Institutional FX trading volumes soar in November as USD falters

November was a very good month for vaccine news, for equity markets – and for institutional FX trading platforms.

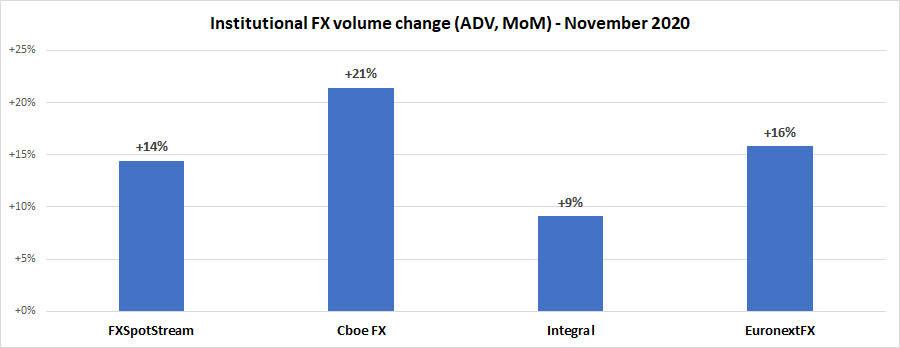

Data from some of the leading forex ECNs and institutional trading platforms indicate an average double-digit 15% rise in trading volumes during November versus a somewhat weak October. All platforms except for Integral reported greater-than-10% volume increases.

While it was retail money pouring into the markets which drove equity valuations to all-time record highs, institutions were clearly very busy trading currencies.

The volume driver seems to be increased currency volatility thanks mainly to the continued erosion during the month of the value of the US Dollar, which sent the EURUSD above 1.20 for the first time since early 2018. The British Pound also strengthened versus the greenback, with the GBPUSD moving from 1.29 to 1.34 during November.

Cboe FX (formerly HotspotFX)

- November 2020 total volumes $789 billion, or ADV $37.57 billion, +21% MoM

EuronextFX (formerly FastMatch)

- November 2020 ADV $21.6 billion, +16% above October’s ADV $18.6 billion.

FXSpotStream

- November ADV of USD44.506bn, third highest monthly ADV on record – only February and March volumes this year had a higher ADV.

- ADV MoM (Nov’20 vs Oct’20) increased +14.45% .

- ADV YoY (Nov’19 vs Nov’20) increased 43.77%.

- 2020 ADV (Jan-Nov) of USD42.635billion, is up 17.02% when compared to the same period during 2019 of USD36.435 billion.

- November saw FXSpotStream cross the USD10trillion mark YTD – the first time FSS has supported USD10 trillion in any year (in March, alone, volume reached a record high of USD1.372trillion).

Integral

- Average daily volumes (ADV) across Integral platforms totaled $47.8 billion in November 2020. This represents an increase of 9.1% compared to October 2020, and an increase of 40.6% compared to the same period in 2019.

- From October 2020, reported ADV include volumes traded on the recently launched venue, TrueFX, and is reported in aggregate with volumes from Integral’s other trading platforms. Reported monthly ADV now represents total volumes traded across the group’s entire liquidity network.