Will the iCar drive Apple’s stock price in 2021?

The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

Apple investors are accustomed to being surprised and delighted with the company’s innovations and new product releases Now they’re looking forward to the next big thing. Could this be not a phone, but a car?

The Cupertino, California based tech giant is making strides in the Electronic Vehicle (EV) game, dipping its toes into an industry whose sales grew 34% in 2020. EVs beat out headwinds from the global recession and a semiconductor shortage, showcasing remarkable resilience.

Apple, the largest company on the S&P500, performed better than its counterparts in 2020, rising 78% in the year and 91% from the March pandemic lows. However, despite earnings surprises for the December 2020 and March 2021 quarters, its stock has contracted 1.87% year to date. The pressure has likely been triggered by the thematic flow out of growth stocks, the enduring semiconductor shortage and longer obsolescence cycles on the iPhone.

Apple’s PE ratio has plummeted from around 41 in yearend 2020 to about 29 currently. With future earnings under threat, a new product might be just what the stock needs to excite the market again. Meanwhile, the company remains extremely secretive about unannounced products. So, speculations around the iCar (as its unofficially dubbed) boil down to deal talks and analyst notes.

So, here’s a look at the project, the competition, and how the market may respond.

Gearing Up, But with Speed Bumps

Apple’s foray into the automobile sector is not new. Project Titan launched in 2014 aimed to design a vehicle from scratch. The project has since moved to a software-oriented approach and Apple more than doubled its testing in 2020, with its cars driving over 18,805 miles, as per California DMV data.

Apple started production discussions with Hyundai and Kia, but negotiations fell through in February 2021. While shares of both Hyundai and Kia fell when talks were cancelled, Apple’s stock did not react to the news. Seems like these automakers were not comfortable ceding control to the extent that Apple typically requires from its contract manufacturers. The company could face such resistance ahead as well.

The Korea Times reported in mid-April that Apple had commenced talks with a Magna Steyr and LG joint venture for iCar production. The deal on the table is for test cars but could expand to a broader scale production opportunity in the future. Magna Steyr does not have its own brand but produces vehicles for BMW, Mercedes and Toyota, and its engineers have worked with Apple before. The Austrian plant is also beginning to collect EV experience, producing for Jaguar.

Oncoming Traffic Ahead

Bloomberg reported that the company has hired former Tesla chief engineer Doug Field at the helm of the iCar project. With this, Apple will be competing with Tesla on two fronts – EVs and self-driving vehicles.

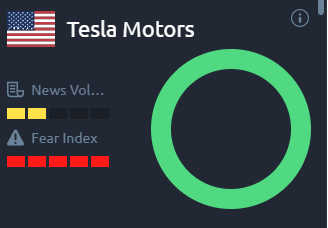

In the EV space, the iPhone maker will face the laborious task of navigating a market replete with competitors. Tesla, on the other hand, has a considerable first-mover advantage. Having already captured an 80% share of the US market, the Elon Musk company plans to deliver 750,000 cars in 2021. Despite significantly lower earnings and production capacity than traditional automakers, Tesla’s market value dwarfs these companies. Also, the market sentiment for its stock remains overly positive, as seen in the Acuity Trading Dashboard.

In the EV space, the iPhone maker will face the laborious task of navigating a market replete with competitors. Tesla, on the other hand, has a considerable first-mover advantage. Having already captured an 80% share of the US market, the Elon Musk company plans to deliver 750,000 cars in 2021. Despite significantly lower earnings and production capacity than traditional automakers, Tesla’s market value dwarfs these companies. Also, the market sentiment for its stock remains overly positive, as seen in the Acuity Trading Dashboard.

Do keep in mind, however, that Tesla has consistently under-delivered on its production and self-driving targets. Apple not only has huge funds, but also the opportunity to learn from Tesla’s mistakes.

Apple’s self-drive technology is also behind its competitors at the moment. Disengagements (when a driver has to interfere during autonomous driving) currently occurs at an average of 145 miles for Apple’s prototype fleet. Fellow tech giant Google reported a disengagement once every 30,000 miles. GM’s self-driven Cruise prototype recorded no disengagements in the 200,000 miles driven in the last quarter of 2020. Apple has deployed considerable talent to bridge the gap, moving the self-driving aspect under its AI chief John Giannandrea and recruiting Stuart Bowers, who led Tesla’s self-driving team till 2019. If Apple can import its existing innovation pedigree to iCar, while contracting out the capital-heavy production process, Tesla might have a legitimate challenger.

Will iCar Drive Shareholder Value?

Prima facie, the automotive industry seems a strange one for Apple to enter from a profitability point of view. Apple posted a robust 42% quarterly gross margin on its existing product line in March. Tesla, by contrast, has only ever posted a profit due to emission credits, while traditional automakers average gross margins of about 15%. While an EV foray might seem value dilutive, Apple can look to its software development as a source of profits and generate further value by offloading production to contract manufacturers.

UBS analyst David Vogt expects the car industry to be 100% EV in 10 years, generating an extra value of $14 per share for Apple in the long run, in the light of the company’s significant research and patents.

Not Quite Sparking Investor Interest

The Magna-LG deal for test cars is expected only in July. Apple’s investors currently seem more interested in macroeconomic themes and the current portfolio than a possible iCar announcement in 2024.

Investor sentiment for both Apple and the tech-laden Nasdaq 100 has turned positive, as can be seen on the Acuity Trading Dashboard.

Any spike in share prices in response to iCar news will likely be short-lived. In fact, what’s more likely in the near term are negative movements due to uncertainty surrounding the venture.

The global economy is still recovering, and fresh virus concerns keep reappearing. Sustained share price increases from iCar are more likely in the long time than in 2021.