Marex registers 18% Y/Y increase in revenues in Q2 2025

Marex Group plc (NASDAQ:MRX) a diversified global financial services platform, today reported financial results for the second quarter of 2025 (Q2 2025).

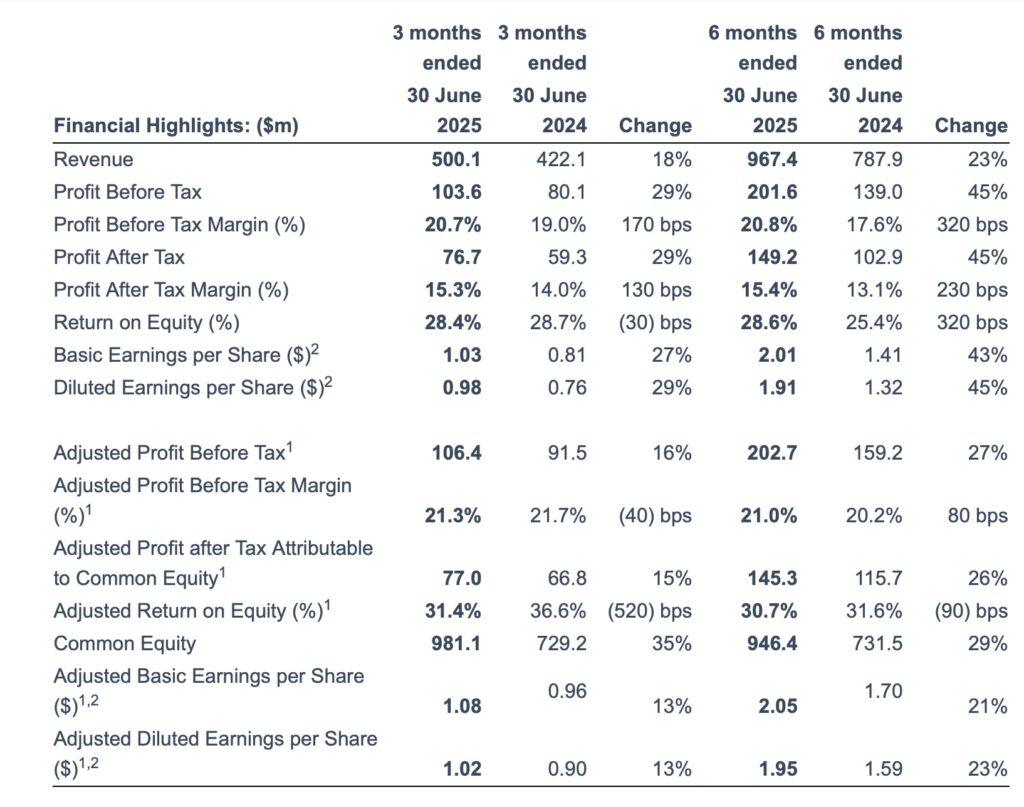

Revenue grew by 18% to $500.1m (Q2 2024: $422.1m), driven by a strong performance in Agency and Execution across both Securities and Energy, as well as Clearing.

Net commission income increased by $48.7m to $257.1m (Q2 2024: $208.4m). The growth was driven mainly by Agency and Execution, which grew $43.2m to $187.2m (Q2 2024: $144.0m), reflecting strong performance in Securities and Energy, supported by higher transaction volumes.

Net trading income rose by $66.8m to $203.3m (Q2 2024: $136.5m). The growth was driven by a $65.4m increase in Agency and Execution to $76.2m (Q2 2024: $10.8m), with strong performance across all asset classes. The most significant contribution came from the continued strategic expansion of Marex’s Prime Services capabilities, including growth in its securities based swaps offering.

Net Interest Income has decreased by 47% to $34.6m (Q2 2024:$65.4m).

Total reported costs increased by 16% from $336.6m in Q2 2024 to $389.5m in Q2 2025 driven by both higher front office and control and support costs.

Reported Profit Before Tax increased by $23.5m to $103.6m (Q2 2024: $80.1m), driven by strong revenue growth and improved operating margins. The Group’s Reported Profit Before Tax margin increased from 19.0% in Q2 2024 to 20.7% in Q2 2025 reflecting margin expansion in Agency and Execution due to the growth of higher margin products including Prime Services and the restructuring of underperforming desks while Q2 2024 was also impacted by a number of adjusting items related to the IPO and owner fees.

Adjusted Profit Before Tax increased $14.9m to $106.4m (Q2 2024: $91.5m) while Adjusted Profit Before Tax Margin remained broadly stable at 21.3% (Q2 2024: 21.7%) reflecting the higher adjusting items removed in the prior period.

Ian Lowitt, Group Chief Executive Officer, stated:

“I am delighted with our very strong performance. In the first half we generated almost $1 billion of revenue and a record $203 million of Adjusted Profit Before Tax (PBT), up 27% on last year. The second quarter, at $106 million of Adjusted PBT, was up 16% on Q2 of last year, which was a tough comparator as we benefited from unusually positive market making opportunities. We continue to generate a high Return on Equity at 28% for the second quarter with a robust Reported Profit Before Tax margin of almost 21% for the same period.

This strong performance validates our strategy and our execution of that strategy. The acquisition of the Prime Services business from TD Cowen in late 2023 has been a particular success and has increased our earnings power, but it is the combination of all our acquisitions and organic growth initiatives which have delivered these great results. We remain very excited about our prospects going forward.”