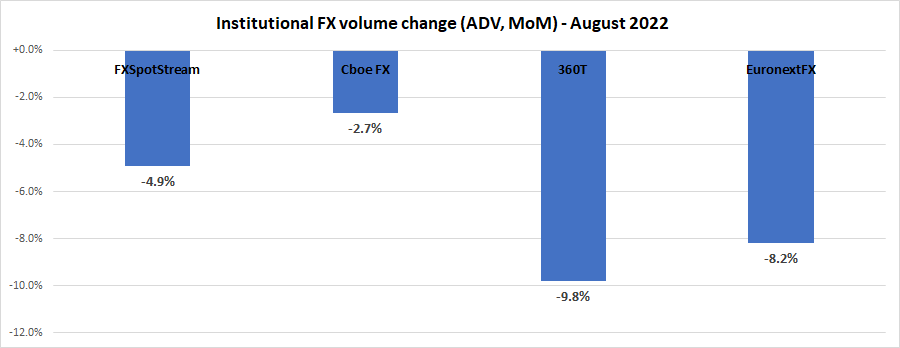

Institutional FX trading volumes continue summer slowdown, August -6%

In what has been somewhat of a wild year, some normalcy returned to the world of institutional FX trading in July and August 2022, with the sector seeing its typical summer slowdown in trading volumes.

Following a very strong first half of the year for the leading FX ECNs, July saw a 5% decline and now August a 6% decline in institutional FX trading volumes. All the eFX firms surveyed by FNG reported a decline in August of between 3% and 10%, averaging as a group 6.4%.

Cboe FX (formerly HotspotFX)

- August 2022 average daily volumes were $37.17 billion, -2.7% from July’s $38.19 billion.

EuronextFX (formerly FastMatch)

- August 2022 ADV $19.67 billion, -8.2% from July’s ADV of $21.42 billion.

FXSpotStream

- FXSpotStream’s ADV YoY (Aug’22 vs Aug‘21) increased 47.24% to USD60.898billion

- FXSpotStream’s ADV MoM (August‘22 vs July’22) decreased 4.9% – following its second highest ADV ever in July

- FXSpotStream’s Overall Volume YoY (Aug‘22 vs Aug‘21) increased 53.94% to USD1.401trillion, the 8th month in a row with supported volume well over 1 Trillion

- FXSpotStream’s ADV YTD (Jan-Aug’22) is USD61.900billion, an increase of 27.67% compared to the same period last year

360T

- Average daily volumes (ADV) at 360T came in at $22.95 billion in August 2022, down 9.8% from July’s $25.45 billion.