Exclusive: Invast Global operator INV Inc sees shares drop to 52-week low on poor 2023 results

FNG Exclusive… FNG has learned that shares of INV Inc (TYO:7338), the Japanese financial services company that operates institutional FX and CFDs broker Invast Global, have dropped to their lowest level in nearly two years, following release of the company’s 2023 financial results. (INV has a March 31 fiscal year end).

Invast shares dropped to a 52 week low of ¥733 on Tuesday (May 30), settling to close at ¥735. At its current share price, the entire INV has a market capitalization of ¥4.32 billion, or USD $30.7 million.

INV Inc operates Australia based Invast Global, in addition to its Japan based businesses that include Japanese online brokerage Invast Securities at website invast.jp, and a Japanese asset management arm, Invast Capital Management Co.

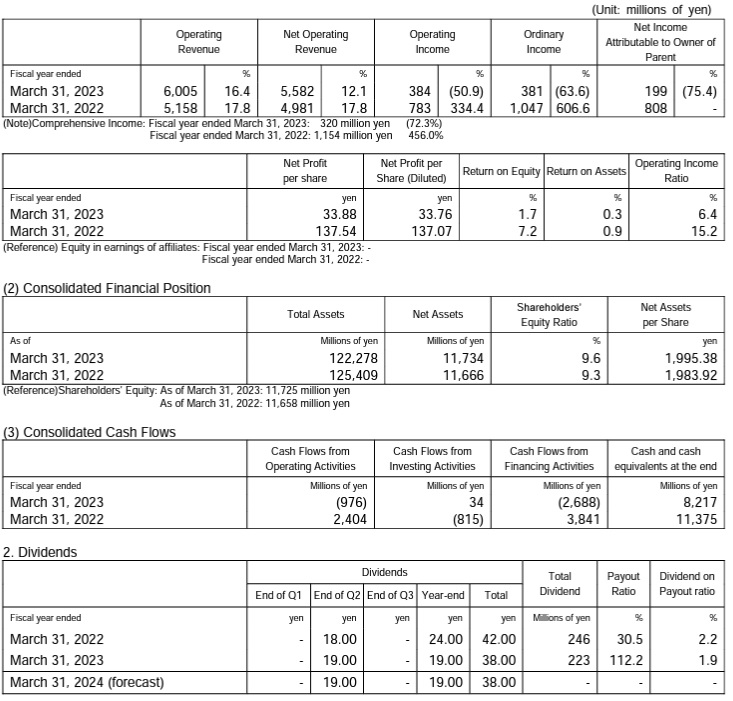

In late April INV Inc reported its results for the year ended March 31, 2023, with the company’s Net Income falling by 75% from ¥808 million in 2022 to just ¥199 million (USD $1.4 million) in 2023. INV generated negative operating cash flow for the year, at minus ¥976 million (USD $7.0 million). The company’s operating revenue did increase from 2022 to 2023, by 16% to ¥6.0 billion (USD $42.8 million), but it appears as though expenses and cash spend far outstripped revenue growth during the past year.

Due to the operating cash outflow alongside negative cash flow from investing activities, INV Inc saw its Cash levels drop in 2023 by 28%, to ¥8.22 billion (USD $58.5 million).

While parent INV has been having its troubles, Invast Global has been spending and expanding its operations, with recent hires including CMC Markets executive Johan Koo as Head of Prime Services APAC, and BTC Markets’ Tiffany Besnard to head Hedge Fund Sales APAC. In late 2022 Invast bought GMO-Z.com, the UK operation of Japanese internet giant GMO, and earlier in the year the company expanded its EU operations naming Riana Chaili as CEO EMEA out of Cyprus.

Regarding the coming year, INV Inc stated that the company does not disclose consolidated financial results forecasts due to the difficulty in predicting business results as the financial instruments business and asset exchange business are strongly influenced by economic and market conditions. Instead, the company provides operating revenue and other sales indicators on a monthly basis.

FNG reached out to Invast Global management for comment, and received an official “no comment”.

INV Inc’s financial summary for FY 2023 and comparison to 2022 follows.

INV Inc one year share price graph. Source: Google Finance.

June 2, 2023 @ 3:17 pm

Shares even lower now, continue to fall. Think twice (or maybe 3 times) before doing business with Invast. There are much more stable and better capitalized players out there.