Virtu reports 55.7% Y/Y increase in Q4 FY24 revenues

Virtu Financial, Inc. (NASDAQ:VIRT) today reported results for the fourth quarter ended December 31, 2024.

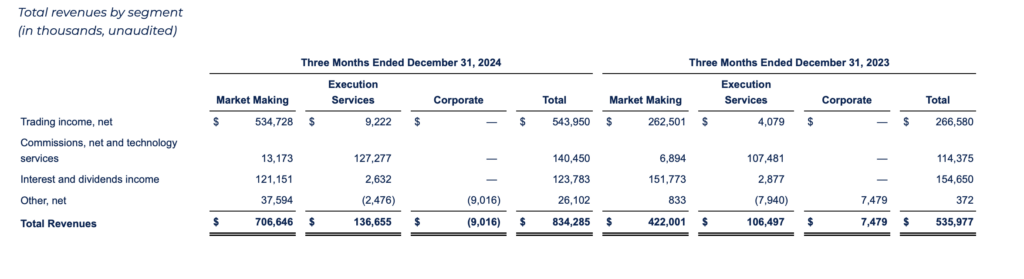

In the final quarter of 2024, total revenues increased 55.7% to $834.3 million, compared to $536.0 million for the same period in 2023.

Trading income, net, increased 104.0% to $544.0 million for the quarter compared to $266.6 million for the same period in 2023. Net income totaled $176.1 million for this quarter, compared to net income of $6.7 million in the prior year quarter.

Basic and diluted earnings per share for this quarter were $1.03, compared to basic and diluted earnings per share of $0.05 for the same period in 2023.

Adjusted Net Trading Income increased 75.4% to $457.7 million for this quarter, compared to $260.9 million for the same period in 2023. Adjusted EBITDA increased 186.4% to $283.5 million for this quarter, compared to $99.0 million for the same period in 2023. Normalized Adjusted Net Income, removing one-time and non-cash items, increased 313.5% to $182.2 million for this quarter, compared to $44.1 million for the same period in 2023.

In 2024, total revenues increased 25.4% to $2,876.9 million, compared to $2,293.4 million for 2023. Trading income, net, increased 40.0% to $1,822.4 million in 2024, compared to $1,301.3 million for 2023.

Net income totaled $534.5 million for 2024, compared to net income of $263.9 million for 2023.

Basic and diluted earnings per share were $2.98 and $2.97, respectively, for 2024, compared to basic and diluted earnings per share of $1.42 for 2023.

Adjusted Net Trading Income increased 32.0% to $1,597.7 million for this year, compared to $1,210.7 million for 2023. Adjusted EBITDA increased 61.7% to $918.7 million for this year, compared to $568.0 million for 2023. Normalized Adjusted Net Income increased 86.3% to $573.9 million for this year, compared to $308.1 million for 2023.

As of December 31, 2024, Virtu had $914.0 million in cash, cash equivalents and restricted cash, and total long-term debt outstanding in an aggregate principal amount of $1,767.3 million.

Since inception of the share repurchase program in November 2020 through settlement date January 27, 2025, the company repurchased approximately 50.7 million shares of Class A Common Stock and Virtu Financial Units for approximately $1,296.2 million.

The company has approximately $423.8 million remaining capacity for future purchases of shares of Class A Common Stock and Virtu Financial Units under the program.