FIS reports rise in revenues for Q1 2022

FIS (NYSE:FIS), a global leader in financial services technology, today reported its first quarter 2022 results.

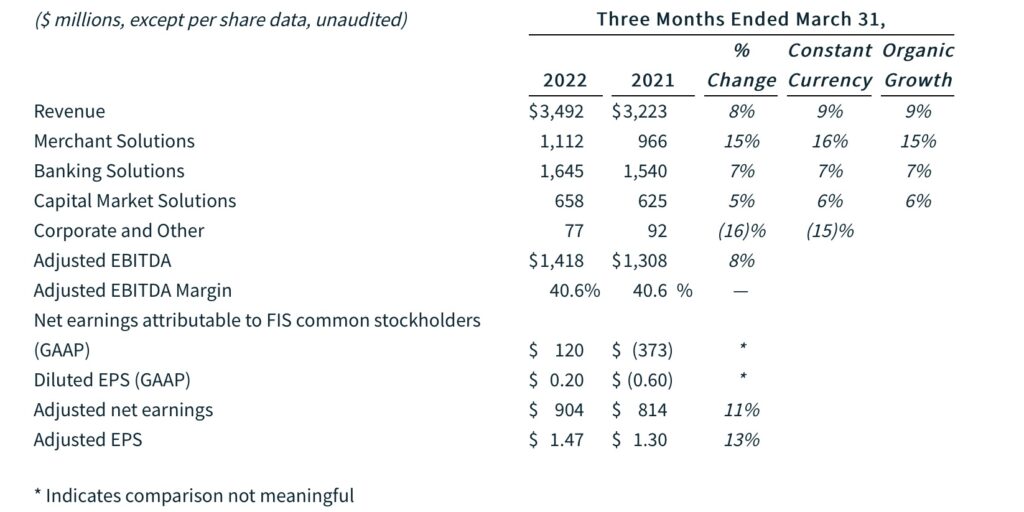

On a GAAP basis, revenue increased by more than $250 million, or 8% as compared to the prior-year period, to $3.5 billion. Net earnings attributable to common stockholders were $120 million or $0.20 per diluted share.

On an organic basis, revenue increased 9% as compared to the prior-year period when excluding the impact of changes in foreign currency exchange rates and inorganic contribution from acquisitions and divestitures.

Adjusted EBITDA was $1.4 billion. Adjusted EBITDA margin was flat at 40.6%, as the company successfully offset rising wage inflation, difficult comparisons created by stimulus-related revenue in the prior-year period and ramping large client wins.

Adjusted net earnings increased 11% as compared to the prior-year period to $904 million, and adjusted net earnings per share increased 13% to $1.47 per diluted share.

Banking Solutions revenue increased by 7% on both a GAAP and an organic basis as compared to the prior-year period to $1.6 billion.

Capital Market Solutions revenue increased by 5% on a GAAP basis and 6% on an organic basis as compared to the prior-year period to $658 million, primarily due to strong growth in recurring revenue.

Merchant Solutions revenue increased by 15% on both a GAAP and an organic basis as compared to the prior-year period to $1.1 billion.

FIS continued to reduce leverage which will enable the resumption of share repurchase under its existing 100 million share authorization during the second quarter. In addition, FIS increased its quarterly dividend by 21% as compared to the prior-year period to $0.47 per share, paying a total of $287 million in dividends during the first quarter.

“FIS is off to a strong start to the year,” said Gary Norcross, FIS Chairman and Chief Executive Officer. “We chose to continue to invest in new solutions and capabilities to benefit our clients throughout the pandemic. These investments are really paying off by enabling us to drive strong revenue growth and returns. In addition, our team’s focus on execution and robust cash flow enabled us to pay down debt more quickly than anticipated, which will allow us to resume share buybacks a quarter ahead of schedule.”