Exclusive: Market-maker XTX Markets sees 2020 Revenue soar 92% to £651M

FNG Exclusive… 2020 was a very good year for the Retail FX and CFDs industry, alongside many of those who trade for a living. And, not surprisingly, for those who serve those brokers and large traders.

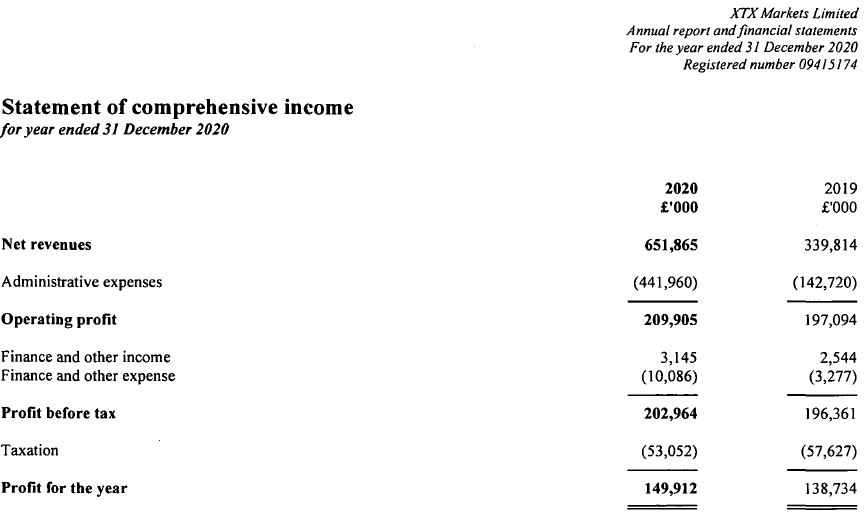

FNG has learned from regulatory filings that London based multi-asset market maker XTX Markets has continued on its amazing growth path, posting a whopping 92% (!!) increase in Revenues during 2020 to £651.9 million (USD $903 million), versus £339.8 million in 2019.

The company earned £149.9 million in Net Profit in 2020, up from £138.7 million in 2019, and paid out dividends of £174.6 million to its shareholders.

During 2020, the XTX Markets group took steps to rebalance risks associated with its global operations and separated non-trading operations and the Group’s key intellectual property from trading activities. All UK staff employment contracts and ownership of intellectual property were moved from XTX Markets Limited to XTX Markets Technologies Limited, a sister company.

Effectively, that splits XTX’s business into one entity which trades for its own account, and one engaged with outside clients. Combining the results of the two companies for 2020 (which provides a better comparison to 2019) actually shows an even greater jump in growth, with combined 2020 revenues of just over £1 billion, and combined net profit of about £450 million.

Just a six-year-old company, XTX exploded onto the scene in 2018 when the company produced Revenues of £305.2 million – nearly double 2017’s £154.6 million – and Net Profit of £116.6 million, as XTX expanded its footprint into new geographies and asset classes. Based on surveys by Euromoney and Rosenblatt, XTX Markets is now the largest Spot FX liquidity provider globally, and and also the largest European equities liquidity provider.

XTX Markets is a quantitative-driven electronic market-maker covering a variety of financial instrument types. XTX partners with counterparties, exchanges and e-trading venues globally to provide liquidity in the equity, FX, fixed income and commodity markets. XTX was founded and is majority-owned by Russian-British mathematician Alex Gerko. Mr. Gerko, who holds a PhD in Mathematics from Moscow State University, started his financial career in equities and subsequently in FX at Deutsche Bank. Before founding XTX he headed up the market-making team at GSA Capital.

XTX has 42 employees in the UK and more than 130 employees worldwide with offices also in New York, Singapore and Paris. The company transacts about $275 billion daily in trading volumes across a variety of asset classes.

The company said that it has plans to launch new trading strategies and continue to grow its Systematic Internaliser (SI) in the UK and in Europe and expand its counterparty offering. The company will be registered as a swap dealer in order to enable trading certain products with US persons. XTX is expected to continue to trade profitably to support organic growth. The Board is continually assessing the changing market and regulatory landscape to ensure it can evolve and adapt to changes in counterparty and operational demands. Except for the proposed changes discussed above, the directors do not anticipate further changes in the company’s core activities for the foreseeable future.

In late 2020 XTX Markets established its own venture capital arm, aptly called XTX Ventures, headed by former Deutsche Bank corporate strategy executive and LSE graduate Ekaterina Holt.

XTX Markets’ 2020 income statement follows: