Virtu Financial posts Q4 2025 net income of $664.9M, up 22% Y/Y

Virtu Financial, Inc. (NYSE:VIRT), a provider of financial services and products that leverages cutting edge technology to deliver innovative, transparent trading solutions to its clients and liquidity to the global markets, today reported results for the fourth quarter ended December 31, 2025.

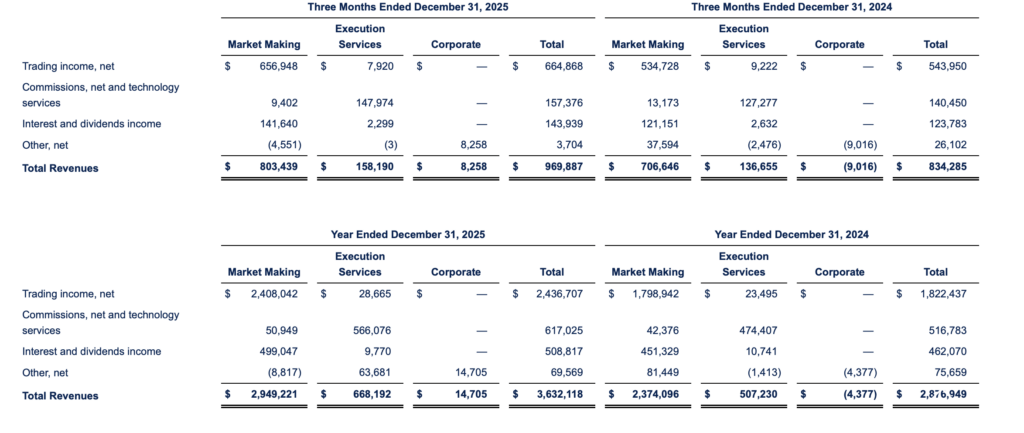

Total revenues increased 16.3% to $969.9 million for the fourth quarter of 2025, compared to $834.3 million for the same period in 2024. Trading income, net, increased 22.2% to $664.9 million for the quarter compared to $544.0 million for the same period in 2024. Net income totaled $280.6 million for this quarter, compared to net income of $176.1 million in the prior year quarter.

Basic and diluted earnings per share for the final quarter of 2025 were $1.54, compared to basic and diluted earnings per share of $1.03 for the same period in 2024.

Adjusted Net Trading Income increased 34.0% to $613.4 million for the fourth quarter of 2025, compared to $457.7 million for the same period in 2024. Adjusted EBITDA increased 55.9% to $442.0 million for this quarter, compared to $283.5 million for the same period in 2024.

Normalized Adjusted Net Income increased 61.6% to $294.5 million for the final quarter of 2025, compared to $182.2 million for the equivalent period in 2024.

Assuming all non-controlling interests had been exchanged for common stock, and the Company’s Normalized Adjusted Net Income before income taxes was subject to corporation taxes, Normalized Adjusted EPS was $1.85 for the fourth quarter of 2025, compared to $1.14 for the corresponding period in 2024.

As of December 31, 2025, Virtu had $1,126.4 million in cash, cash equivalents and restricted cash, and total long-term debt outstanding in an aggregate principal amount of $2,067.3 million.