FIS keeps reaping the benefits of Worldpay acquisition

FIS (NYSE:FIS) today reported its third quarter 2020 results, with the company continuing to reap the benefits of its acquisition of Worldpay.

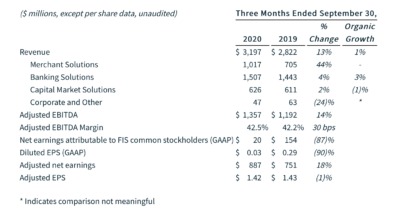

On a GAAP basis, revenue increased 13% to $3,197 million in the third quarter of 2020, primarily due to the July 31, 2019 acquisition of Worldpay, Inc. FIS achieved annual run-rate synergies related to the Worldpay acquisition, exiting the third quarter of 2020 as follows:

- Revenue synergies of approximately $150 million, including continued successful origination of new bank referral agreements and Premium Payback cross-selling wins. Revenue synergies remain on track to exceed $200 million in annual run-rate achievement exiting 2020.

- Expense synergies exceeding $700 million, including approximately $385 million of operational expense savings. Operational expense synergies remain on track to exceed $400 million in annual run-rate achievement exiting 2020.

On an organic basis, revenue increased 1% as compared to the prior year period, primarily due to consumer spending trends associated with the ongoing COVID-19 pandemic. Adjusted EBITDA margin expanded by 30 basis points (bps) over the prior year period to 42.5%, primarily due to the achievement of Worldpay cost synergies.

Adjusted net earnings were $887 million or $1.42 per diluted share.

Net earnings attributable to common stockholders totalled $20 million or $0.03 per diluted share.

- The Merchant Solutions segment saw third quarter revenue increase 44% to $1,017 million, primarily due to the Worldpay acquisition.

- The Banking Solutions segment saw its third quarter revenue increase 4% to $1,507 million. On an organic basis, revenue increased 3% as compared to the prior year period, primarily due to growth in recurring revenue.

- The Capital Market solutions segment saw third quarter revenue increase 2% to $626 million. On an organic basis, revenue decreased 1% as compared to the prior year period, primarily due to quarterly variability in license renewal timing as the business transitions to a recurring, SAAS-based revenue model.

- In Corporate and Other, third quarter revenue decreased 24% to $47 million. Adjusted EBITDA loss was $68 million, including $10 million of Adjusted EBITDA from our non-strategic businesses offset by $78 million of corporate expenses.