What the ECB Rate Hike Could Mean for the Markets

The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

It’s finally happened. For months the European Central Bank had refrained from announcing a rate hike, despite the aggressive monetary tightening followed by US Fed and Bank of England to fend off inflation. This ended on July 21, with the ECB raising its key rate for the first time in 11 years. The rate hike, at 50bps, was higher than market expectations of 25bps. Markets were quick to react. Although most indices ended in the green on July 21, the gains remained muted on a day when several large corporates released healthy earnings. Should we remain concerned about the ECB rate hike? Here’s a look at the implications of this larger-than-expected move for financial markets.

Reading Between the Lines

Yes, rate hikes can dampen economic activity. However, there are two important things to consider related to the ECB’s move. First, the bloc’s central bank remains more accommodative than its advanced economy counterparts. Although, on the face of it, the 50bps rate hike was higher than expected, it simply brings the central bank’s key rate back to 0 from negative territory. On the other hand, the UK and US have hiked their rates over the past few months to 1.5% and 1.75%, respectively.

Second, although there is growing concern around inflation in Europe, the issues are not intrinsic to the region (unlike the other advanced economies). Much of Europe’s inflation is imported, coming in from across the Atlantic. The Russia-Ukraine war has added fuel to the fire. Gas prices have been a significant contributor, rising over 100% since the invasion of Ukraine in February 2022. Since the issues are external, the EU can take action to shield itself. For instance, the bloc has made attempts to alleviate its dependence on Moscow, signing new gas deals with the US and Azerbaijan and asking EU member nations to reduce consumption by 15%.

A Focus on Defensive Assets

Short-term fixed income yields are the most sensitive to policy changes. An increase in rates makes bonds less valuable, leading to a sell-off and a corresponding increase in yields. German Bund yields rose despite downward pressure from a sharp fall in US treasury yields. The 2-y German Bund increased 22% from 0.61% to 0.75% on the back of the rate-hike announcement. Bond yields are likely to keep rising, with markets anticipating further rate hikes by the ECB. Corporate bonds are likely to see a strong rise in yields too.

Rake in the Cash

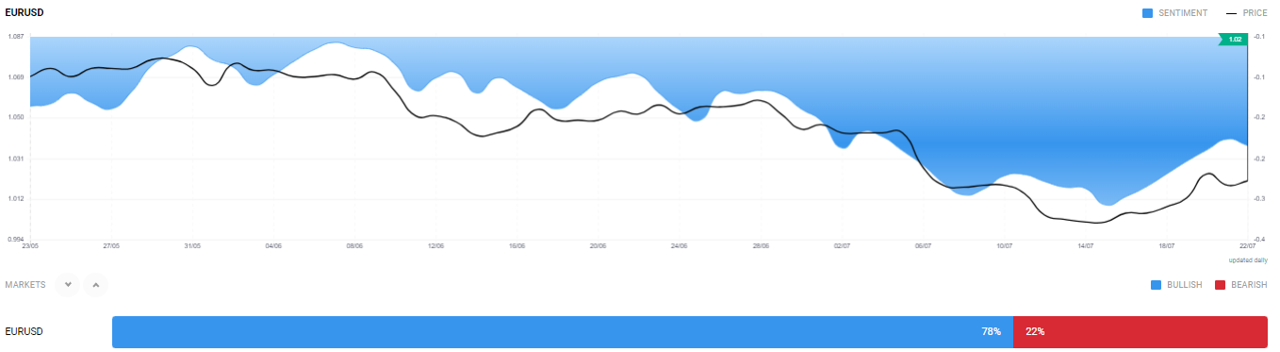

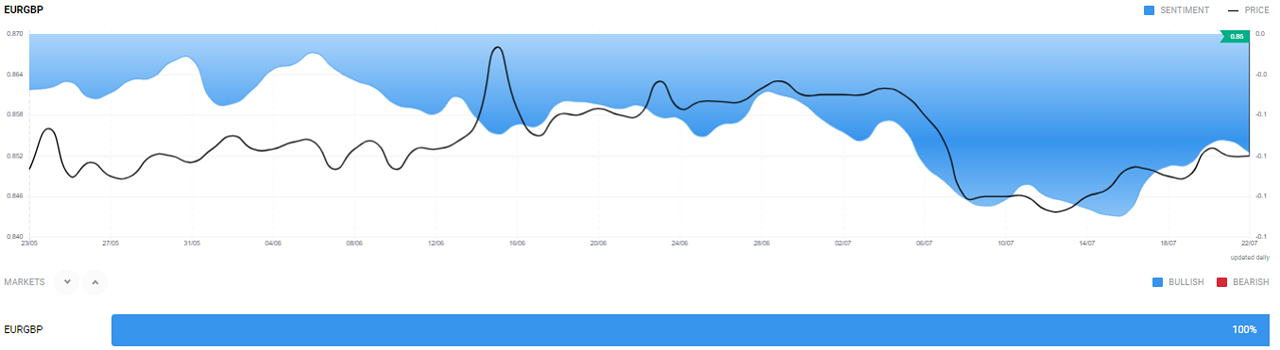

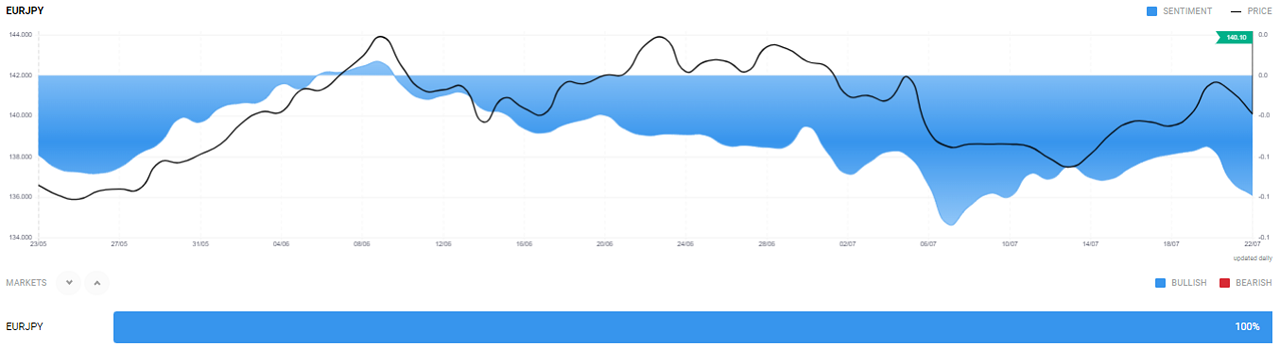

Cash is a defensive asset that is directly impacted by interest rates. The euro has experienced a turbulent year so far, reaching parity with the US dollar, as it hit 20-year lows in July. This fall was as much driven by inflation as by the Fed’s aggressive rate hikes. The ECB’s alignment with other major banks to raise rates could trigger demand for the euro. If the rate hike succeeds in easing inflation, even slightly, the euro could soon pare all its losses. The sentiment for the euro has already turned overwhelmingly positive, as can be seen on Acuity’s Sentiment Widget.

Taking Stock of the Situation

Cyclical stocks could feel the pressure of the recent hike and expectations of subsequent ones. Companies that produce discretionary goods and services are the most likely to feel the pinch. Investors may also be cautious of high-growth tech stocks, as a large percentage of the value is tied to earnings potential far in the future.

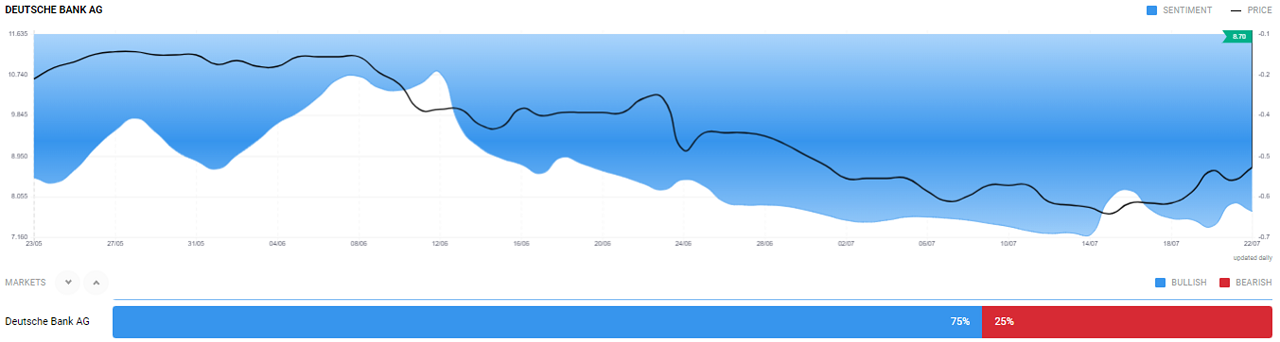

Rate hikes are good news for banks, which will experience better profit margins in the initial years and offer opportunities for better returns for investors. Deutsche Bank, listed on the stock exchanges of Frankfurt and New York, estimated that a 1% rise in rates in 2022 would add as much as €400 million to its net earnings in 2022 and up to €1 billion in 2023.

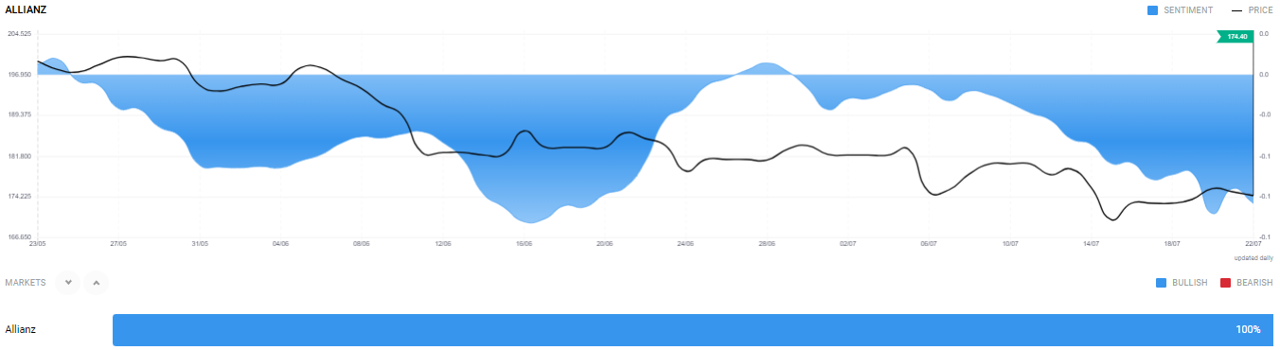

Stocks of insurance companies, like Allianz, also stand to benefit. A rise in interest rates will raise the cost of funds, and consequently their investment values, while their incomes are stable based on contracted insurance premiums. Top insurers could record positive income flows in a tightening monetary environment.

It’s also worth noting that even stocks of companies with strong underlying fundamentals are trading at a substantial discount and bigger investors could tap on this opportunity.

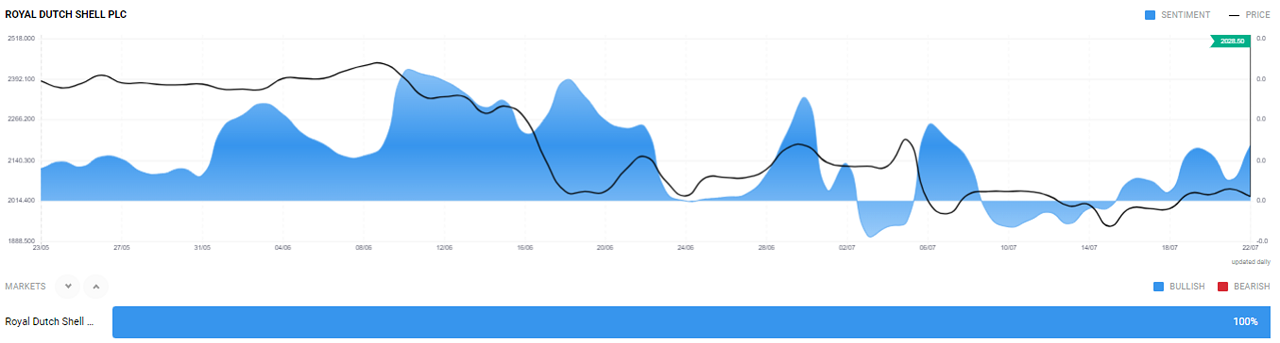

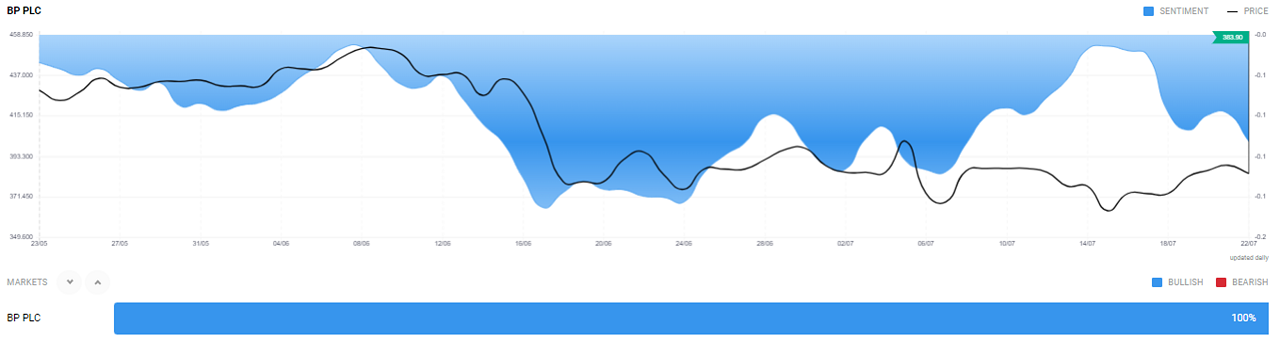

Some oil & gas companies are also worth noting. Companies like Shell and BP not only benefit from rising fuel prices but also from their massive cash reserves, which appreciate with rate hikes.

The STOXX Europe 600 index, which includes several banking and insurance firms as well as larger companies with solid fundamentals and loads of cash, has lost around 15% year-to-date and represents a potential investment to earn from rate hikes.

What’s Next?

It’s still unclear whether the ECB will announce another rate hike at its September meeting. What’s even more uncertain is how the Russia-Ukraine and supply chain situations are going to play out. Meanwhile, all investors and traders can do is to stick to the basics. Create and test strategies before jumping in, make informed decisions, exercise discipline and adopt risk management techniques.