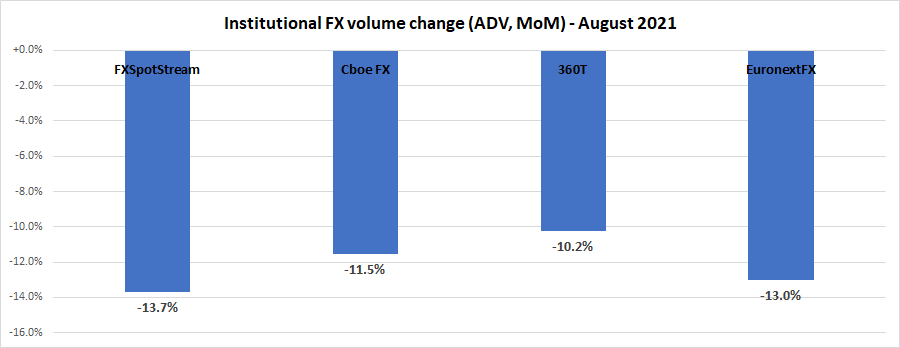

Institutional FX trading volumes drop 10%+ in August 2021

Some normalcy returned to institutional FX trading in August 2021 in what has been anything but a normal year, with the sector seeing its typical seasonal swoon during the summer.

After July saw a slight (4%) drop in institutional FX trading at leading eFX ECNs and platforms, August repeated the trick with the usual summer slowdown resulting in a further 12% MoM drop in activity. All the institutional FX venues surveyed by FNG reported MoM volume declines during August of between 10-14%.

Cboe FX (formerly HotspotFX)

- August 2021 average daily volumes were $28.91 billion, -11.5% from July’s $32.68 billion.

EuronextFX (formerly FastMatch)

- August 2021 ADV $15.80 billion, -13.0% below July’s ADV $18.17 billion.

FXSpotStream

- FXSpotStream’s ADV YoY (August ‘21 vs August ‘20) increased 0.47% to USD41.358billion

- FXSpotStream’s ADV MoM (August ‘21 vs July ‘21) decreased 13.68% to USD41.358billion

- FXSpotStream’s Overall Volume YoY (August ‘21 vs August ‘20) increased 5.26% to USD909.879billion

- FXSpotStream’s ADV YTD (Jan-Aug ‘21 vs Jan-Aug ‘20) increased 13.42% to USD48.486billion when compared to the same period last year

360T

- Average daily volumes (ADV) at 360T came in at $19.13 billion in August, down 10.2% from July’s $21.31 billion.