Exclusive: Trivepro sees 9x increase in 2022 Revenues to £10.8M

FNG Exclusive… FNG has learned via regulatory filings that Trive Financial Services UK Limited, which operates the Trivepro institutional brokerage brand, has posted a steep increase in Revenues and profitability ahead of its first full year of operation since rebranding from GKPro.

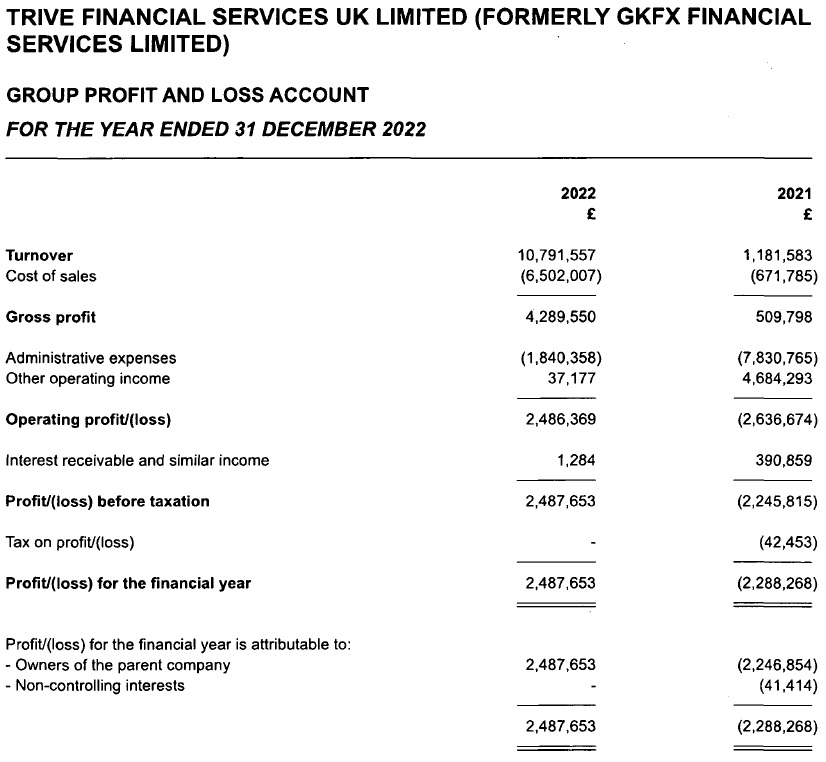

Revenues at Trivepro came in at £10.8 million (USD $13.1 million) in 2022, up by more than 9x from just £1.2 million in 2021. Net Profit was £2.5 million, versus a £2.3 million loss the previous year. However we’d note that when the company was operating previously under the GKPro brand (more on that below), Revenues were as high as £94 million in 2016 and £60 million in 2017.

Trivepro is an FCA licensed multi-asset securities brokerage offering online financial services to global financial professional and institutional investors. Trading revenues for the year were generated predominantly through volume rebates with counterparties related by common ownership. The level of such revenues is influenced by the volume of trades executed on behalf of the company’s clients.

We had exclusively reported in early 2023 that Retail FX and CFDs broker GKFX (and its institutional brokerage sister arm GKPro) were rebranding as Trive. That followed a 2022 restructuring at Turkey based Global Kapital Group, which included the transfer of ownership of its retail (GKFX) and institutional (GKPro) brokerage arms to Amsterdam based Trive, in which Global Kapital controlling shareholder Kasim Garipoğlu has an interest.

The company’s Malta operation runs the Retail FX part of the business, and was renamed from AKFX Financial Services Ltd to Trive Financial Services Malta Limited as part of the aforementioned restructuring. The retail brand was then changed from GKFX to just Trive.

Trivepro is run out of offices in Canary Wharf, London by CEO Adam Dougall.

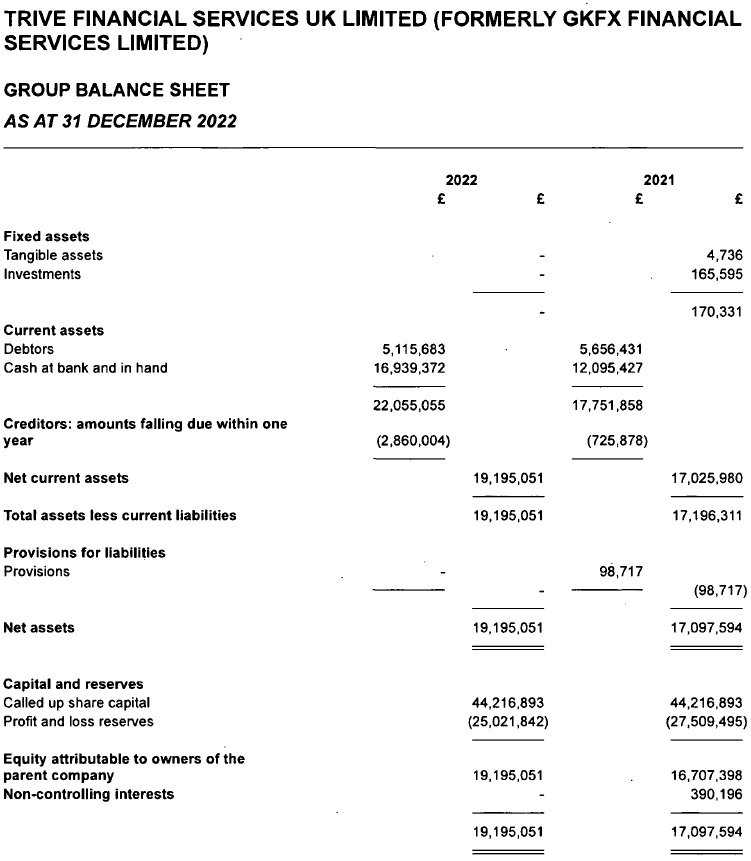

Trivepro’s 2022 income statement and balance sheet follow.