U.S. Hiring Falls to 22-Year Low in December

The following is a guest editorial courtesy of Carolane de Palmas, Markets Analyst at Retail FX and CFDs broker ActivTrades.

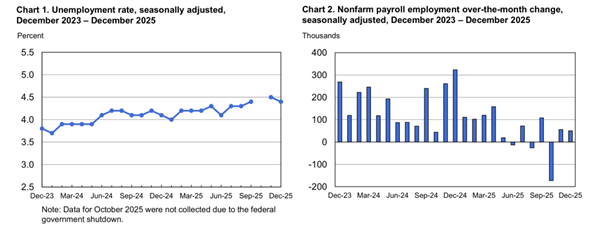

The December employment report, released last Friday, painted a stark picture of a U.S. labor market that has fundamentally shifted gears throughout 2025. With employers adding just 50,000 jobs last month—falling short of the 73,000 expected by economists—the data marks the culmination of a year characterized by historically weak hiring. This job report is also the first comprehensive view of the U.S. labor market conditions in several months, following the unprecedented 43-day government shutdown that halted data collection and delayed the release of crucial economic statistics and indicators in the United States.

Source: Bureau of Labor Statistics

The headline unemployment rate edged down to 4.4% in December, yet this modest improvement masks a broader trend of gradual deterioration from the 4.0% rate recorded in January 2025. More telling is the annual picture: employers added merely 584,000 positions throughout 2025, translating to an average monthly gain of 49,000 jobs. This represents a deceleration from 2024’s robust performance, when the economy generated two million jobs at a monthly pace of 168,000. To put this slowdown in historical context, 2025 recorded the weakest average monthly job growth in 22 years, excluding only the periods surrounding recent recessions. The limited job creation that occurred in 2025 showed remarkable concentration, with education and health services accounting for the bulk of new positions.

What Seems to Be Behind the Current Hiring Freeze?

The sharp pullback in hiring reflects a recalibration following the post-pandemic employment boom. Companies that aggressively expanded their workforces during the recovery years have shifted to a more cautious stance, entering what some economists describe as a “low hire, low fire” equilibrium. In this environment, employers demonstrate little appetite for expanding headcount while simultaneously showing reluctance to conduct widespread layoffs.

What factors can explain this hiring paralysis?

Uncertainty surrounding trade policy has emerged as a significant headwind, particularly following the White House’s announcement of sweeping tariffs on imports last year. These measures unsettled financial markets for a little while and left businesses hesitant to commit to long-term staffing decisions amid unclear cost structures. The broader economic environment has also shifted, with companies facing elevated operational costs that make expansion decisions more complex.

Adding another dimension to the hiring slowdown is the growing corporate belief that artificial intelligence could shoulder an increasing share of workplace tasks. This technological optimism has prompted many organizations to reassess their staffing needs, questioning whether traditional headcount expansion remains necessary to maintain or grow operations.

The recent decisions from Trump’s administration has also contributed to labor market dynamics. Following President Trump’s January inauguration, his administration moved aggressively to reduce federal government employment levels (with the federal headcount hitting a ten-year low), while simultaneously tightening restrictions on immigration and the number of foreign workers entering the country. These policy shifts have further constrained the available labor pool and influenced overall hiring patterns.

Worker behavior has reinforced the stasis. Anxious employees, sensing the uncertain environment, are clinging to existing positions rather than seeking new opportunities. This reduced labor mobility leaves companies with fewer openings to fill, creating a self-reinforcing cycle of minimal hiring activity.

Concurrent data from the Labor Department reinforced the cooling demand narrative. Job openings in November stood nearly 900,000 below year-earlier levels, while both hiring and layoff activity remained subdued. This three-way slowdown—fewer openings, less hiring, and minimal layoffs—confirms that employers have adopted a holding pattern, neither expanding nor contracting their workforces significantly.

How Did the Fed Respond?

Despite the labor market’s struggles, the broader economy has demonstrated surprising resilience. Gross domestic product growth maintained a steady pace throughout the year, aside from a first-quarter stumble. The third quarter saw GDP expand at its fastest rate in two years with an annualized rate of 4.3% (after 3.8% in Q2), propelled by robust consumer spending and substantial business investment in artificial intelligence infrastructure. Productivity gains also accelerated, reaching a two-year high in the third quarter, a crucial development for the economy’s long-term health prospects.

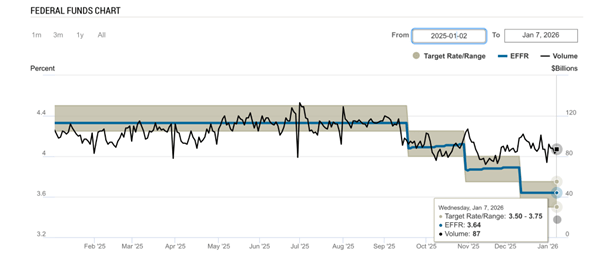

This divergence between a weakening labor market and strong overall economic growth created a complex challenge for monetary policymakers. Still, the hiring slowdown and the overall deterioration of the job market seems to have become a factor in the Federal Reserve’s decision to reduce interest rates in 2025. The central bank lowered its benchmark rate to a range between 3.5% and 3.75% in December 2025, marking a three-year low and representing a notable shift from the restrictive policy stance maintained throughout the previous tightening cycle.

Source: Federal Reserve Bank of New York

Following Friday’s employment report, financial markets recalibrated their expectations for future Fed action. Fed funds futures now price in a 32% probability of two quarter-point rate cuts materializing by year-end 2026, a slight increase from pre-report levels. However, expectations for near-term action have moderated, with the likelihood of an April rate reduction declining from 53% to 47%.

The market consensus has coalesced around a scenario where the central bank maintains its current policy stance through the spring. Many investors believe the December rate cut was Powell’s last before his term concludes this spring. This shifts the responsibility for future monetary adjustments to whoever President Trump nominates to lead the Fed next. A resumption of rate cuts in June appears the more probable outcome, giving policymakers time to assess incoming data and allowing Powell’s successor to shape the policy trajectory.

Significant data releases remain on the calendar before Powell’s departure, including upcoming benchmark revisions to labor market statistics. These revisions are widely anticipated to reveal that hiring throughout 2025 was even weaker than initially reported, potentially reinforcing the case for continued monetary accommodation.

As market participants digest the December employment report and its implications for monetary policy, attention now turns to additional critical economic indicators arriving in the coming days. Particularly significant will be this week’s inflation data releases (CPI and PPI), which will provide fresh insights into price pressures and how they might influence the Fed’s next moves.

Sources: Wall Street Journal, CNN, CNBC, BLS, FED NY, Reuters

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.