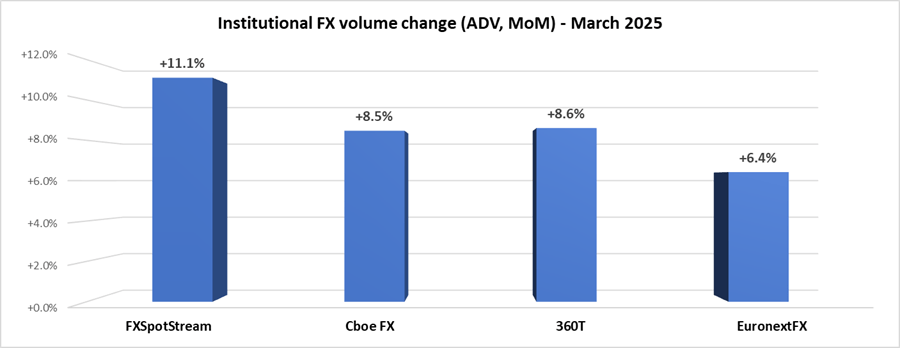

Institutional FX trading ends Q1 strong with March 2025 volumes up 9%

Heightened capital markets volatility in the wake of impending Trump tariffs led to a very good month in the institutional FX trading market in March 2025, with trading volumes well above monthly and seasonal norms.

Average trading volumes at the leading eFX venues surveyed by FNG rose by an average of 8.7% in March 2025, following up a 2.4% increase in February and 16% jump in January, closing out what was a very strong quarter in the institutional FX trading business. Each of FXSpotStream – reporting another month of record trading volumes – Cboe FX, EuronextFX and 360T saw activity increases of between 6-11% during March.

Cboe FX (formerly HotspotFX)

- March 2025 average daily volumes were $52.11 billion, +8.5% from February’s $48.04 billion.

EuronextFX (formerly FastMatch)

- March 2025 ADV $31.33 billion, +6.4% from February’s ADV of $29.44 billion.

FXSpotStream

- March saw FXSpotStream set a new high in terms of Overall ADV at USD116.891billion. This marked an 11.15% increase MoM (when compared to February 2025) and 41.55% YoY (vs. March 2024). March’s ADV surpasses our previous high of USD105.163billion set last month (February 2025).

- March’s Overall ADV consisted of USD83.072billion in Spot (a new high on the Service) and USD33.819billion across other products (also a new high on the Service), including ADV records in Swaps and NDFs.

- FXSpotStream’s Total ADV MoM (Mar’25 vs Feb’25) increased 11.15%.

- FXSpotStream’s Total ADV YoY (Mar’25 vs Mar’24) increased 41.55%.

- FXSpotStream’s Spot ADV MoM (Mar’25 vs Feb’25) increased 10.57%.

- FXSpotStream’s Spot ADV YoY (Mar’25 vs Mar’24) increased 42.78%.

- FXSpotStream’s Other ADV MoM (Mar’25 vs Feb’25) increased 12.62%.

- FXSpotStream’s Other ADV YoY (Mar’25 vs Mar’24) increased 38.64%.

360T

- Average daily volumes (ADV) at 360T came in at $36.81 billion in March 2025, up 8.6% from February’s $33.89 billion.