Institutional FX trading volumes recover slightly in June 2025 but lag earlier months

Closing out the first half year of trading in the institutional FX sphere, each of the leading eFX venues surveyed by FNG reported a slight increase in trading volumes over May, but remained well below earlier-in-the-year record figures.

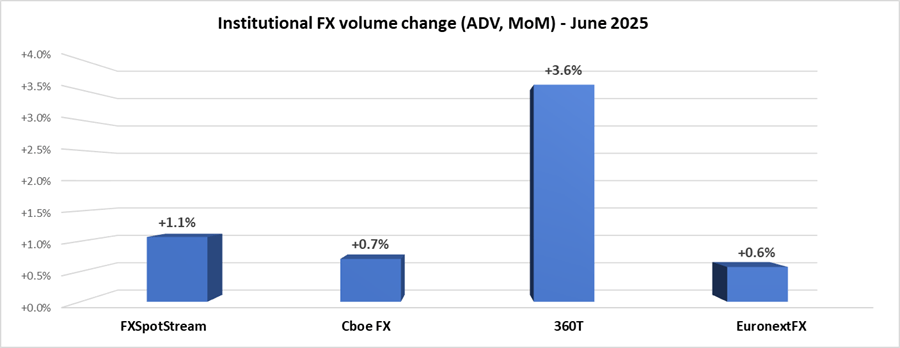

After seeing a 22% across-the-board decrease in FX trading volumes in May, each of FXSpotStream, Cboe FX, EuronextFX and Deutsche Borse’s 360T reported between 0.6% and 3.6% increases in June 2025, averaging 1.5%. Better than May, but well below March and April’s record figures enjoyed when currency volatility was at a multi-year peak.

Cboe FX (formerly HotspotFX)

- June 2025 average daily volumes were $48.31 billion, +0.7% from May’s $47.97 billion.

EuronextFX (formerly FastMatch)

- June 2025 ADV $27.66 billion, +0.6% from May’s ADV of $27.50 billion.

FXSpotStream

- In June, FXSpotStream’s overall ADV was USD99.792billion an increase of 1.07% MoM. This consisted of a Spot ADV of USD66.913billion and USD32.878billion in other products.

- Year to date, FXSpotStream’s Overall ADV (for the period January-June 2025) is up 28.45% when compared to the same period last year.

- Details of June total volumes can be found below:

- FXSpotStream’s Total ADV MoM (Jun’25 vs May’25) increased 1.07%

- FXSpotStream’s Total ADV YoY (Jun’25 vs Jun’24) increased 5.22%

- FXSpotStream’s Spot ADV MoM (Jun’25 vs May’25) decreased 1.61%

- FXSpotStream’s Spot ADV YoY (Jun’25 vs Jun’24) decreased 2.69%

- FXSpotStream’s Other ADV MoM (Jun’25 vs May’25) increased 6.98%

- FXSpotStream’s Other ADV YoY (Jun’25 vs Jun’24) increased 26.07%

360T

- Average daily volumes (ADV) at 360T came in at $33.89 billion in June 2025, up 3.6% from May’s $32.72 billion.