Tradeweb reports 18.8% Y/Y rise in revenues in Q4 2021

Tradeweb Markets Inc (NASDAQ:TW), a leading, global operator of electronic marketplaces for rates, credit, equities and money markets, today reported financial results for the fourth quarter and full year ended December 31, 2021.

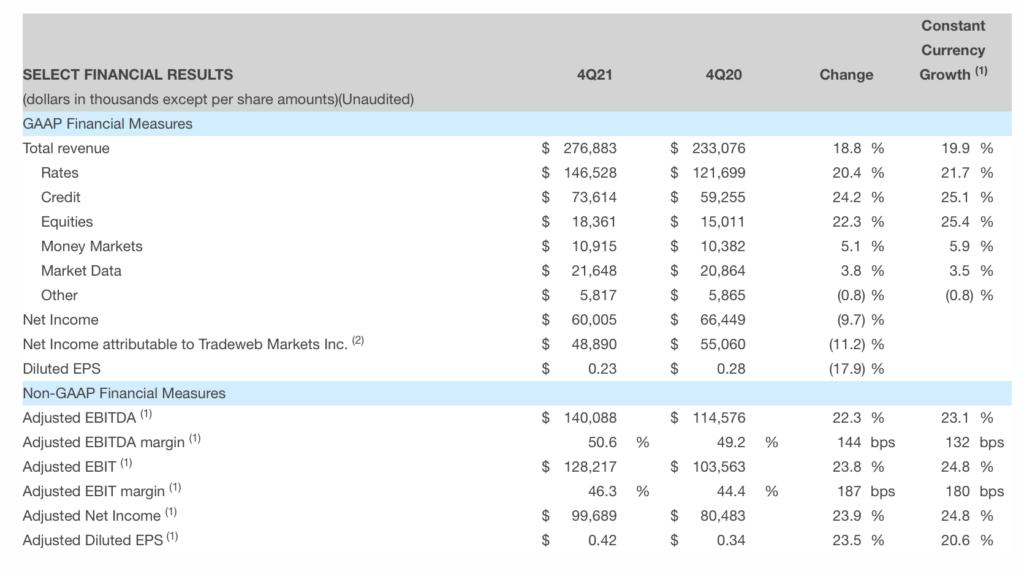

The company posted $276.9 million of quarterly revenues, up 18.8% (19.9% on a constant currency basis) from the prior year period.

Equities generated revenues of $18.4 million in the fourth quarter of 2021, marking an increase of 22.3% compared to prior year period (25.4% on a constant currency basis). Equities performance reflected increased adoption of RFQ for electronic trading in ETFs globally.

Money Markets brought revenues of $10.9 million in the fourth quarter of 2021, up 5.1% from the prior year period (5.9% on a constant currency basis). Growth in Global Repo activity was supported by the continued addition of new clients and dealers on the platform and partially offset by lower revenue from certificates of deposit.

Market Data revenues amounted to $21.6 million in the fourth quarter of 2021, up 3.8% compared to prior year period (3.5% on a constant currency basis). The increase was derived from increased third party market data fees and revenue from Tradeweb’s APA reporting service.

On the downside, Tradeweb posted $60.0 million of net income for the quarter, down 9.7% from prior year period due to higher tax expense, as state apportionment rate changes drove a reduction in deferred tax assets.

Tradeweb recorded its 22nd consecutive year of record revenues in 2021, as total revenue increased 20.6% (19.3% on a constant currency basis) to $1.1 billion compared to full year 2020. Revenue was driven by average daily trading volume of more than $1 trillion and record activity in U.S. and European government bonds; Rates Futures; U.S. High Grade and High Yield credit; European credit; Chinese bonds; U.S. and European ETFs; equity convertibles/swaps/options; and Repurchase Agreements.

Net income increased 25.1% to $273.1 million for the year ended December 31, 2021, compared to $218.4 million for the year ended December 31, 2020. Adjusted EBITDA margin increased to 50.8% for the year ended December 31, 2021 compared to 48.9% for the year ended December 31, 2020, representing an increase of 192 bps (211 bps on a constant currency basis).

Diluted EPS increased 23.9% to $1.09 for the year ended December 31, 2021. Adjusted Diluted EPS increased 24.4% to $1.63 for the year ended December 31, 2021.

Lee Olesky, CEO of Tradeweb Markets, commented:

“Tradeweb recorded its 22nd consecutive year of revenue growth in 2021 and surpassed $1 billion in annual revenues for the first time. We became the largest electronic trading platform for U.S. Treasuries, and as rates volatility increased we benefited from a global resurgence in swaps market activity on our platform.

In credit, we continued to grow volume and market share, extending our industry leadership in electronic portfolio trading and reflecting strong client demand for both traditional RFQ and increased automation. We published our inaugural corporate sustainability report and continued to attract and develop world-class talent — reaffirming the strength of our culture during a time that tested each and every one of us.

While increased adoption of electronic trading has been a long-term trend in recent years, we saw a clear acceleration of that trend during 2021. Looking ahead, we believe markets will continue to benefit from growth in electronic execution and digitized workflow.”