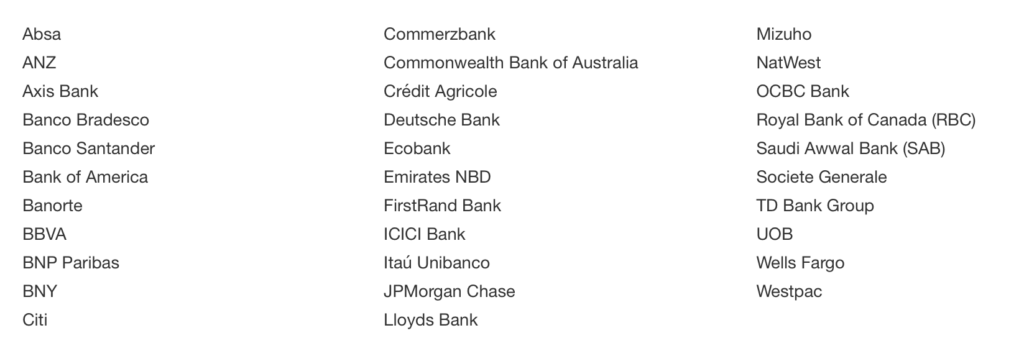

Banks from 17 countries will work with Swift to set the retail rules in stages, including defining mechanisms to ensure adherence. The banks include:

The work advances the 2027 G20 Roadmap for cross-border payments, which Swift has made a strategic priority. It has made strong progress in the “in-flight” cross-border leg, and it has also been doing additional work to help remove friction in end-to-end transaction chains. It has put considerable focus in the domestic “last mile” leg to help move the needle.