TP ICAP registers rise in H1 2025 revenues driven by Global Broking and Liquidnet

TP ICAP Group plc (LON:TCAP) today posted its interim management report for the six months ended 30 June 2025.

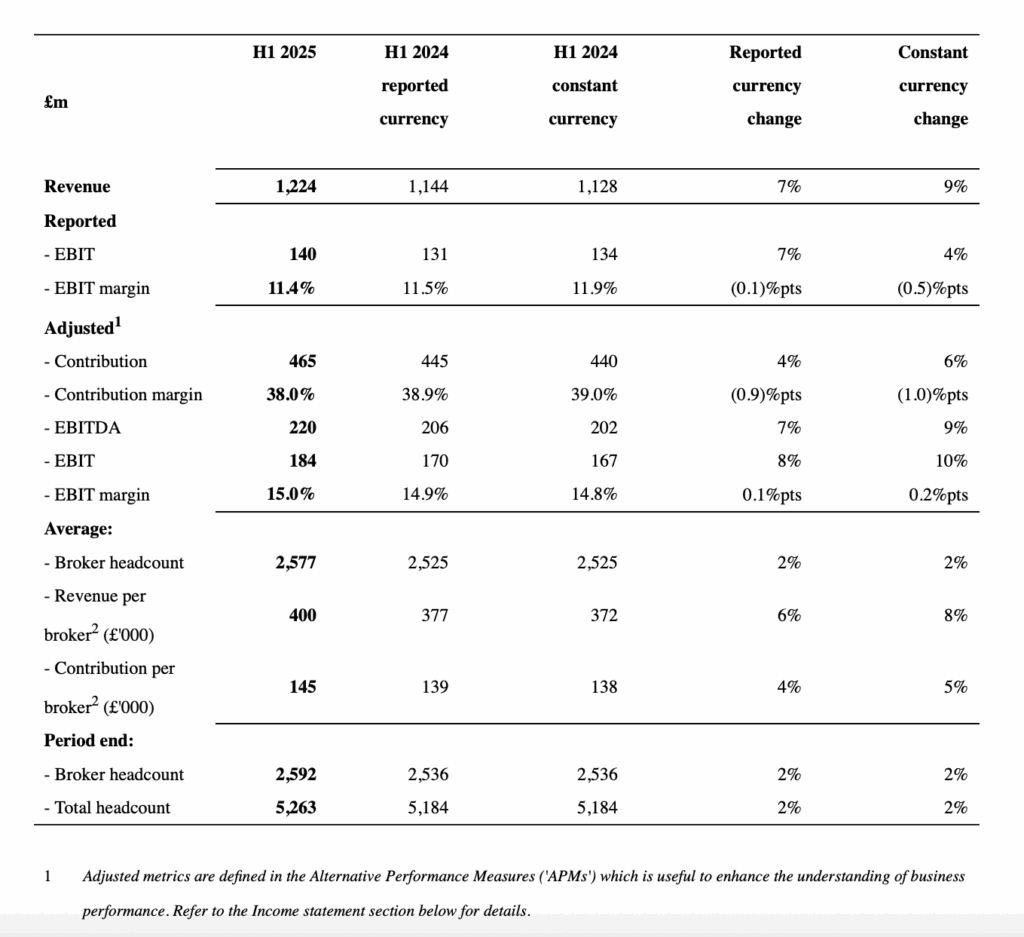

The Group delivered strong results in the first half of 2025, with revenue increasing by 7% to £1,224 million (+9% in constant currency). This performance was primarily driven by Global Broking and Liquidnet divisions, supported by elevated market volatility and client demand amid a complex macroeconomic and geopolitical environment.

Global Broking, which contributed 58% of the Group’s revenue, delivered a double-digit increase of 10% (+12% in constant currency), with strong contributions across all asset classes benefitting from supportive market conditions.

Energy & Commodities saw a modest decline in revenue of 2% (-2% in constant currency) against a record H1 2024 and reflecting a competitive environment for talent.

Liquidnet delivered a record 14% (+15% in constant currency) increase in revenue to £195m, reflecting continued growth in Multi-Asset Agency Execution1 and Equity markets.

Parameta Solutions achieved 3% (+5% in constant currency) revenue growth. The growth continues to be supported by the division’s subscription-based model, with Annual Recurring Revenue (ARR) growth of 5%. The performance reflects the decision to moderate price increases in 2025 to support sustainable growth and current longer sales cycles.

The Group’s overall performance was characterised by strong operational leverage, underpinned by disciplined cost management and enhanced broker productivity, with average revenue per broker increasing by 6%.

This supported a further expansion of the Group’s adjusted EBIT margin to 15.0%, slightly up from 14.9% in H1 2024. Adjusted EBIT increased by 8% (+10% in constant currency) to £184m (H1 2024: £170m). Reported EBIT grew 7% to £140m (H1 2024: £131m), after significant items; reported earnings grew 9% to £99m (H1 2024: £91m).

Significant items, of which around 35% were non-cash, included planned investment in TP ICAP’s major operational efficiency program and ongoing costs relating to the potential minority listing of Parameta Solutions in the US.

Capital discipline remains a key focus for TP ICAP. The Group announced another £30m share buyback today, bringing the total to £150m in the last 24 months. Over the same period TP ICAP declared dividends totalling £250m, including its interim dividend announced today, and freed up £100m of cash to reduce debt.

TP ICAP’s three-year operational efficiency program launched in H2 2024 to release £50m of surplus cash through legal entity consolidation and deliver annualised cost savings of £50m is progressing well and is on track to deliver its targets by 2027.

The Group expects to deliver in excess of £200m of surplus cash organically across 2026 and 2027. This includes £50m to be released from legal entity consolidation. This surplus will be available for investment and returns to shareholders.

In line with TP ICAP’s dividend policy, the Board is proposing an interim dividend of 5.2 pence per share (up 8%).