Tradeweb registers steep increase in net income in Q2 2021

Tradeweb Markets Inc (NASDAQ:TW), a global operator of electronic marketplaces for rates, credit, equities and money markets, today reported financial results for the quarter ended June 30, 2021.

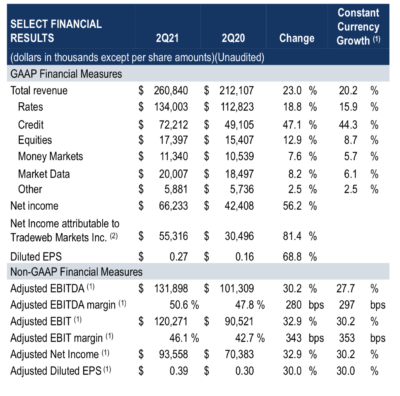

- Tradeweb posted revenues of $260.8 million for the second quarter of 2021, an increase of 23.0% (20.2% on a constant currency basis) from the year-ago period.

- Net income for the second quarter of 2021 amounted to $66.2 million, up 56.2% from prior year period.

- The company reported $131.9 million of adjusted EBITDA for the quarter, compared to $101.3 million for prior year period.

- Tradeweb posted $0.27 of diluted earnings per share (“Diluted EPS”) for the quarter and $0.39 adjusted diluted earnings per share.

- The company declared quarterly cash dividend of $0.08 per share.

Across segments, Equities delivered revenues of $17.4 million in the second quarter of 2021, up 12.9% compared to prior year period (8.7% on a constant currency basis). Client growth and adoption, particularly among institutional clients, continued to drive overall volumes.

Money Markets generated revenues of $11.3 million in the second quarter of 2021, up 7.6% compared to prior year period (5.7% on a constant currency basis). Strong growth in Global Repo activity was supported by the continued addition of new clients and dealers on the platform. Retail money markets activity remained pressured by the low interest rate environment.

Market Data saw revenues of $20.0 million in the second quarter of 2021, marking an increase of 8.2% compared to prior year period (6.1% on a constant currency basis). The increase was derived from increased third party market data fees, revenue from our APA reporting service and Refinitiv market data fees.

Lee Olesky, CEO of Tradeweb Markets, commented:

“Broadening client choice was an important theme this quarter in both credit and rates. Our clients utilized a wider range of electronic trading tools and protocols in credit including RFQ, Tradeweb AllTrade and Portfolio Trading — further evidence that electronic trading activity continues to grow in terms of both volume and sophistication.

With the acquisition of the Nasdaq Fixed Income platform completed in June, clients trading wholesale U.S. Treasuries have more choice between our popular streams protocol and the new central limit order book. From a broader Tradeweb perspective, this acquisition is a great opportunity and we believe it positions us well to drive additional shareholder value.”